Checking for Tailwinds in Wheat

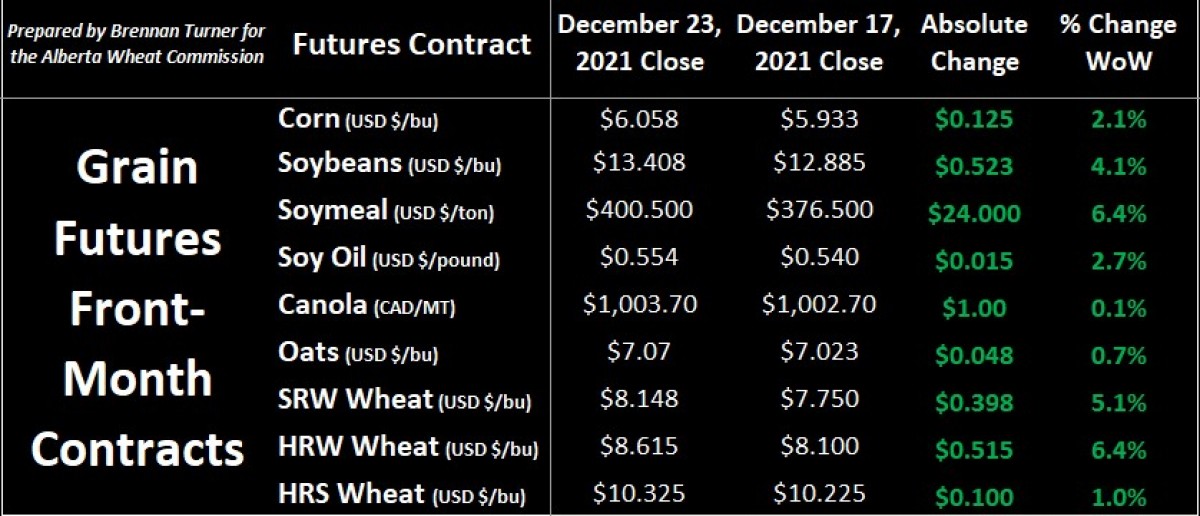

Grain markets pushed higher in the shortened-trading week leading into Christmas (markets were closed on Friday, December 24), as weather fears drove any bearish pressure to the sidelines. Corn and soybeans led the complex higher as weather forecasts for southern Brazil, northern Argentina, and Paraguay were looking very dry, a function of the ongoing La Nina system. To the pleasure of the bulls though, the lack of rain and ongoing heat comes at key point in the crop’s development for this region. Therefore, this amplifies bullish interest, and with a less participants in the markets, prices can move higher, faster.

The other geography where weather is a concern is squarely impacting the wheat complex. Strong winds, low humidity, and above-average temperatures have put the U.S. winter wheat crop in its second-worst condition ever as it entered dormancy with nearly one-quarter of all fields in the U.S. in poor or very poor shape. This is also the worst rating for the American wheat crop since 2012. It’s important to remember that winter wheat is incredibly resilient and can surely rebound, but a similarly important variable to also factor in is the lack of topsoil moisture.

Back in 2008 though, when wheat prices across all three exchanges hit their record levels, January and February weather further negatively impacted the potential of the American winter wheat crop. This drove most speculators to the bullish column, and therein, pushed prices up to historical levels that we haven’t seen since. Therein, the weather that not only materializes, but is forecasted over the next six weeks will have a great impact on wheat prices. As we all know, and was shown back in 2008, the possibility of further supply risks will fuel any bullish speculation.

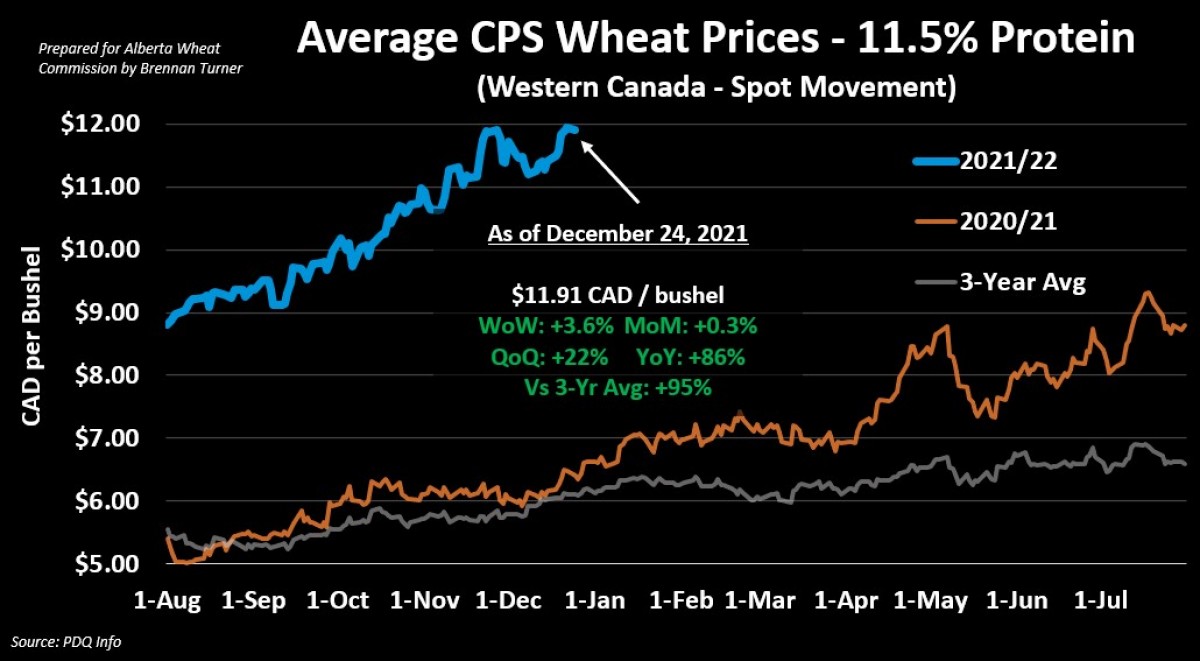

That said, low-protein (CPS) wheat prices on the cash market have already seen the benefit of futures rebounding, but local demand has significantly helped basis levels. In fact, current average basis for CPS wheat for spot movement in Western Canada is sitting at $3.30 CAD/bushel, which is basically six-times what it was a year ago, and three-times the three-year average.

Any increase in Kansas City HRW wheat futures (which is tied to production in the U.S. Southern Plains) will certainly continue to help cash CPS wheat prices, but it’s worth noting that basis almost accounts for 30% of today’s cash price; This is the highest it’s ever been. Something to mindful of going forward is how this market pulls back a bit in February and March.

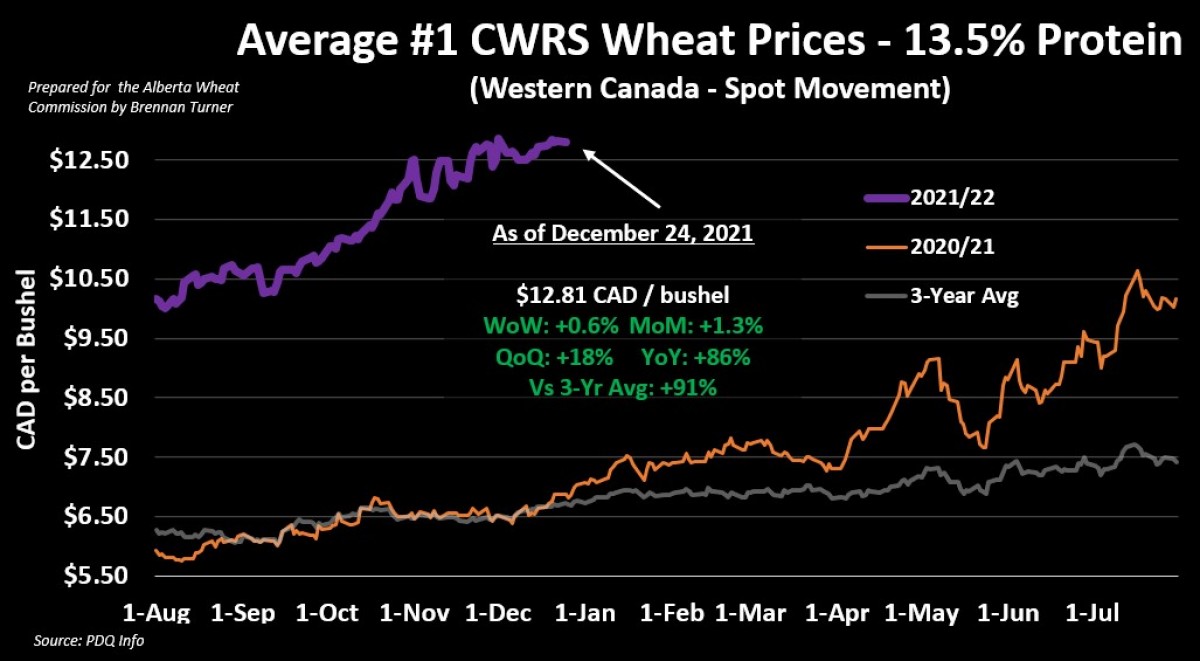

For HRS wheat, futures values have been holding up fairly well, despite a slowdown in bullish headlines. This past Thursday, the March 2022 contract’s close on Minneapolis’ exchange of $10.33 isn’t far from the high of $10.50 seen back in mid-November. While some snowstorms have been seen in the U.S. Northern Plains and Western Canada, there are plenty of areas that will need to see more moisture events to be out of the deficit that’s still a reality today.

Further, because of other high-priced crops, HRS wheat acres in this region will likely decline in Plant 2022 in favour of other options like peas, lentils, canola, flax, oats, or durum. Just to be clear, I don’t think we will see 2008’s record prices for HRS wheat, but regardless, seasonal tendencies suggest higher HRS wheat prices before the end of January. Thereafter, I’m mindful of the doldrum of the HRS wheat market from February through April, although, with reduced spring wheat acres, a pullback may be less significant than in years past.

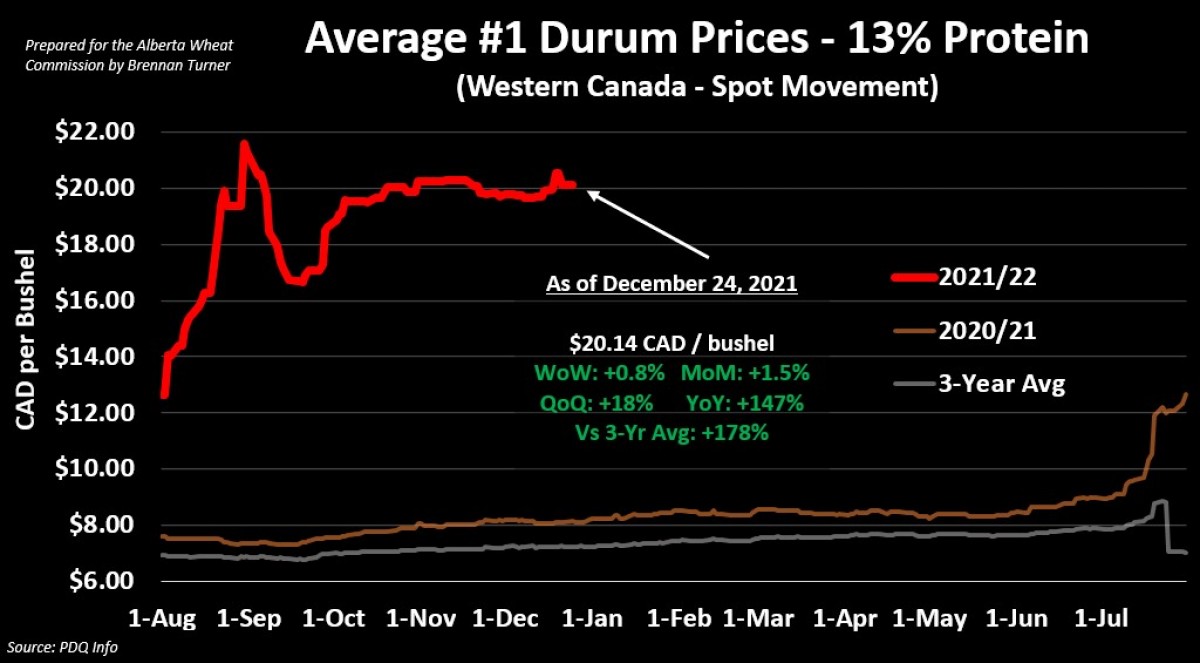

Finally, durum prices have levelled off a bit after StatsCan reduced total Canadian supplies by nearly 900,000 MT from their previous estimate to sit at a new record-low harvest of just 2.65 MMT. While the limited supply has been known for awhile, durum prices remain two-and-a-half to three times higher than years past. From a seasonal standpoint, there’s no real direction that durum prices tend to follow in the coming months, but I am mindful of the coming harvests in Europe, North Africa, and the Middle East. Worth noting though is that governments from the MENA region (Middle East|North Africa) continue to generate strong demand for all types of wheat.

This comes as wheat acres in Turkey are likely to be reduced for the new crop year, as high fertilizer prices will push farmers there away from planting the cereal on non-irrigated soil. This, combined with the very devalued Lira and the Turkish government intervening in wheat prices (read: adjusting them to battle high inflation), is pushing Turkish producers to plant lentils and chickpeas instead. Potentially complicating production potential of these pulses, wheat, durum, or any other crop is that the country is likely see a second straight year of drought (rainfall over the next few months will be closely monitored).

Reflecting on 2021 wheat markets, they were largely a function of supply-driven rally, but one that springboarded off the demand-fueled rally seen at the end of 2020. A rally usually sees a pullback thereafter, so why should a rally following a rally mean anything different? The key difference is that a demand rally is usually a function of substitution effects – i.e. China buying more feed wheat when corn prices are too high. However, when a supply-driven rally happens, limited carryover of stocks into the next year helps keep prices elevated for a little while, or at least until a healthy understanding of what that crop’s potential will be. Next week, we’ll look at what this means for wheat prices in 2022.

Happy New Year!

To growth,

Brennan Turner

Founder | Combyne.ag