A Contrarian Case for Spring Wheat

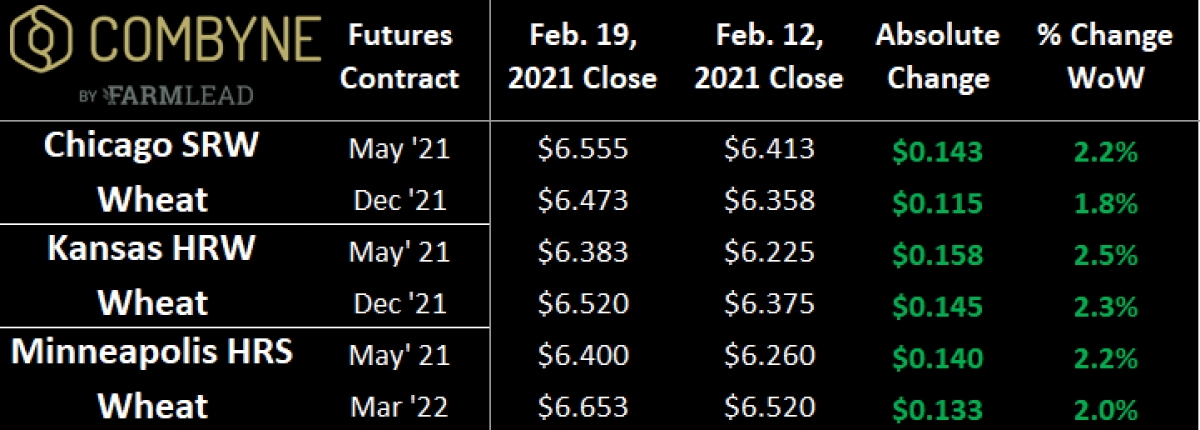

Wheat markets continued their march higher last week as frosty temperatures across the Southern Plains continued to spark concern of more winterkill of the winter wheat lying in dormancy. Also supporting wheat was a lower production estimate for the Russian 2021/22 wheat crop by SovEcon, who cited the impact of unfavourable February weather on a wheat crop that went into the winter in its worst shape in a decade (mainly thanks to limited moisture in the autumn). Finally, last week, the USDA held its annual Ag Outlook Forum, suggesting U.S. farmers will plant a total of 45M acres and produce 1.83B bushels (or 49.7 MMT) for the 2021/22 crop year (both numbers are a slight increase over 2020/21).

On the flip side, U.S. corn and soybean acreage are both expected to increase to 92M (+1.2M year-over-year) and 90M (+6.9M) respectively, which, combined, would be a new record area for the 2 staple American crops. From a production standpoint, the USDA has big expectations, forecasting a new record for average U.S. corn yields of 179.5 bu/ac, which would produce 15.15B bushels (or 384.8 MMT), matching the record for largest crop set in the 2016 harvest. For soybeans, the USDA expects to see 50.8 bu/ac, which would be the 3rd-largest ever, and, off the near-record acreage, would result in a new production record of 4.53B bushels (123.2 MMT).

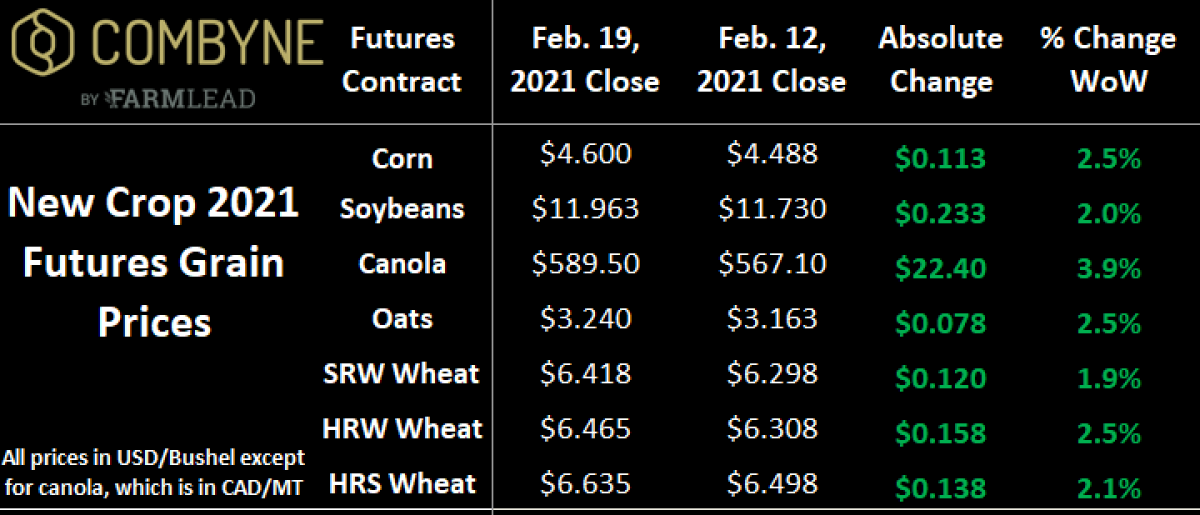

So, how does this impact wheat? Well, at current new crop prices, planting corn or soybeans looks a lot more financially attractive than spring wheat. Using 2020 average yields from North Dakota and Minnesota, and current new crop futures pricing, the back-of-the-envelope math suggests, today, that soybeans per acre revenues would be 40% greater than spring wheat, while corn gross income would be more than double spring wheat’s. Therein, if we don’t see new crop spring wheat prices increase a bit before tractors roll in April/May, we could actually see a lot less spring wheat get planted in the U.S. than the USDA is currently forecasting. Worth noting, however, is that the aggregate net-long position held by speculators in corn is about 27,000 contracts behind the all-time record. If we start to see any unwinding of these positions in the next few weeks, the financial incentive to plant corn, instead of spring wheat, will be inherently weaker.

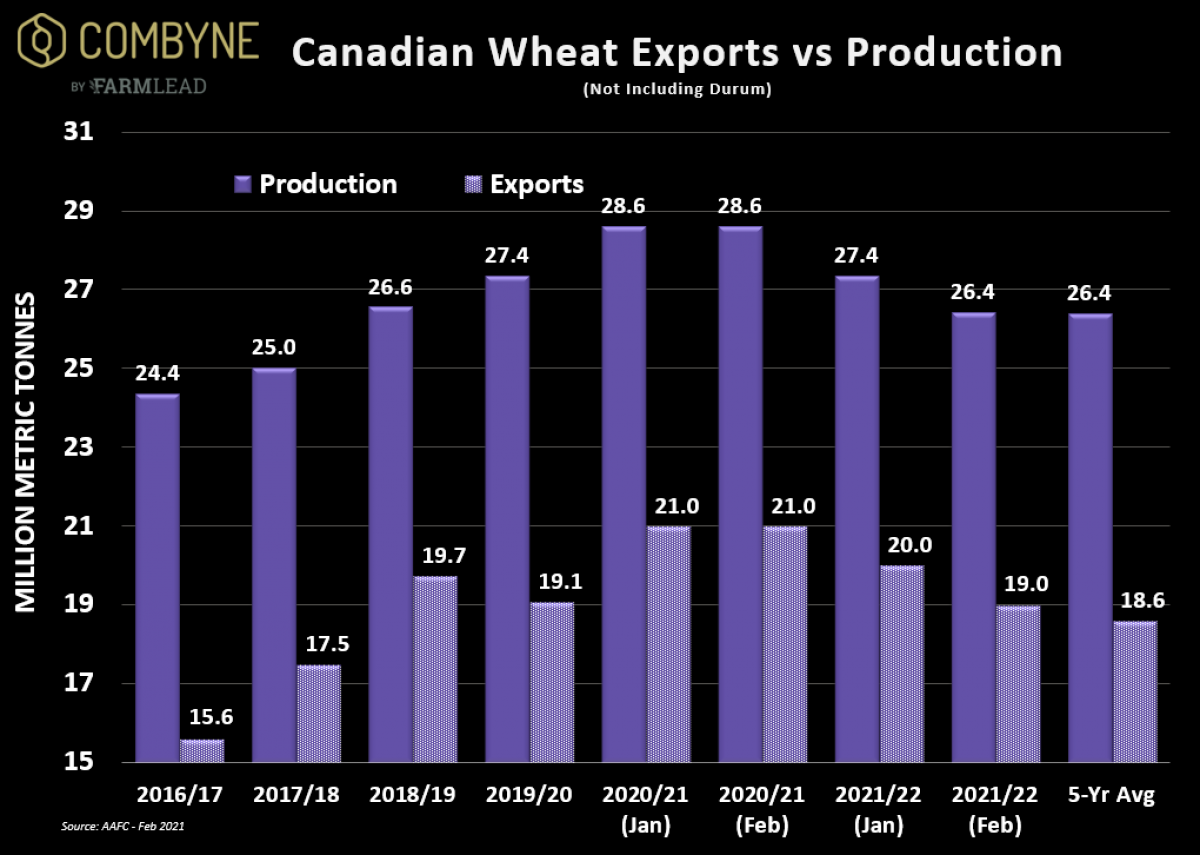

Speaking of spring wheat acreage planted, last week, Agriculture Canada updated its estimates for the upcoming Plant 2021 campaign, reducing their forecast for non-durum wheat area by 1M acres to now sit at 18.5M acres. The reason for the downgrade is the competitive prices for other crops, namely canola (acres increased by 250,000 from the January AAFC estimate), barley (+830,000 acres), and oats (+300,000 acres). Accordingly, with a smaller crop comes smaller production, and to reflect that, AAFC lowered their expectations for non-durum wheat exports in 2021/22 by 1 MMT to now sit at 19 MMT. AAFC also said that their decision to lower exports was based “on uncertainty surrounding China maintaining its current aggressive purchasing behaviour.”

With domestic use of Canadian non-durum wheat also dropping by 307,000 MT to now sit at 7.45 MMT for the 2021/22 crop year, ending stocks have stayed the same at 5 MMT. Looking at the old crop, stronger domestic use, especially in the feed category, resulted in Ag Canada revising 2019/20 ending stocks by 400,000 MT to sit at 4.9 MMT. On the durum front, the balance sheet was relatively unchanged, with AAFC keeping ending stocks at 950,000 MT for 2020/21 and 1.3 MMT for 2021/22.

Ultimately, there’s a bit of a contrarian case for bullish spring wheat that’s emerging. Given the expected reduced acreage in both Canada and the U.S., a Russian wheat export tax, and China and other big importers continuing to overbuy to ensure food security in the COVID-19 pandemic, demand should remain strong. However, instead of demand driving any rallies 6-12 months from now, it will likely be the supply variable that will have the greatest influence.

To growth,

Brennan Turner

CEO | Combyne Ag