Adding to Wheat Risk Premiums

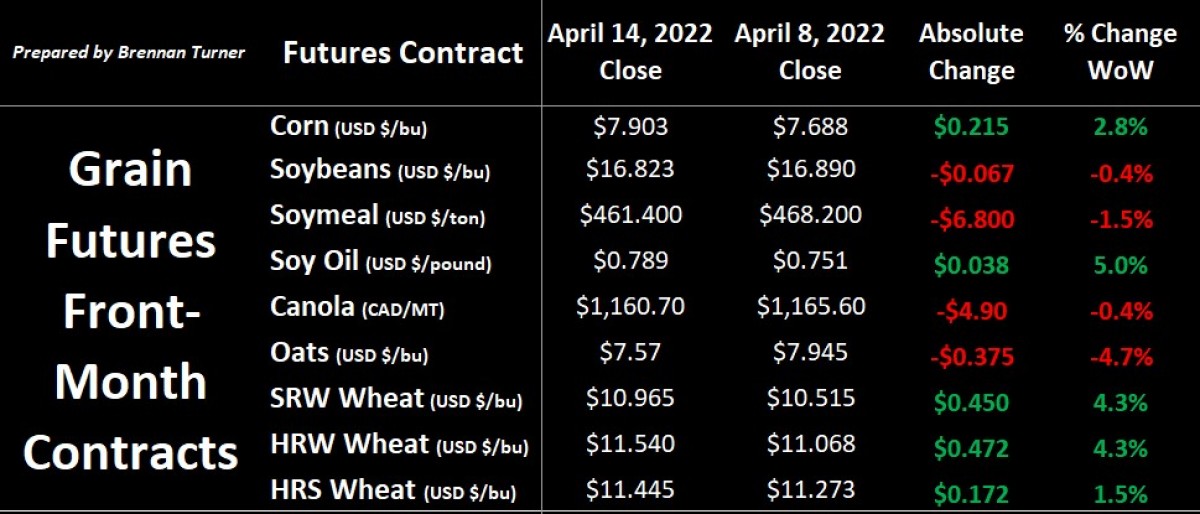

Grain markets were mixed over the 4 days of trading prior to the Easter long weekend. Wheat and corn led things higher, while oilseeds pulled back. Corn gained thanks to some big U.S. export sales to China, while more risk premium is getting built into the winter wheat market because of high temperatures and strong winds have reduced the remaining optimism for the crop in Texas and a good portion of Oklahoma. With the drought in the Southern Plains showing no signs of letting up, traders are recognizing its importance amidst the backdrop of a lot of ongoing uncertainties in the Black Sea.

There is a lot of talk that this year’s winter wheat crop in the Southern Plains could mirror that of 2011 as consistently dry conditions throughout the winter have led to many fields already getting zeroed out by crop adjusters. This shouldn’t come as a surprise though when nearly 80% of the entire winter wheat crop in Texas is rated by the USDA in poor-to-very poor (P/VP) condition. As the La Nina-induced weather isn’t forecasted to let up any time soon, this obviously not only impacts the fall-planted crops, but also those seeded in the spring, even if it is on irrigated land. More important though will be what happens in Kansas, the largest wheat-producing state in America, where about 70% of the state is in abnormally dry conditions, including 35% in a state of severe drought (mostly in the western half).

Therein, drought-reduced supplies can (and probably will) continue to feed the bullish narrative that’s been swirling around for the past 8 weeks since Russia invaded Ukraine. Combined with higher input and transportation costs (mostly because of higher energy prices or export bans), there is more concentration from the market on this year’s European, North American, and Australian harvests. Put another way, if any of these areas experience negative weather, the market is likely to exaggerate the potential impact before calming down. Or in grain marketing terms, this means opportunities to sell the rumour and profit on the fact!

The question is when to pull the trigger? Again, because of so much uncertainty in the Black Sea, and the importance of this year’s wheat harvest, we could see more than a few times that the market gets jumpy before the Canadian wheat harvest comes off later this fall. Historically speaking, in years where there are planting concerns, the winter wheat market tends to top out around the end of May or early June. HRS wheat futures tend to follow winter wheat unless drought conditions worsen in the Northern Plains and Western Canada, which usually pushes their highs out to around the end of June / early July (much like we saw in 2017).

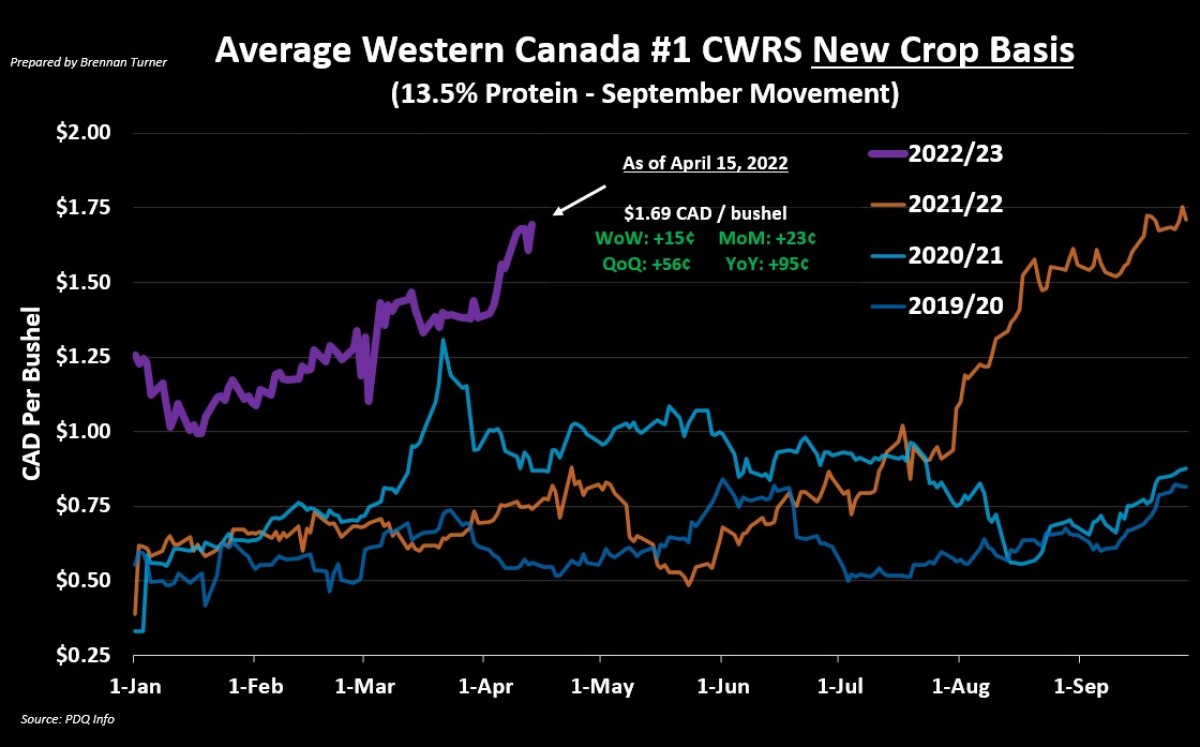

This is probably why, while new crop HRS wheat futures in Minneapolis haven’t really been pacing stride for stride with winter wheat futures, HRS wheat basis has been pushing significantly higher. In fact, while new crop Western Canadian HRS wheat prices topped $13 CAD/bushel in a few areas last week, average cash prices for September 2022 delivery now sitting at $12.93, including $1.69 of basis. This basis now represents more than 13% of the total cash price, which is high for this time of year. From an absolute value standpoint, this is also the strongest basis seen since September last fall. How I could interpret this is a good opportunity to lock in the basis and then price out the futures over the coming months as traders get more sensitive to adverse weather over said next few months.

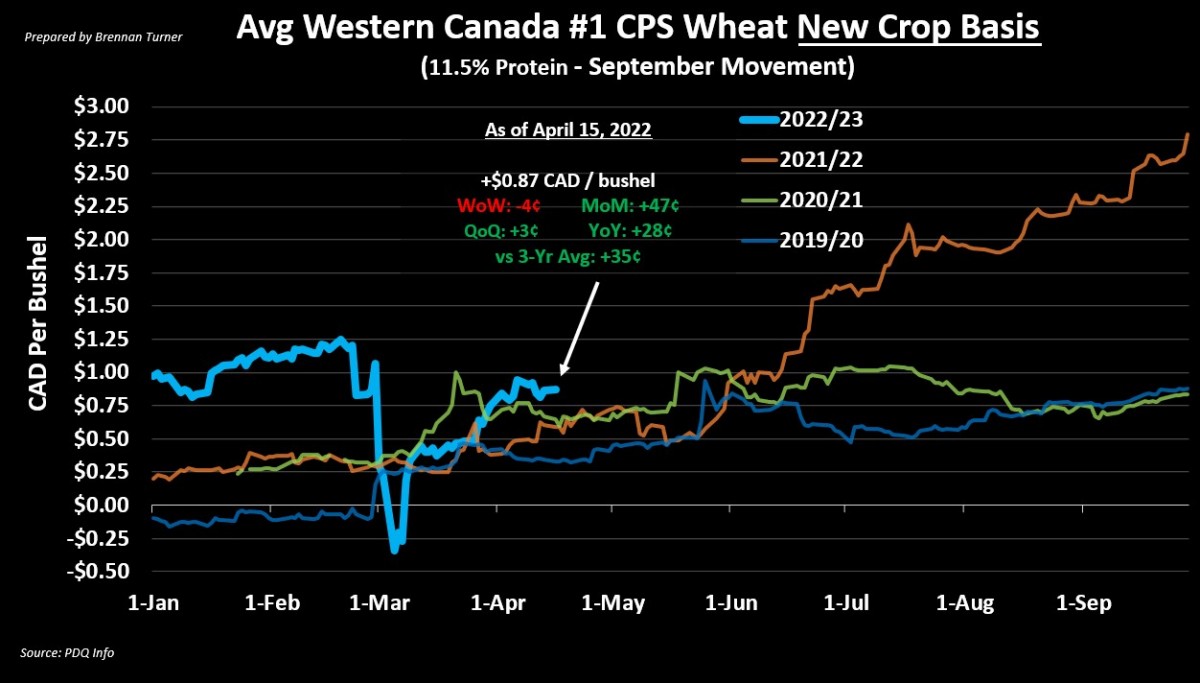

Comparably, new crop CPS wheat prices continue to follow the HRW wheat futures market lockstep, with average cash values for September 2022 delivery of $12.42, primarily driven by the speculative activity on the Kansas City board. Similar to HRS wheat futures, based on today’s fundamentals, there is plenty of room for volatility in the coming weeks for low-protein / CPS wheat, so I’m okay being patient before my next new crop sale. This is mostly driven by the aforementioned drought in the Southern Plains drought and limited wheat exports from Ukraine. For the latter, even if the war in Ukraine were to end tomorrow, it would probably take more than a few months to get all export capacity online again, largely because of how much is in Russia’s hands versus under Ukrainian control.

To growth,

Brennan Turner

Founder | Combyne Ag