Funds Helping Fuel Bullish Grain Run

Grain markets continued to push higher through the end of October 2021 as U.S. harvest rain-delays and strong export sales (despite slower producer selling) are all helping push the complex higher. Oats futures were the biggest winner for both the week and month of October as the reality of this year’s smaller harvest continues to push up pricing competition amongst buyers in the cash market for the cereal.

Corn futures also climbed to the highest they’ve been in 2.5 months, while Minneapolis-traded HRS wheat futures pushed up to their highest levels in 10.5 years, with the next level of resistance being around the $11 USD/bushel level! It’s worth also noting that Kansas City-traded HRW wheat futures made a 7.5-year high earlier in the week, before some profit-taking amongst traders. Looking abroad, EU milling wheat futures on the Paris Matif exchange are trading at their highest levels in 13 years.

This bullish trend doesn’t look like it will immediately reverse itself, largely because we’re seeing the support for the fresh influx of net-new speculative money. In fact, we haven’t seen this level of open interest (total number of futures contracts, be they short or long) since mid-April, just before Plant 2021 started. Over the summer though, more fund managers focused on trying to beat inflation by buying up other commodities like oil and lumber. As those commodities became overbought though, they were drained of their profits and now managed money has turned its attention back to the grain sector.

Why? Well, it’s now very well known amongst the non-farming community that a supply shortage of grains like HRS wheat, oats, and canola are all battling against very consistent demand. Therein, prices are bound to rise (and of course they have). While the speculative money is making the farmers who’ve locked their bin doors look smart, corn fundamentals are fairly bullish, driven currently by healthy exports and strong ethanol margins.

This may lead some investors to move out of other grains – like HRS wheat – into corn, which is the most liquid and heavily traded in the grains complex (hence, it’s easy to quickly get in and out of positions). As many readers will know, when speculative money starts selling, it can quickly push values down. However, because the fundamentals of the wheat market are not changing any time soon (read: until we get closer to Harvest 2022) I would expect speculators to stay in their bullish bets for at least a few months.

From a wheat marketing standpoint, as buyers are started to figure out the lay of the land in this tighter balance sheet year, great sales opportunities are likely to emerge for deferred delivery. Thus, it’s important to keep an eye on delivery months ahead of when you know you’ll need some cash flow (or at least 1-2 months ahead of it, based on stories of some incredibly slow payments this fall by more than a few grain companies).

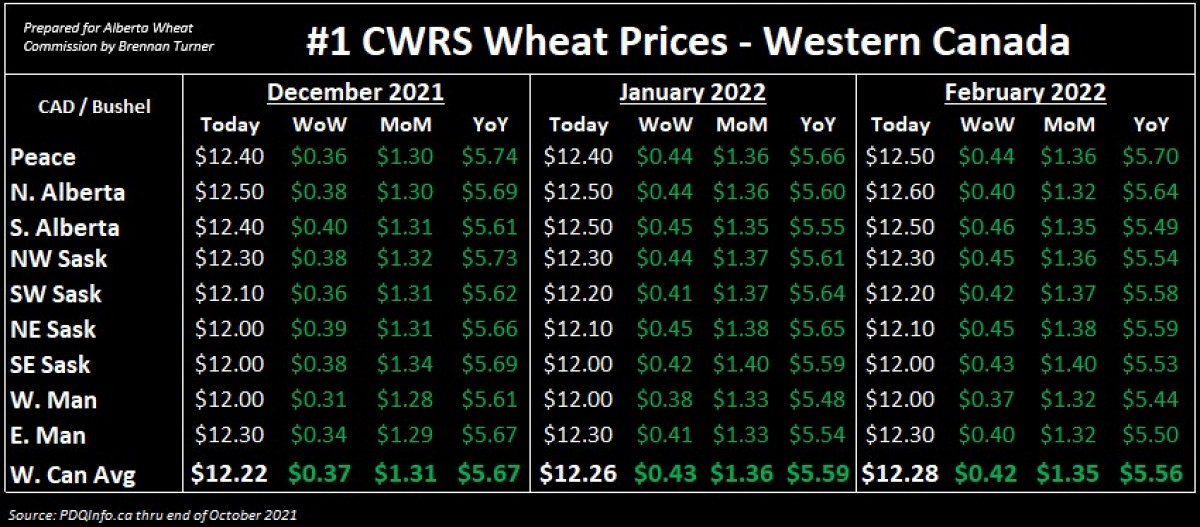

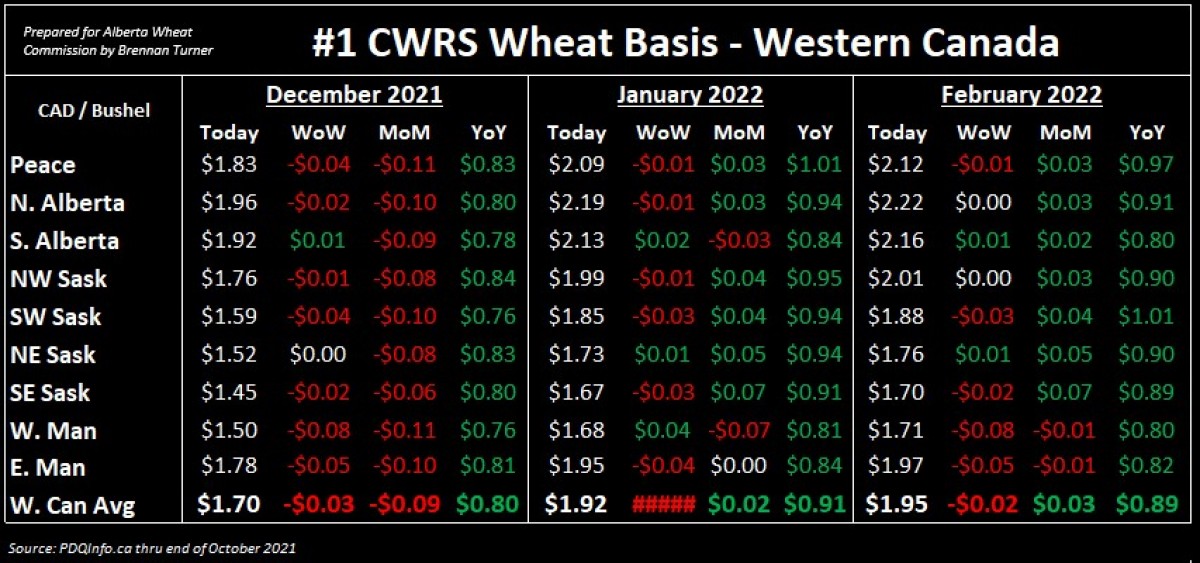

Therefore, I’m looking at the December 2021, January 2022, and February 2022 movement periods as potentially my next sale opportunity. Not only have cash HRS wheat prices jumped considerably compared to a year ago, but also in the past month and week! This rise has mostly been attributed to the rise in futures markets, but it’s worth recognizing that in the past week and month, as futures have rallied, the basis has widened just a tad in most areas of Western Canada.

If the futures markets continue to help cash HRS wheat prices, the basis could continue to widen. Ultimately, with $2 CAD/bushel basis available in a few places today for January and February 2022 delivery, I am considering locking in the basis and pricing out the futures anytime over the next 3 months, which would mirror the time when the records of the 2007/08 crop year were seen (something I talked about in the Wheat Market Insider column from 2 weeks ago).

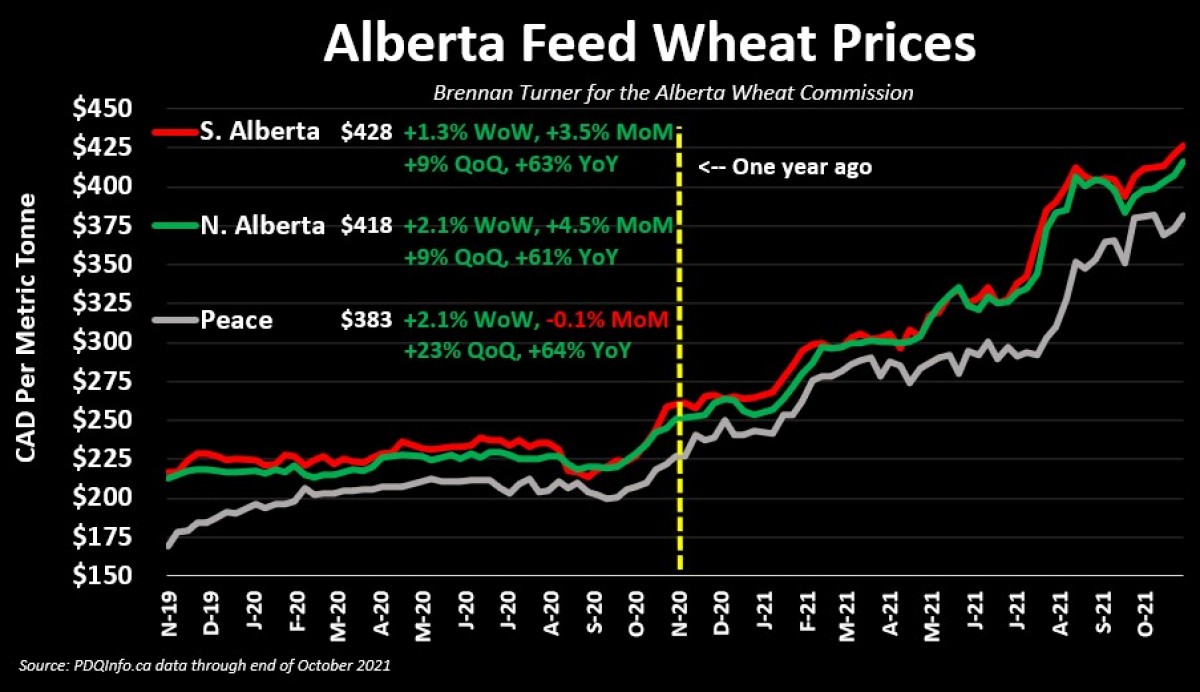

If your wheat isn’t making the milling grade, don’t fret as feed wheat prices continue to make fresh highs, trading at nearly $420 CAD/MT in Northern Alberta and almost $430 CAD/MT in southern regions of the Wild Rose province (or $11.45 CAD/bushel and $11.70 CAD/bushel respectively)! Something to be cognizant of here though is that substitution effects can easily see wheat replaced in livestock feed rations by a cheaper alternative – and there are lots of alternatives: canola meal, soymeal, oats, barley, corn, etc. Ultimately, if you’re needing to satisfy cash flow needs in the near term and can afford to hold onto your higher-quality inventory, selling some feed wheat might not be a bad idea.

To growth,

Brennan Turner

Founder | Combyne.ag