Weather Markets to the Finish Line?

Grain markets finished the first week of August in the red, giving back some of the buying seen at the end of July. Forecasts for spotty rain throughout North American growing regions pushed the complex lower on Friday, as traders remember last year when crops seemed to survive on little, but timely rains. Optimism is growing for Ukrainian grain exports to scale up as three ships of corn feed left Black Sea ports last week. While wheat from this year’s harvest won’t start moving until next month, wheat values re-touched a 6-month low earlier in the week on the expectation that more supply will be able to make it to market eventually. As a reminder, the alternative options that don’t require Russia’s involvement/cooperation aren’t ideal, be it through, Danube River ports, trucking to Romania and then sailing out, or to the EU, via train, and then other international destinations.

Coming back to this side of the pond, also weighing on prices this week was private firms IHS Markit and Barchart putting out forecasts that are slightly larger than the USDA’s estimates from July (the USDA will update theirs in this month’s WASDE report, released on Friday, August 12). While the USDA’s last print suggested 177 bu/ac average yield and 14.5 billion bushels of production, IHS is pegging them at 176.9 and 15 billion bushels, while Barchart is at 177.8 and 14.7 billion bushels (obviously the key difference here is in harvested acres). For soybeans, IHS is estimating an average yield of 51.8 bu/ac and a crop of 4.53 billion bushels, while Barchart is at 51.4 bu/ac and 4.6 billion bushels, both in line with the USDA’s forecast of 51.5 bu/ac and 4.5 billion bushels harvested.

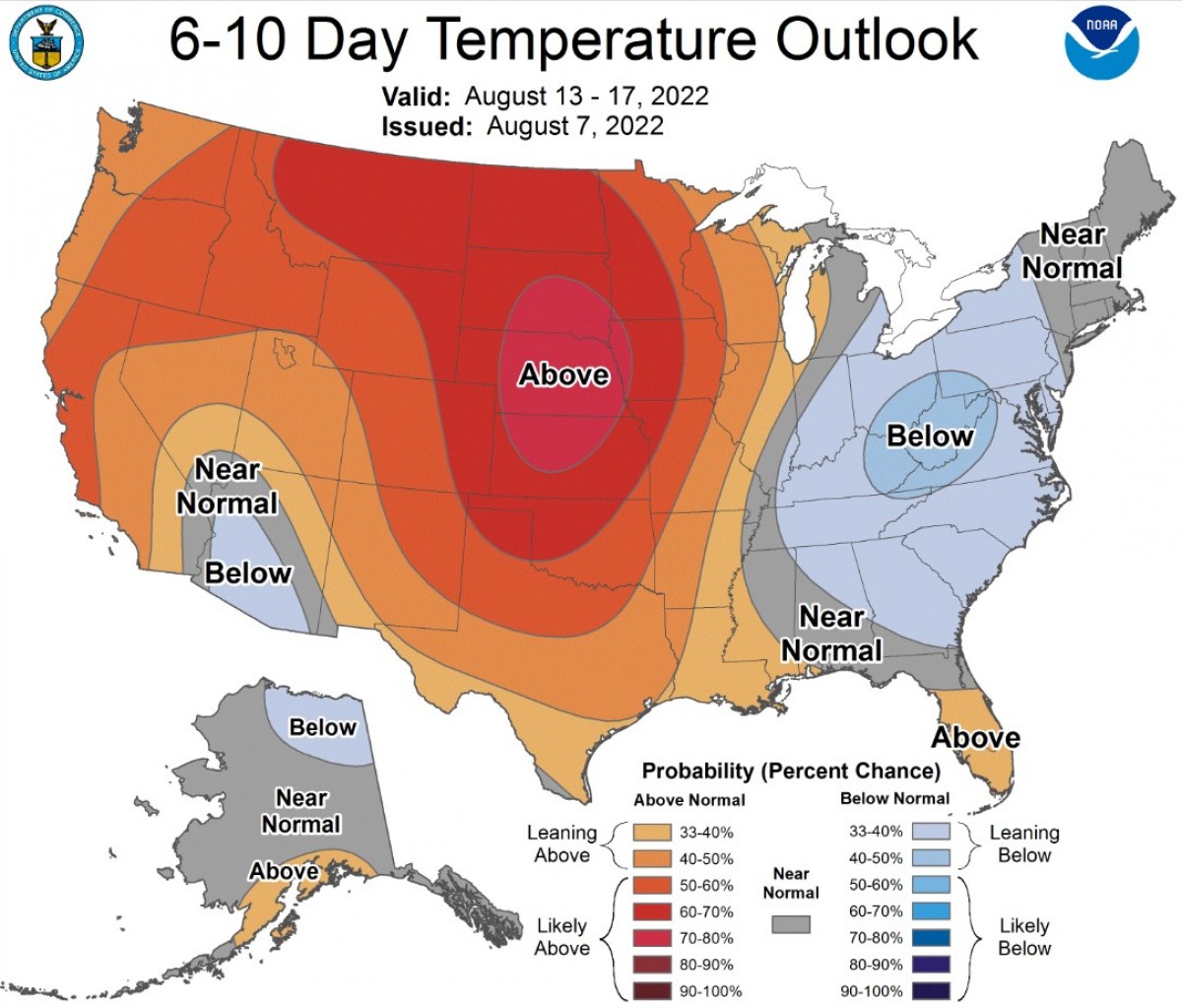

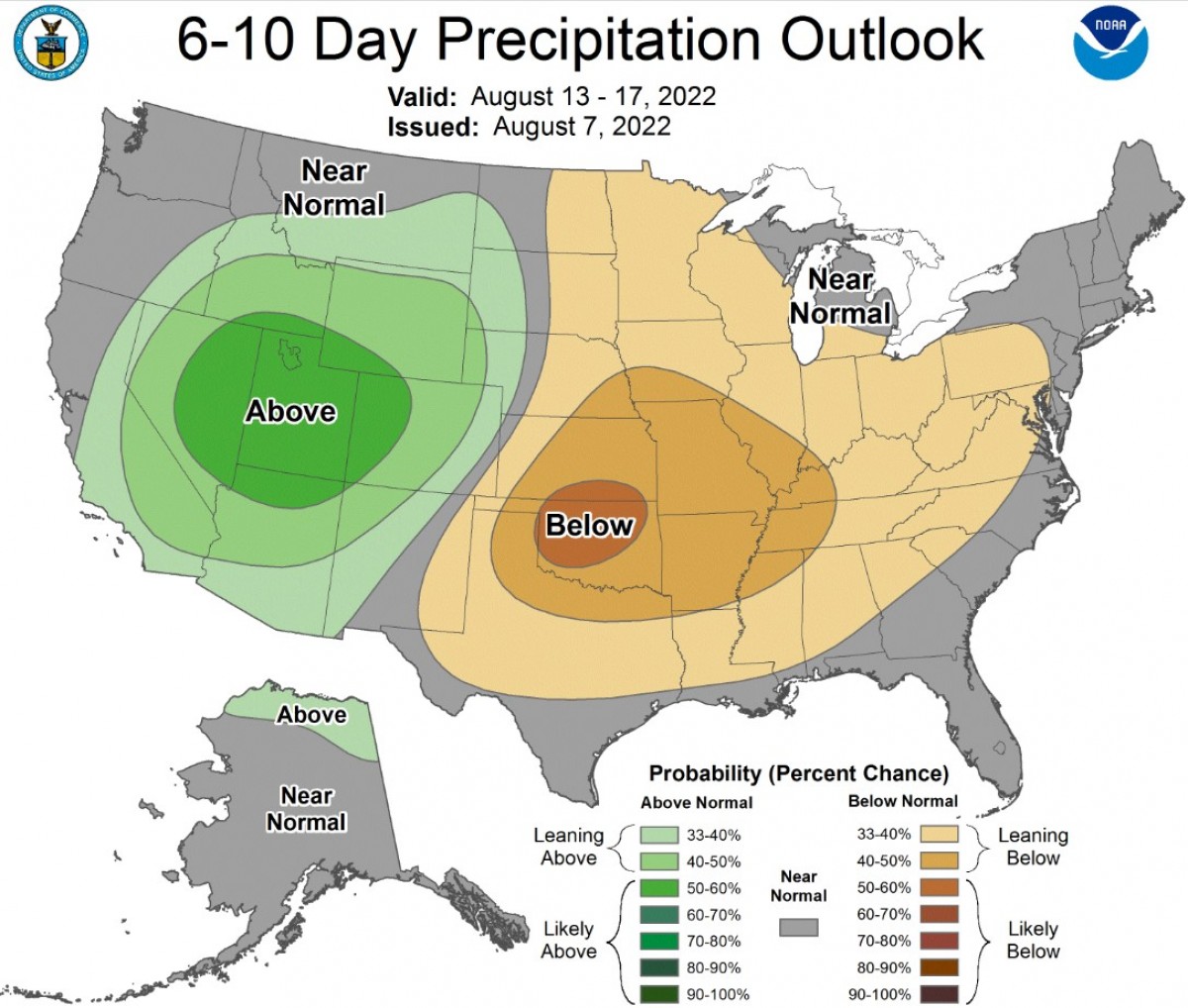

At this point in the growing season, the U.S. corn estimates are likely to come to fruition as the crop pollinated under generally favourable conditions, and so it’s likely that the bulk of the crop will be there, especially if it receives another shot or two of moisture in August. There’s still a question mark though for soybeans as pod-filling is happening now, and too much heat, or a lack of moisture, or both, could certainly push end-users to secure supply faster than usual, moving from a “just-in-time” pipeline to one of “secure-it-while-you-can”. Therein, through the middle of August, U.S. soybean growing regions are expected to see some significant heat, as well as minimal moisture.

How might this all impact the wheat trade? Frankly, upward price pressure in just soybeans or corn could help wheat prices as well, but likely more for the low-protein varieties (feed rations may change, depending on the price!). That’s why we saw the wheat complex pull back this week, but also because speculators continued to get more bearish on the crop. More specifically, money managers in the Kansas City HRW wheat trade are in their most minor net long position since September 2020, while they went net short for the first time in the Minneapolis HRS wheat market since 2020.

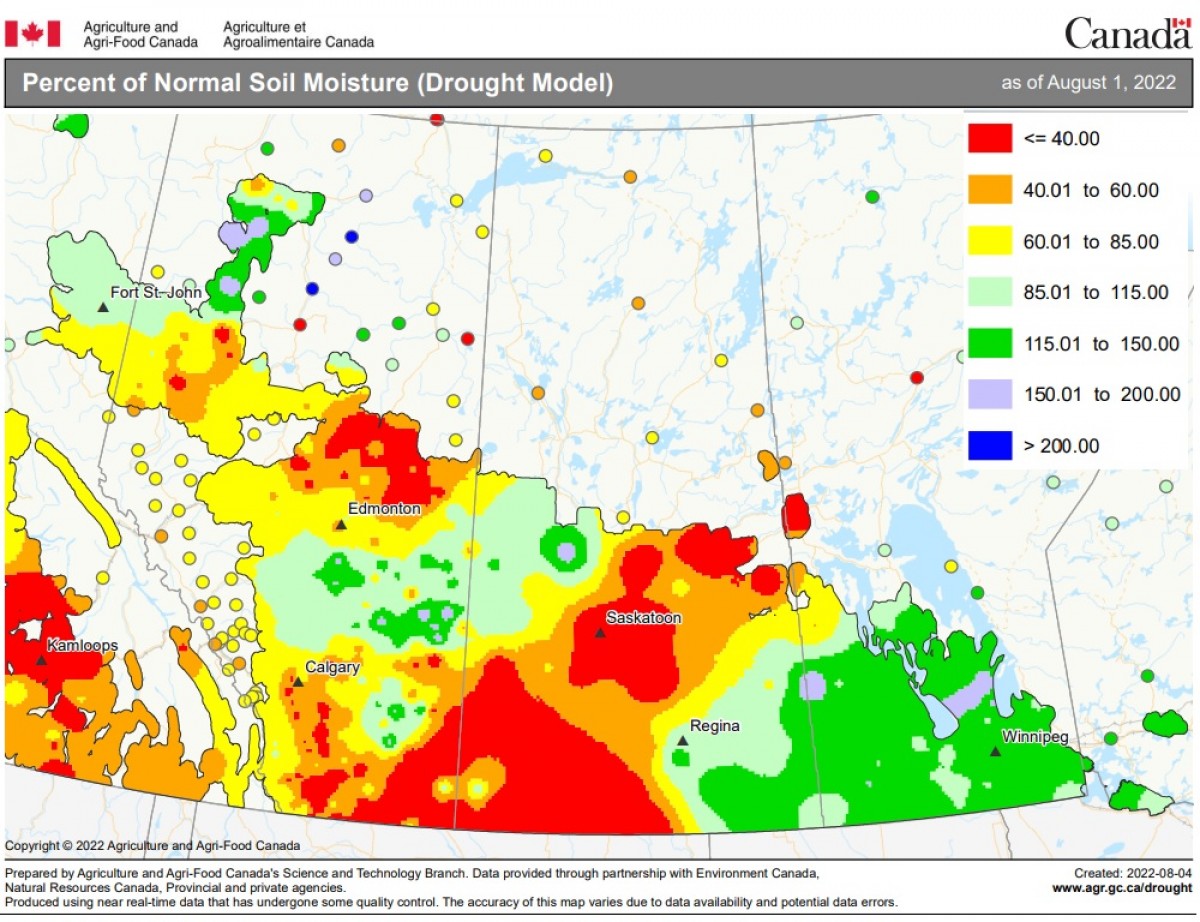

Thus, one might infer that the market is anticipating a decent wheat crop and, with some boatloads of grain starting to leave Ukraine, optimism that trade will flow without much issue this year. The North American spring-planted wheat crop is still a few weeks away from getting into the bin. Save for east central Alberta, NW Saskatchewan, SE Saskatchewan, and Manitoba, there is a pretty significant area of the Canadian Prairies that could still use more rain to bring things home, with soil moisture in these drier areas currently sitting well below the average, as per Agriculture Canada’s model.

Ultimately, it’s looking like grain market activity for the rest of August will largely be influenced by changing weather forecasts and more private production estimates, as well as this week’s WASDE report, which will reset some goalposts. For the Canadian market, we won’t get a government estimate of production potential until August 29 when StatsCan will release its model-based estimates from July, and then another update from them about two weeks later on September 14. Without some adverse weather – read: hot temperatures and/or limited rainfall – the market is likely to be in a risk-off mode, waiting to see the crop materialize, relative to the published and updated forecasts. While volatility will continue as long as the war in Ukraine and recession issues are on the table, the weather will still be the variable shifting gears the most for grain prices as we near the finish line.

To growth,

Brennan Turner

Founder | Combyne.ag