Are the Highs in for Wheat?

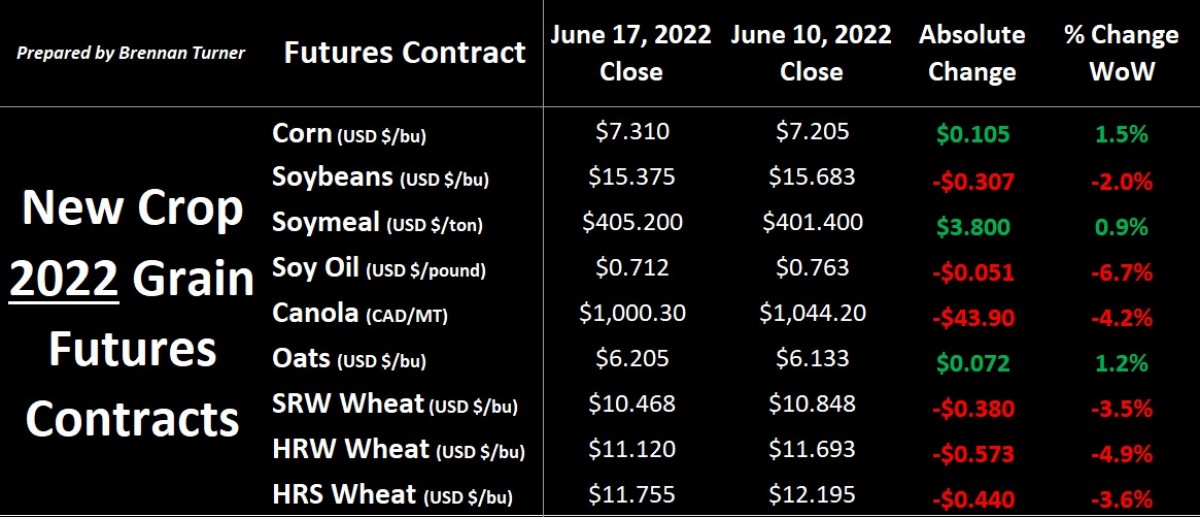

Grain markets moved through the middle of June a little mixed as profit-taking at the end of the week pushed things lower. Traders put a lot of focus on the weather this week, with rains starting to fall in some drier areas of Western Canada, but this was offset by a potentially bullish heat wave in the Midwest and Northern Plains. Wheat futures touched their June 1 lows, and from a momentum standpoint, Chicago, Kansas City, and Minneapolis boards are now deeply in oversold territory. In outside markets, for the first time in over 30 years, the U.S. Federal Reserve raised its main interest rate by 75 basis points (or 0.75%), with likely more hikes coming as they try to battle 9% inflation. Also from Washington, D.C. this week, the U.S. House of Representatives passed a bill that would enable year-round sales of E15 fuel, which is currently about 10 - 40¢ / gallon cheaper than E10 gas. This would be supportive of corn prices, given the potentially higher ethanol demand.

Despite the selling on Friday, corn prices were also supported by some very hot weather hitting the U.S. Corn Belt as a ridge of high pressure led to nearly 1,900 heat records getting broken across the U.S. in the last week. Traders are concerned that if the high-pressure ridge sticks around and remains strong, it will have similarities to 2012 or even 1988 when it stopped raining in the Midwest after June 21 but 100-degree days stuck around. Therein, some premium is added to corn as the risk of a flash drought is now higher, and therefore the USDA’s 177 bu/ac corn yield estimate is also at risk.

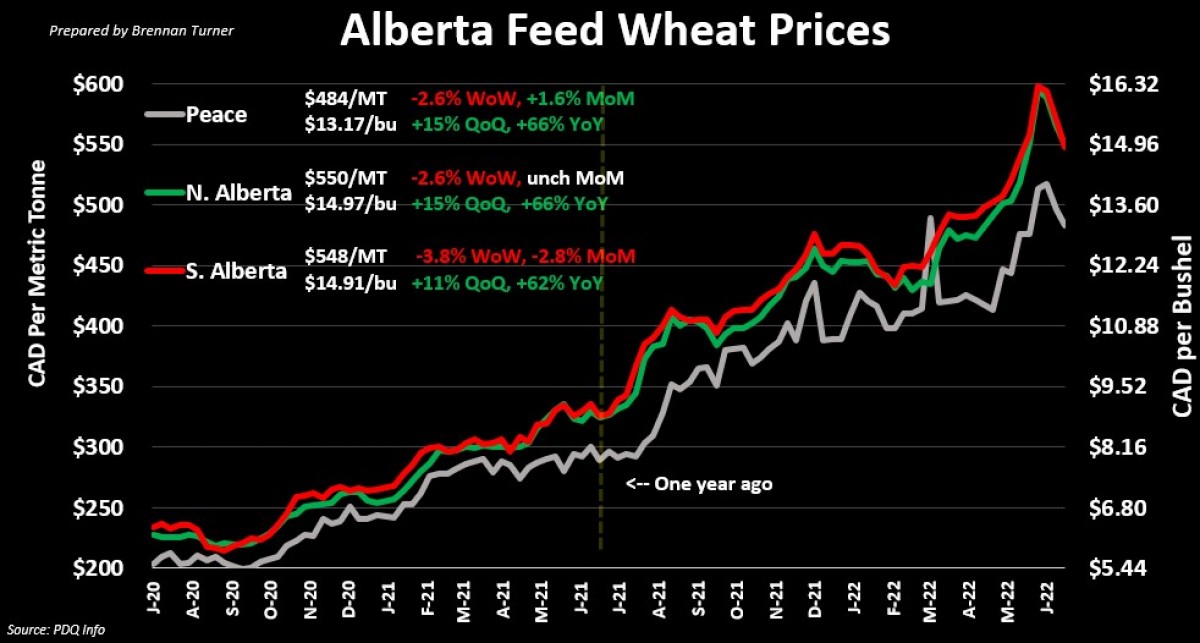

We haven’t looked at many cash wheat prices in the past few weeks, as the focus has been all about getting the crop in the ground, and not necessarily making any cash sales. But with fields now emerging, being aware of seasonal tendencies is essential, and, depending on this heat, it’s possible we haven’t seen the top yet. Intuitively, this would be supportive of feed prices, but feed wheat values in Alberta have pulled back for 3 straight weeks now as the market is anticipating the first new crop supplies being available in the coming weeks.

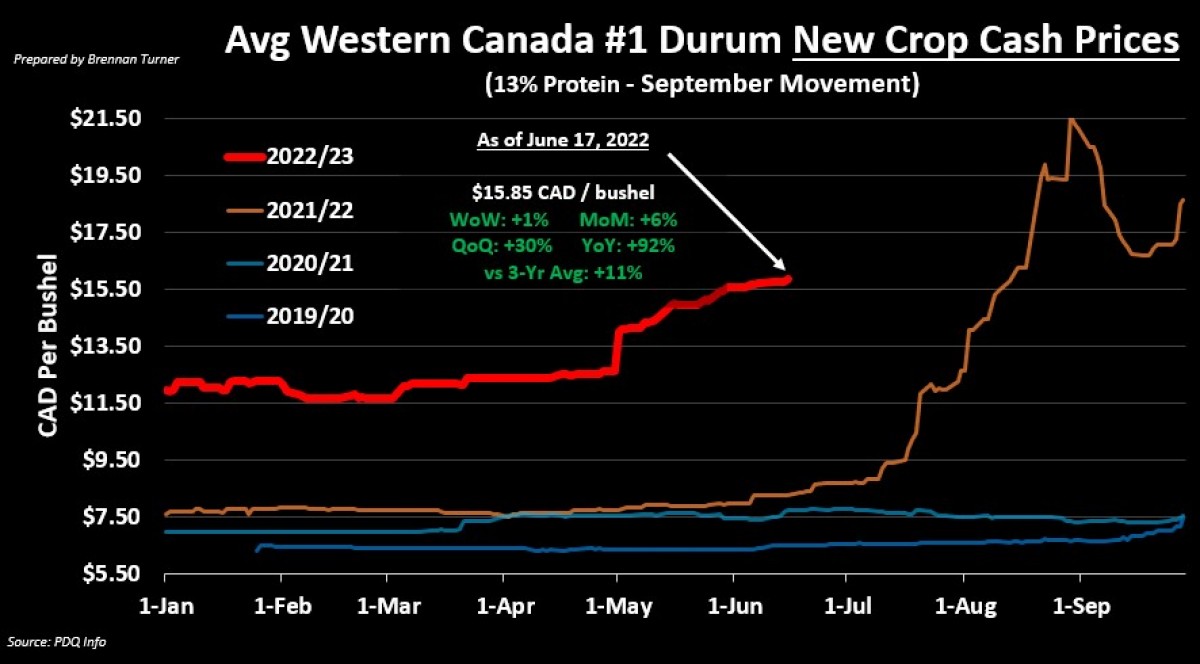

Where it’s also been hot is Europe’s key durum-producing regions, as the European Commission just lowered its estimate for this year’s harvest to 7.6 MMT, down 2% year-over-year and 5% below the five-year average. However, Italy has been really hot the last few weeks – I can personally attest to multiple days in a row of over 35 Celsius temperatures when I was in Rome and Florence the first week of June. In fact, Coldiretti, an Italian farm group, thinks that the country’s wheat production could end up 15% below last year’s output. This is relevant when the country accounts for at least half of Europe’s durum harvest every year (followed by France, which has had below-average precipitation since January, then Spain and Greece).

Combined with the below-average durum harvest in North Africa, demand from across the Atlantic Ocean for North America durum – be it Canadian, American, or Mexican – should be very strong, with discussion out there that the EU will import 1 MMT more durum in 2022/23 than 2021/22, for a total of 2.5 MMT. Given the record-tight inventory scenario, and the European harvest starting here soon, the market will remain very sensitive to production outlooks in Canada and the U.S.. Put another way, these increased demand and lower supply scenarios are why new crop durum prices in Western Canada have climbed about $2 CAD/bushel in the past 2 months. However, I think there’s some potential for higher values yet, as we’re far from being guaranteed average yields in durum’s Harvest 2022, let alone a bumper crop.

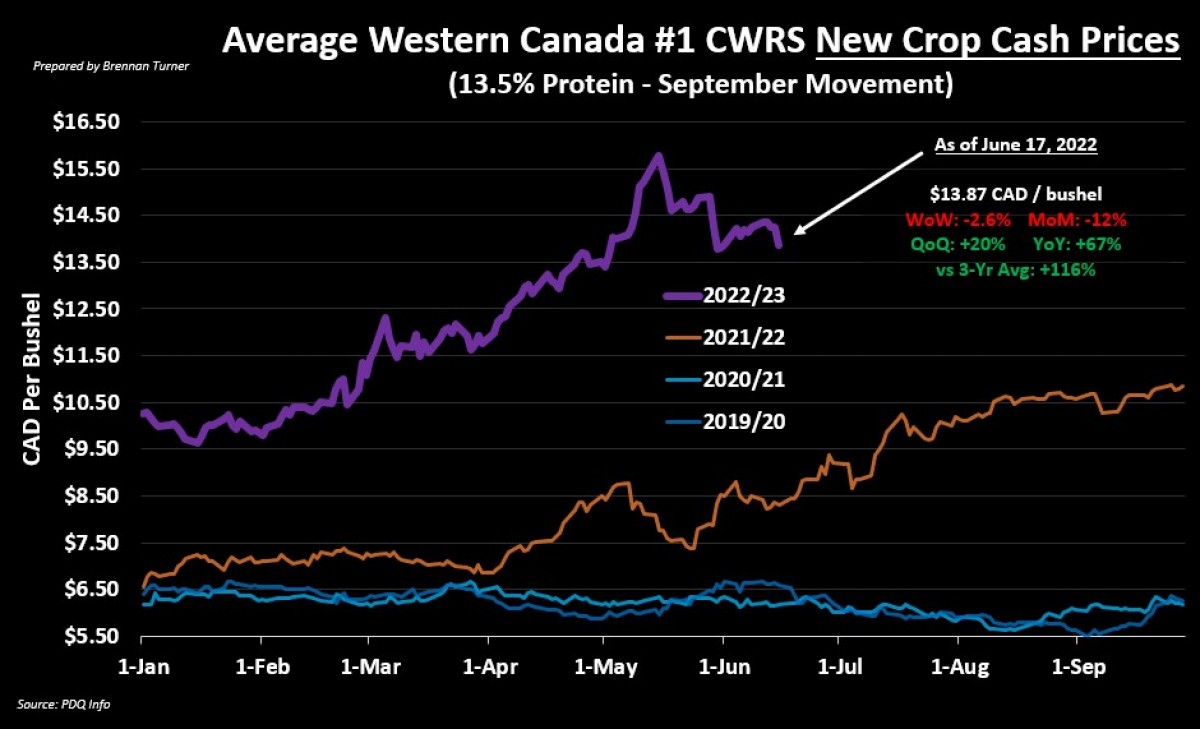

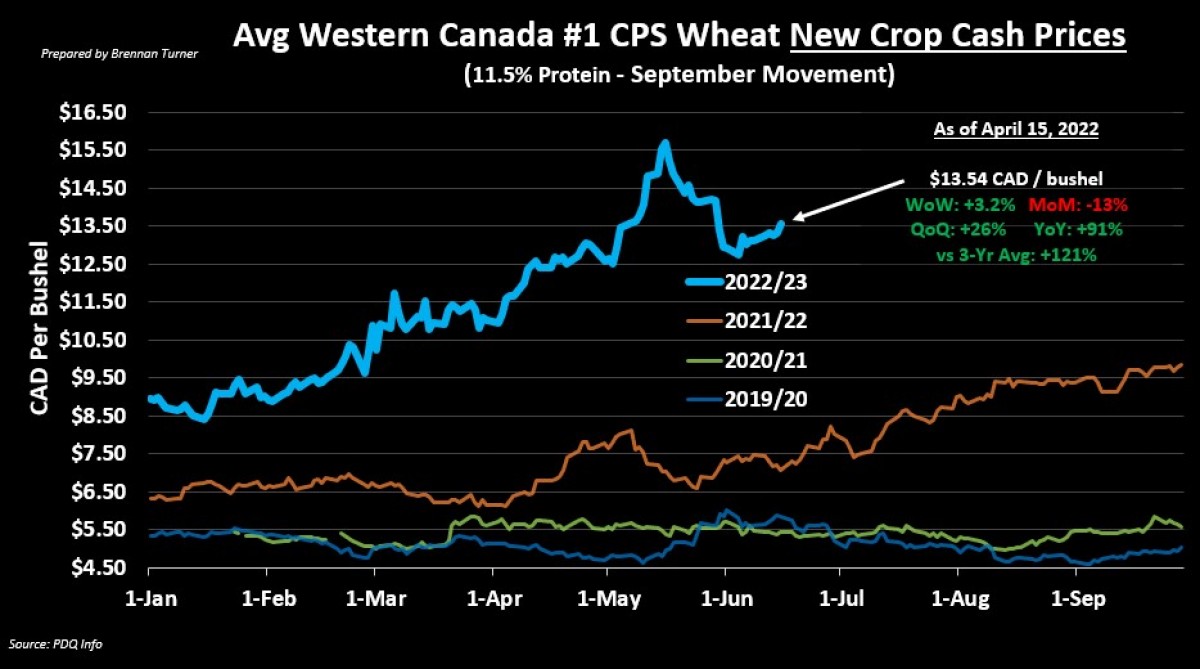

On the flip side, new crop CPS and HRS wheat prices in Western Canada have gone the opposite way, down about $2 CAD/bushel from the highs seen about a month ago when planting concerns were at peak panic. As the orange line in these new crop price charts shows, if the heat sticks around, we can certainly expect a higher push throughout July than we saw last year. Just remember that plenty of areas in the eastern half of the Canadian Prairies could use heat after an incredibly cool and wet spring. Therein, some dates I think about in terms of locking additional new-crop cash sales for CPS or HRS wheat would be early-to-mid July. Of course, this could change with the USDA’s refreshed acreage report on June 30th, and Statistics Canada’s own update to the country’s planted acres on July 5th, but this is the window I’m currently watching.

To growth,

Brennan Turner

Founder | Combyne Ag