Bigger Supply, Stronger Demand

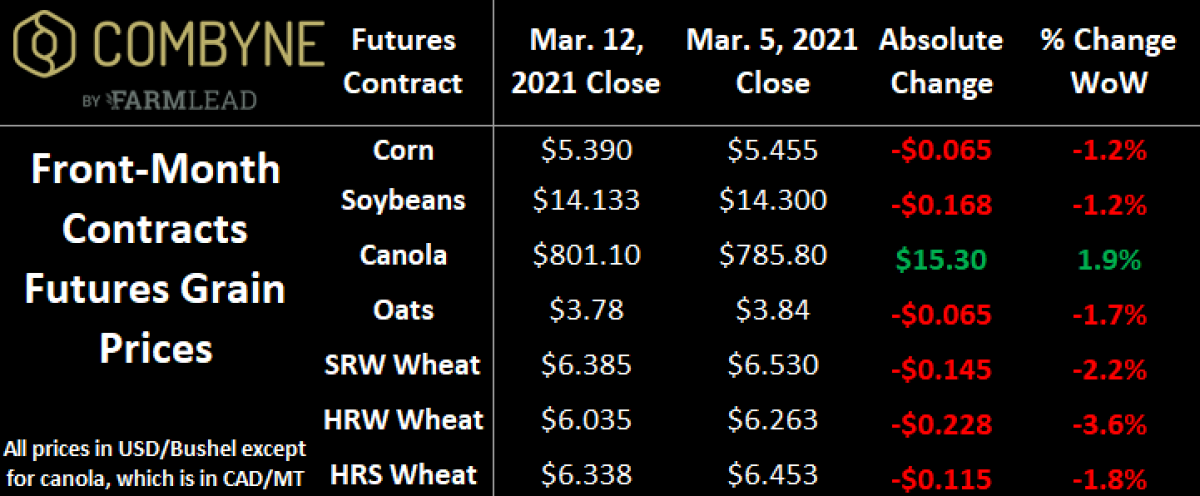

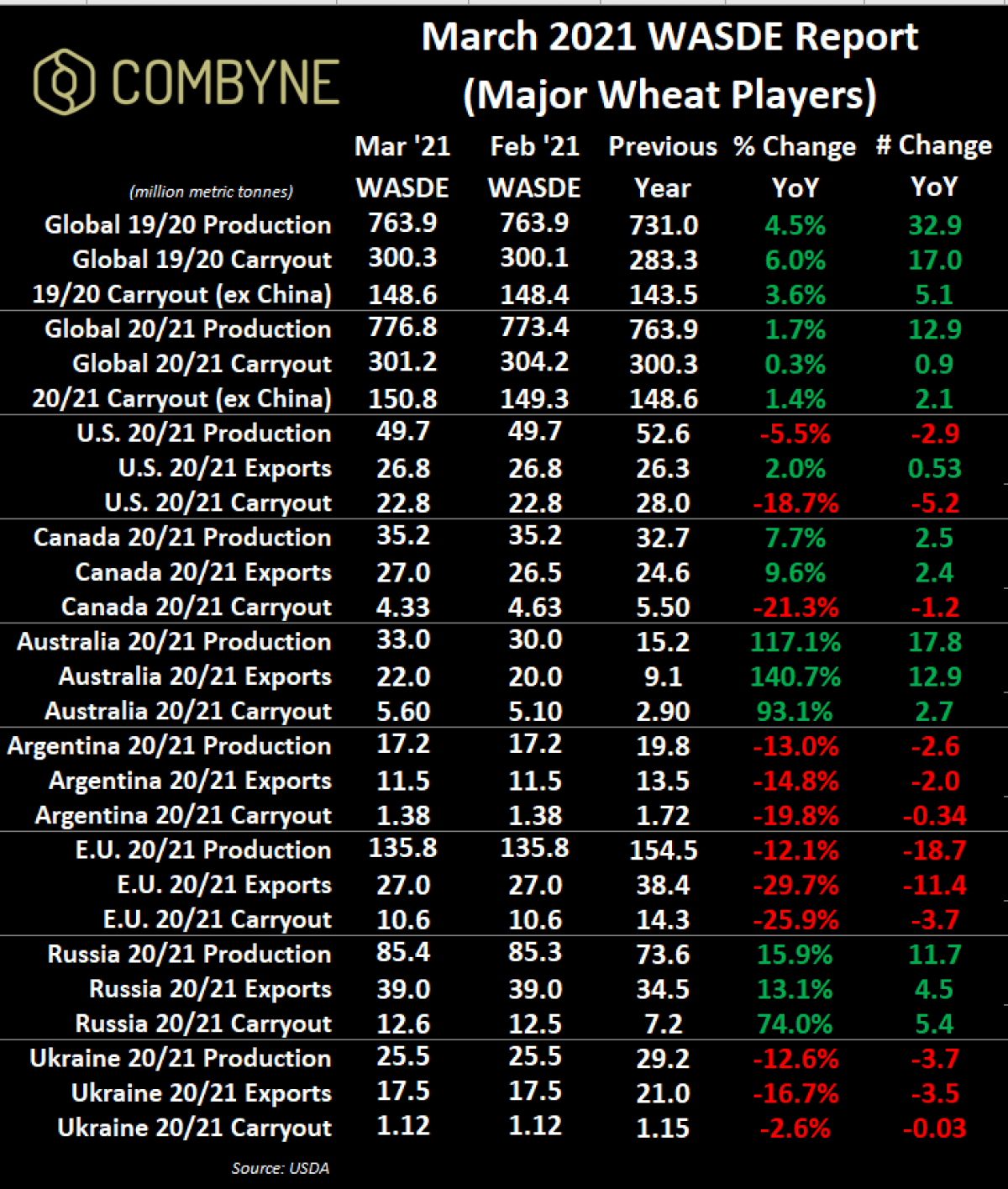

Wheat markets and everything else (save, canola), ended the middle of March in the red after a week of fund selling and bearish weather reports. Last week, the market was also served the USDA’s monthly WASDE report, which showed a bigger worldwide 2020/21 wheat harvest, but also stronger feed use, meaning ending stocks fell (albeit, it’s still sitting at a record of 301 MMT).

More importantly for the wheat crop, well-appreciated moisture – both rain and snow – was expected to fall over the weekend and to start this week in major wheat-growing areas. This would help replenish soil moisture levels and alleviate some production concerns, which is why hedge funds reduced their net-long position in both HRW and SRW wheat futures. However, parts of the U.S. Northern Plains missed the weekend moisture, which is partially why wheat markets started the current week in the green.

Coming back to the March WASDE report, the USDA raised their estimate of the Australian wheat harvest by 3 MMT to a new record of 33 MMT. Therein, Australian exports were also raised by 2 MMT to now sit at 22 MMT, which would be more than double last year’s shipments and 56% above the five-year average. There were no other major production changes, but the USDA did raise global demand to a new record of nearly 776 MMT, which basically matched the production record of 777 MMT. Compared to the February 2021 WASDE report, wheat demand was raised by 7 MMT, and was mostly attributed to increased feed wheat use in China, now estimated to be a record of 145 MMT.

In two weeks, we’ll get the USDA’s Prospective Plantings and Quarterly Stocks reports, which usually have the ability to influence markets a bit. On that note, brokerage firm, Allendale, in their annual farmer survey suggested that American farmers will plant 92.8M acres of corn and 90.3M of soybeans, both slightly higher than what the USDA forecasted at their Outlook Forum in February. Specific to wheat, Allendale’s survey suggests 32.2M acres of winter wheat (+1.66M acres or +5.4% year-over-year), 12.5M acres of spring wheat (+265,000 acres or +2.2% YoY), and 1.74M acres of durum (+240,000 acres or +16% YoY). Given some of the ongoing drought concerns in the Northern Plains, spring wheat and durum crop progress reports will be closely watched when the Plant 2021 campaign fires up in a few weeks.

Speaking of new crop, the International Grains Council is forecasting a 2021/22 global wheat harvest of 780 MMT. Accordingly, this would, again, be a new record level of production and the third consecutive annual increase by wheat farmers globally. Most of the increase year-over-year is being put on the shoulders of E.U. farmers, where wheat acreage is expected to expand by about 5%. In that vein, Strategie Grains is estimating a soft-wheat crop of 130 MMT, whereas the European grain trade association, Cocereal, is forecasting a 127 MMT, blaming the abundant moisture in February for their smaller number. (NOTE: the USDA’s estimate shown in the table above is for ALL wheat, including durum).

Overall, there continue to be some healthy new crop pricing opportunities, and we’re also seeing some quality old-crop trades on the Combyne Ag Trading network. Accordingly, given the prospect of a big wheat crop here in North America, reducing some of your exposure to the downside is a disciplined risk management approach. On the flipside, by sticking to 5% - 15% incremental sales, you’ll still be able to capture any major weather premiums that could show up, should conditions stay dry in North American wheat areas in April / May / June.

To growth,

Brennan Turner CEO | Combyne Ag