Hunting for a Headline

Grain markets switched gears last week, with cereals and corn finally finding some gains, while oilseeds saw some profit-taking. The wheat market posted a positive performance for the first time in 6 weeks, and after a long period of weakness, the complex is technically and, in my opinion, fundamentally oversold. That said, despite the U.S. Dollar losing about 10% since September, and the pullback in corn and wheat prices, U.S. exports remain fairly slow, and the market is surely factoring it in, especially with no net-new bullish headlines to trade off. The next major report to watch in the wheat complex will be the USDA’s Winter Wheat seeding report on January 12th, but any weather issues in South America will likely add some buying to the corn and soybean complex, which would likely spill over into wheat.

The market seems to be pricing in a big harvest from South America, with some analysts believing that whatever is lost in Argentina due to drought conditions will be made up for by Brazilian producers. It’s currently estimated that about half of Argentina’s corn and soybean acres are already in a tough spot, and with no rain expecting to fall this week, some speculate this percentage will climb above 75%. As of last week, it seems like most Argentine farmers are waiting for said moisture, with just 37% of expected soybean acres seeded, and 33% of corn planted, well below their respective 61% and 47% five-year averages. Next door in Brazil, CONAB (their version of the USDA), suggested that the same weather impacting Argentina will negatively impact southern Brazilian states’ production too.

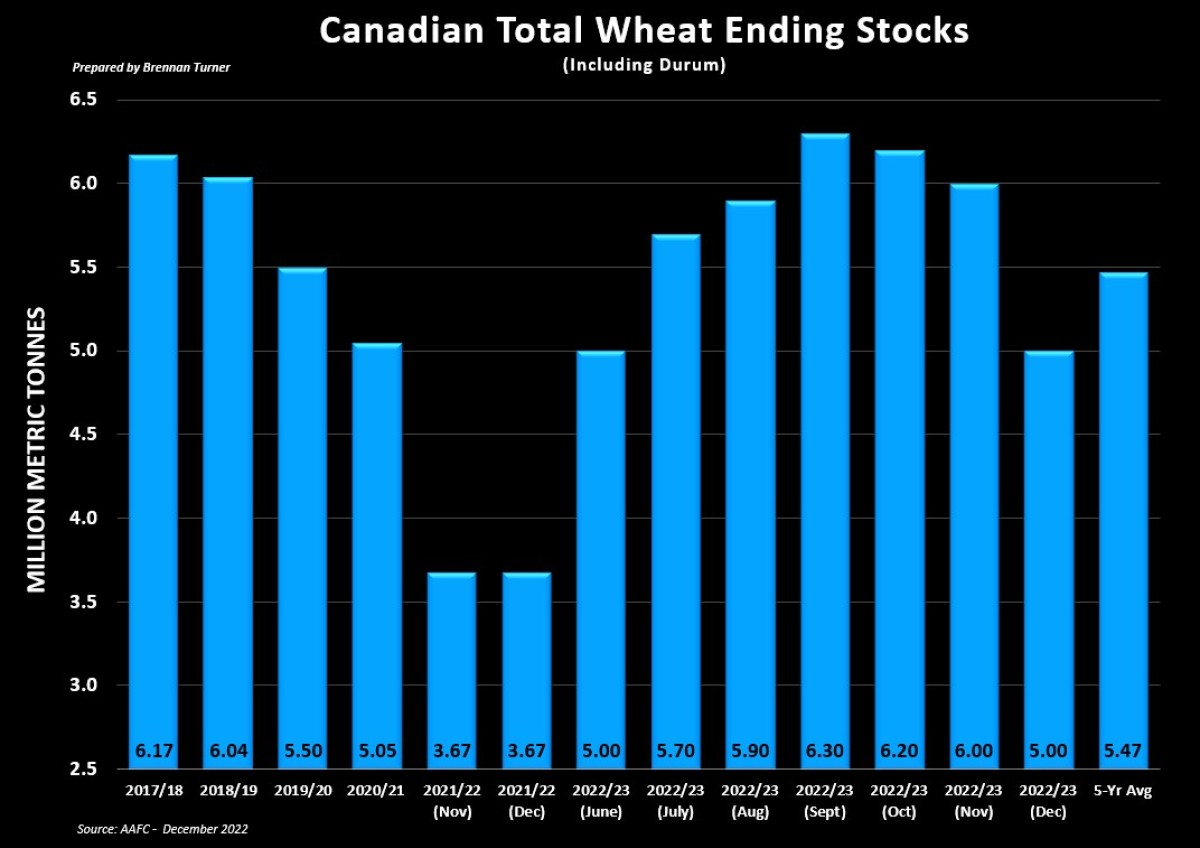

Coming back to this side of the equator, AAFC released its balance sheet update for December, taking into account Statistic Canada’s yield and production updates from a few weeks ago, as well as how demand has shaped up through the first 4 months of the 2022/23 crop year. Between the wheat production declines that Agriculture Canada took from StatsCan, and an export increase for non-durum wheat, Canadian total wheat ending stocks for 2022/23 were lowered by 1 MMT this month, down to 5 MMT (which is exactly where AAFC’s estimate was back in June!). While this is a 36% or 1.33 MMT increase from last year’s drought-riddled balance sheet, it is 9% or 468,000 MT below the 5-year average.

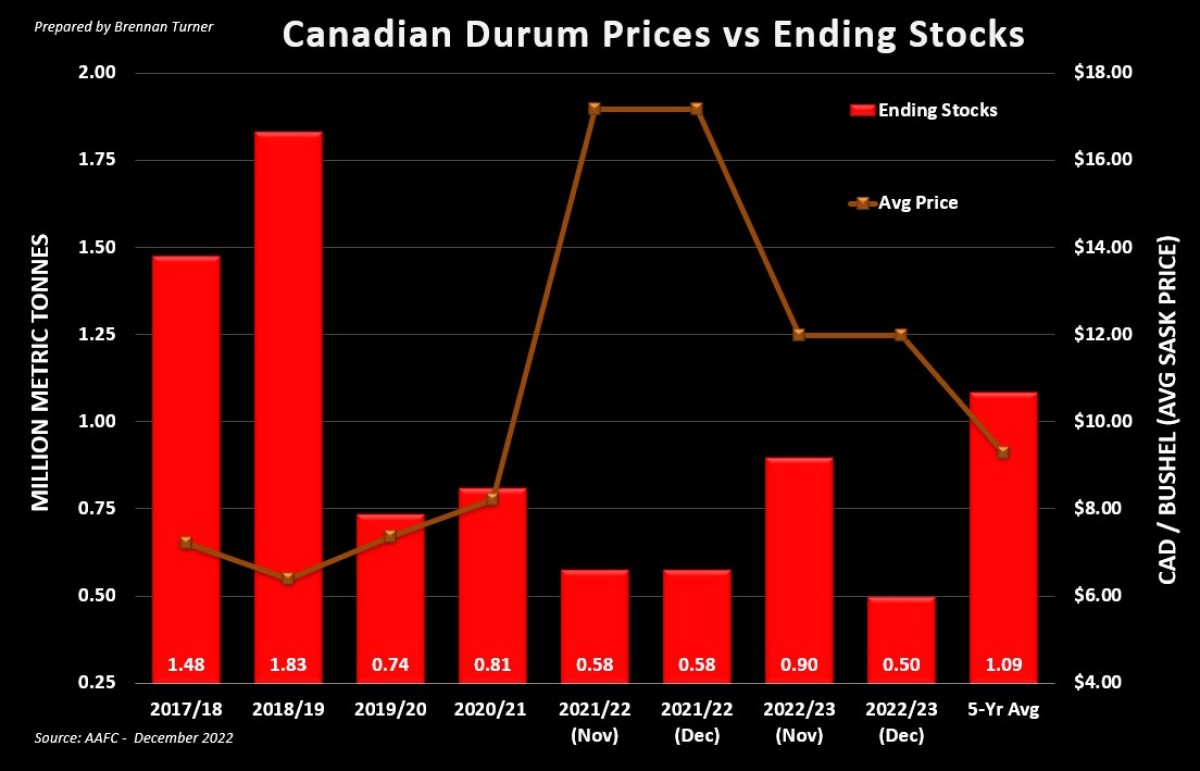

With the smaller durum harvest, Agriculture Canada lowered exports by 200,000 MT to now sit at 4.8 MMT. I believe this is achievable, as through 19 weeks of 2022/23, Canadian durum exports are averaging just under 91,000 MT per week, and will need to average just over 93,000 MT to hit the AAFC target. Despite the smaller exports, the durum’s lower production revision pushed Canadian durum ending stocks down to 500,000 MT, which would be the smallest carryout since 1984/85’s 499,000 MT. Globally, durum trade remains strong, up about 40% year-over-year thanks to stronger North American production and drought impacting production in parts of Europe and North Africa. Therein, with the healthy demand, worldwide durum ending stocks were recently lowered by the International Grains Council by 200,000 MT to sit at 6.1 MMT.

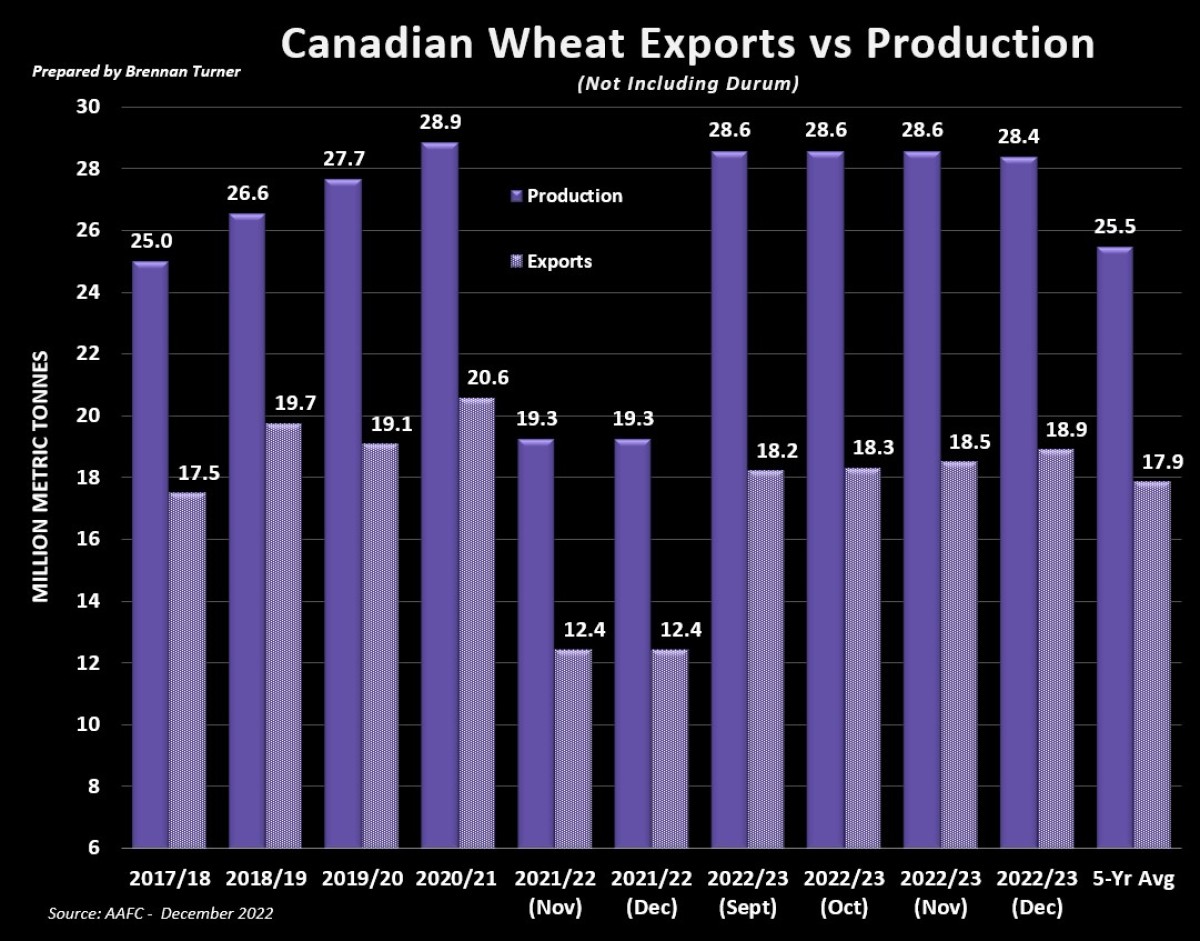

On the flipside, Agriculture Canada raised non-durum wheat exports for the 4th consecutive month, this time by 400,000 MT up to 18.9 MMT. Currently, weekly shipments are averaging just under 371,000 MT per week, slightly above the 359,000 MT needed to meet this new target in the remaining 33 weeks of the 2022/23 crop year. Given how much canola Australian farmers have produced this year, and how profitable Canadian crush margins are, there is some buzz that Canadian wheat will be more competitive than canola on the export front, meaning more boats would be lining up for the cereal instead of the Canadian Prairie’s black gold. Should this materialize, there’s certainly a possibility that Canadian non-durum wheat exports in 2022/23 could actually surpass last year’s total harvest volumes! Ultimately though, with little-to-no bullish news to jump on for wheat, with supply known, demand will need to stay in order to keep wheat prices where they are today (let alone, head higher).

Merry Christmas and Happy Holidays!

To growth,

Brennan Turner

Founder | Combyne Ag