AAFC Finds More Old Crop Wheat, Helps 2021/22 Stocks

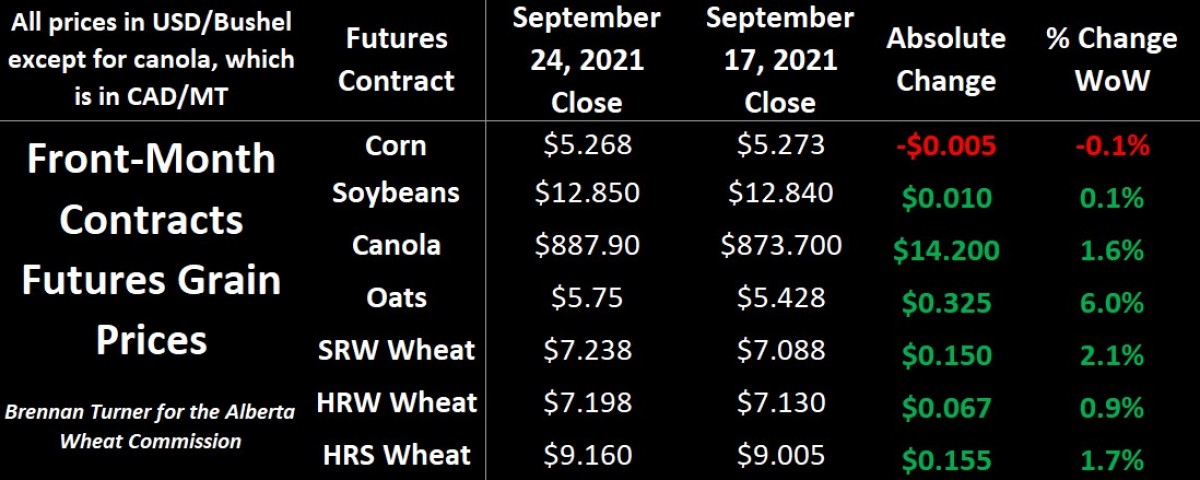

Grain markets found some more momentum this past week on weather issues and more bullish reports of production shortfalls in Western Canada and the U.S. Northern Plains. That said, the bearish pressure is coming from drier weather allowing for accelerated harvest activity but global supply chain headwinds continue to help keep grain values elevated above their post-September WASDE lows. Looking outside the continent, some concerns over France’s wheat quality have prompted China to buy more from Australia, while Algeria has publicly stated that they’re looking to import less hard wheat this year.

Elsewhere, Russian wheat prices climbed for the 11th straight week, with 12.5% protein product out of Black Sea ports for nearby movement trading at $304 USD/MT (or $8.30 USD/bu, $10.50 CAD/bu, and $385 CAD/MT if converting metric tonnes to bushels). Contrasting this is the reality that Russian wheat exports so far in their 2021/22 crop year (which started July 1) are tracking 22% behind last year’s pace, mostly because of the smaller harvest, as well as export taxes changing weekly making it incredibly complicated to do forward-contract business. Add in some reports that spring wheat acres there are being abandoned, and it’s no wonder wheat prices there continue to climb.

Coming home, this past week, Agriculture Canada updated its supply and demand tables, using Statistic Canada’s satellite-based production estimates that were released the week previous (which I discussed in last week’s Wheat Market Insider column). Like many other reports we’re seeing, AAFC’s September tables acknowledge the drastic impact that 94% of all Western Canada experiencing drought this year has on both production, and therefore the demand side of the balance sheet. Ultimately, AAFC now estimates that total available inventories of all grain, oilseeds, and pulse crops in Canada, by the end of the 2021/22 crop year, will be a new record low.

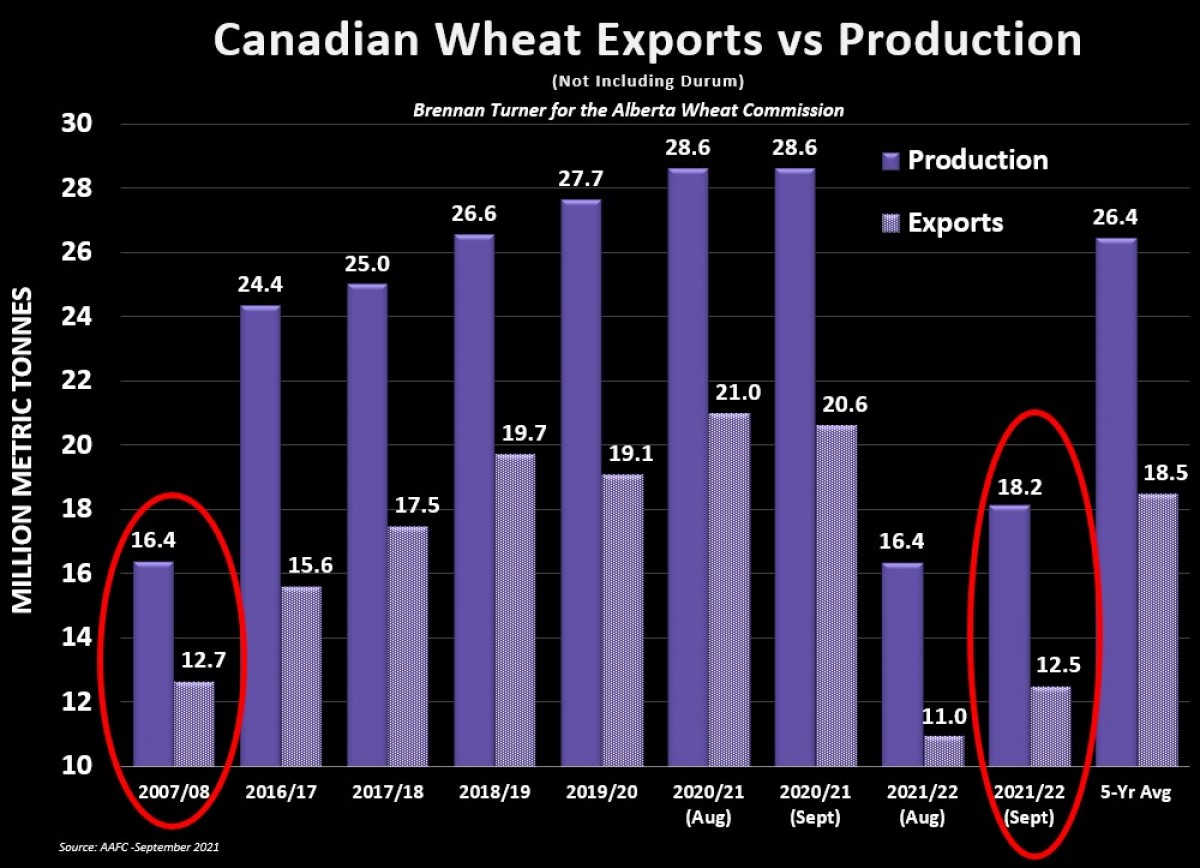

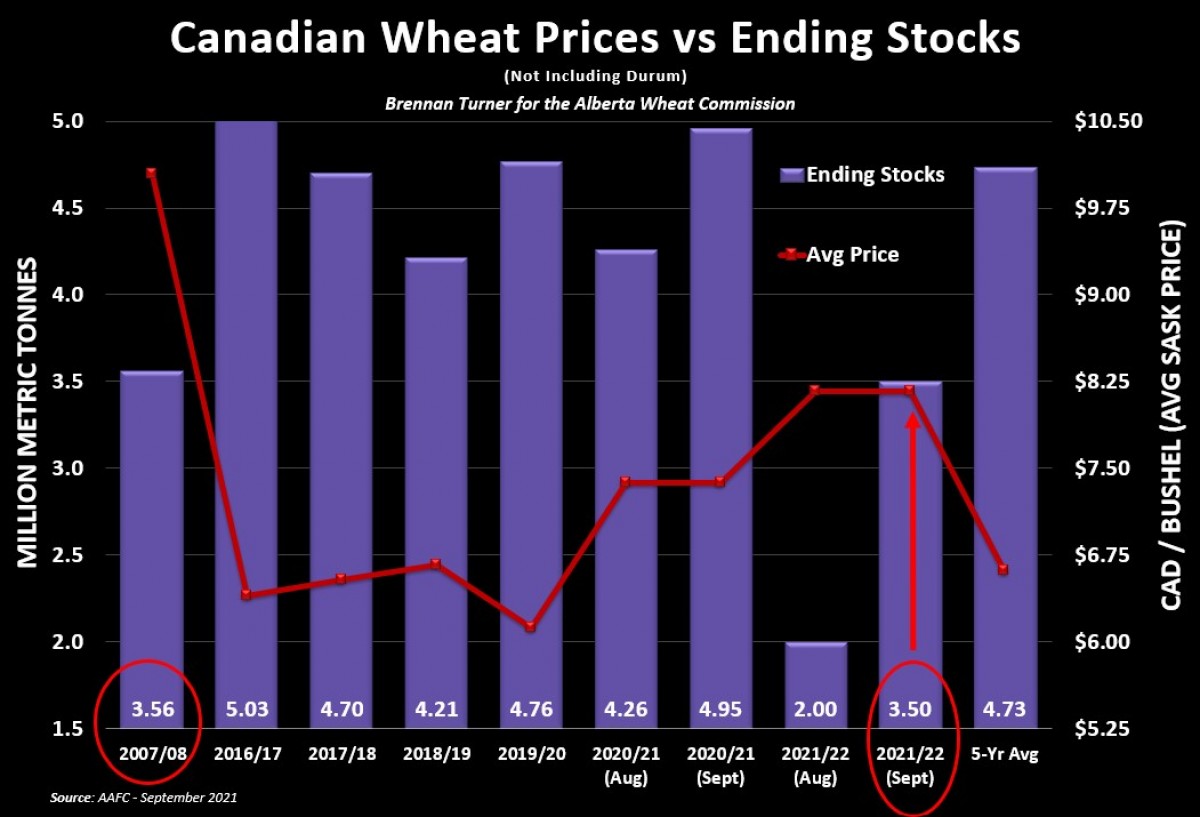

Leaning into the numbers, for non-durum wheat, 2020/21 old crop exports and domestic use were lowered by nearly 700,000 MT combined, which raised ending stocks by an equivalent amount, and therefore, provides a bit more wheat to carry over into the 2021/22 crop year. Ag Canada took this extra supply and expanded new crop exports by 1.5 MMT from their previous estimate to now sit at 12.5 MMT, but lowered domestic use by nearly 500,000 MT.

This all adds up to 2021/22 ending stocks now sitting at 3.5 MMT, 1.5 MMT higher than what the AAFC was forecasting just a month ago. That said, they did not change their price forecast, and I continue to look at 2007/08 as a comparable year in terms of pricing opportunities.

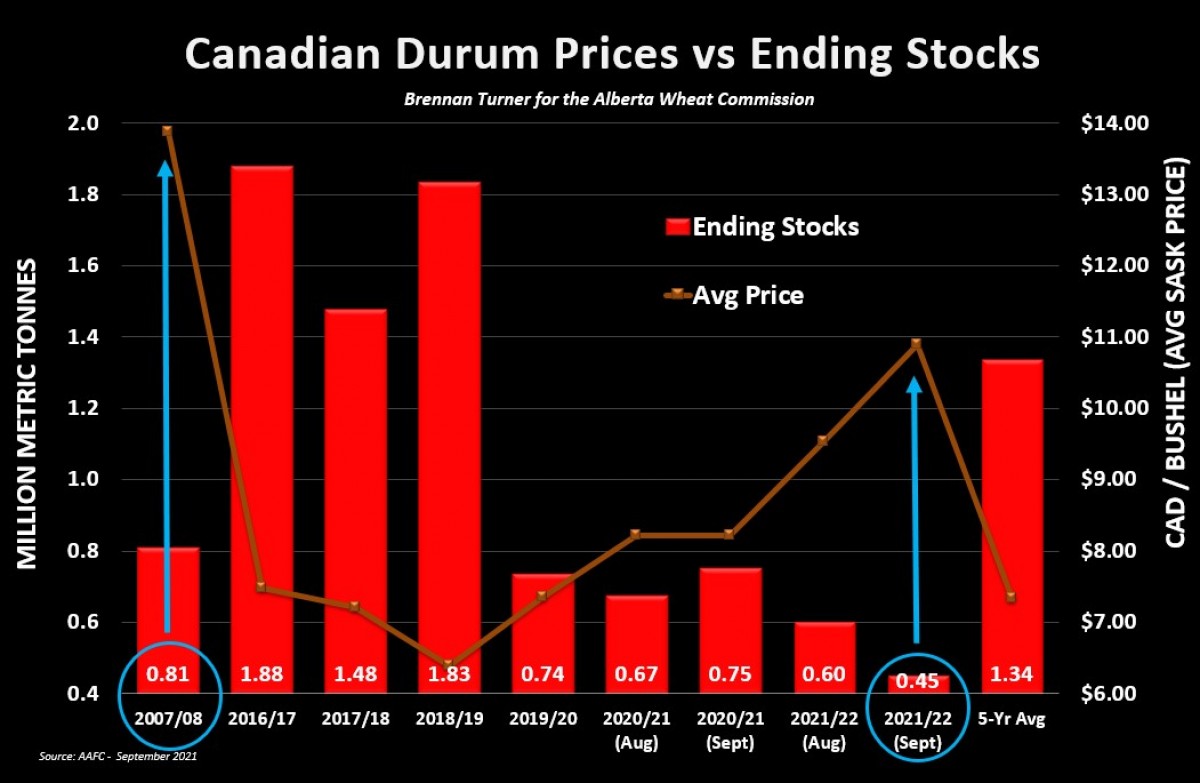

For durum, an extra 78,000 MT in old crop carry-out was found by Agriculture Canada, due to old crop exports being lowered to 5.77 MMT (still a new record!). However, with AgCanada using StatsCan’s 3.55 MMT 2021/22 harvest number (versus the 3.83 MMT estimate AAFC used in their August report), total durum inventories were lowered yet again to an extremely tight 450,000 MT. Worth noting is that, despite the production drop, 2021/22 exports were stayed at 3.1 MMT, which is largely a function of the tight global durum balance sheet. That said, I expect durum prices to creep up a bit higher as we move into fall as buyers get past their harvest-time contracts and start to get coverage for their winter and spring shipping windows.

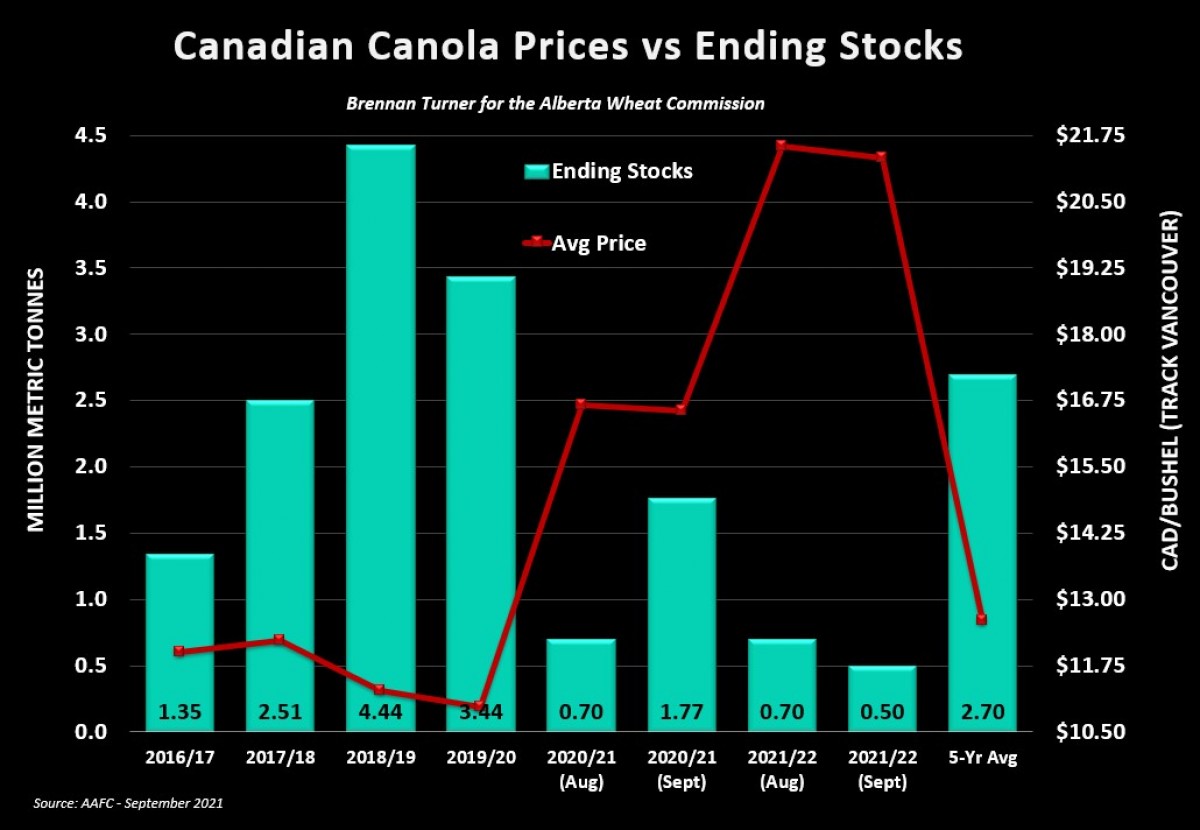

While this is the “Wheat Market Insider” column, it’s worth acknowledging some of the significant updates to the canola balance sheet, namely from years past. Digging in, AAFC raised 2019/20 ending stocks by over 300,000 MT, which, combined with the Ag Canada finding an extra 750,000 MT from Harvest 2020, meant that 2020/21 carryout was raised by more than 1 MMT to now sit at 1.77 MMT. Nonetheless, the much smaller 2021 canola harvest means 2021/22 carryout is estimated at just 500,000 MT.

Also of note, compared to last month’s August estimates, AAFC’s forecasted average prices for all pulses and specialty crops in 2021/22 were increased by 28% - 65% (or $220 - $500 CAD/MT): Average prices for peas were raised 65% month-over-month to $580 ($15.80 CAD/bushel); Lentils up 46% to $1,000 (45.5¢ CAD/lbs); Chickpeas up 43% to $985 (45¢); Mustard up 28% to $1,200 (54.5¢), Canary seed up 49% to $1,060 (48¢)! As a reminder, these are estimated average prices over the entire crop year, which means the top will likely be higher than what AAFC is projected (and evidenced by the reality that prices today are already higher than these values).

To growth,

Brennan Turner