May 2023 Grain Markets: Rains or Rallies?

"Every new beginning comes from some other beginning’s end.” —Seneca (Ancient Roman philosopher)

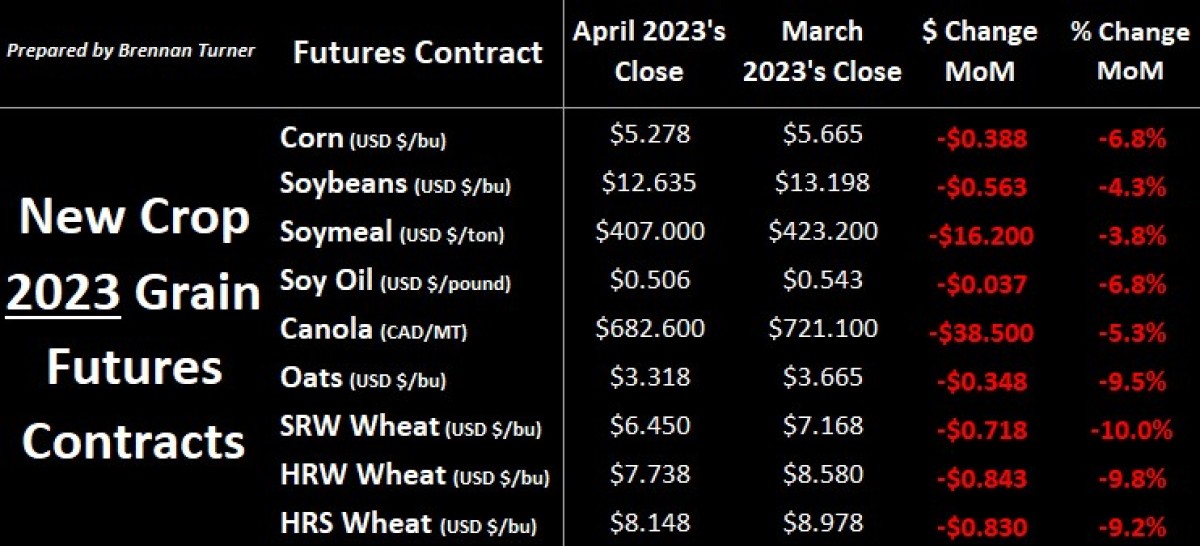

Grain markets pushed higher on Friday, but it wasn’t enough to reverse the previous four days of heavy fund selling and profit-taking to end the month of April. There’s optimism that Friday’s turnaround may signal bargain buying to start the month of May, with last week’s sell-off mirroring that of end the of February due to March contract’s option expiry. That said, as we flip the calendar into May, there’s seemingly less concern from managed money that the crop will get planted, despite the data telling us we’re already behind in spring wheat and winter wheat crop ratings remain at historic lows. Conversely, while the rain that fell last week in the U.S. Southern Plains isn’t drought-busting, it certainly helps the HRW winter wheat fields that are still hanging on. Adding to the bears’ momentum, using 4-month-old survey responses from a smaller-than-usual pool of farmers, Statistics Canada suggested Canadian wheat acres for 2023/24 will be 27M, an increase of 7% or 1.75M more acres than last year!

Accordingly, the wheat complex all posted new lows for their July, front-month contracts, with fund managers now holding their largest net short position in Chicago SRW wheat since January 2018. Similarly, both old and new crop corn futures contracts settled at the lowest since January 2022 thanks to China cancelling ~610,000 of U.S. corn exports, likely opting instead for Brazilian options that are $30 - $50 USD/MT cheaper for summer delivery (it’s a similar dynamic for soybeans too!). The timing is notable as snowmelt across the Midwest is causing the river systems in the region to flood – a sharp and ironic contrast to the historic low water levels seen in late 2022 – with grain and fertilizer movement along the Mississippi stalled for up to three weeks in some places.

Speaking of grain movement, based on inconsistent inspection of Ukrainian grain, exports out of the embattled country are expected to keep slowing down into the summer months. There’s an estimated 10 – 15 MMT of old crop of Ukrainian grain that could be shipped but the third renewal of the Black Sea is coming up on May 18th and Russia is drawing harder line in the sand ahead of the 2023/24 crop year start. On top of this, given the pseudo-blockade of Ukrainian grain by their EU land neighbours, there’s definitely more buzz about exports stalling. Finally, combined with unease about access to international markets, recent rains have slowed down spring planting in the Ukraine, and with input costs up 20% - 30% year-over-year, there’s some sentiment of fewer acres getting seeded this year. This is significant, as Citi Research believes that only 16.5 MMT of wheat will get harvested in Ukraine this year, literally half of what was normally produced pre-war. Of further reference, Ukraine exported just 8.4 MMT in the first half of 2022/23, versus 15.9 MMT in the same period in 2021/22.

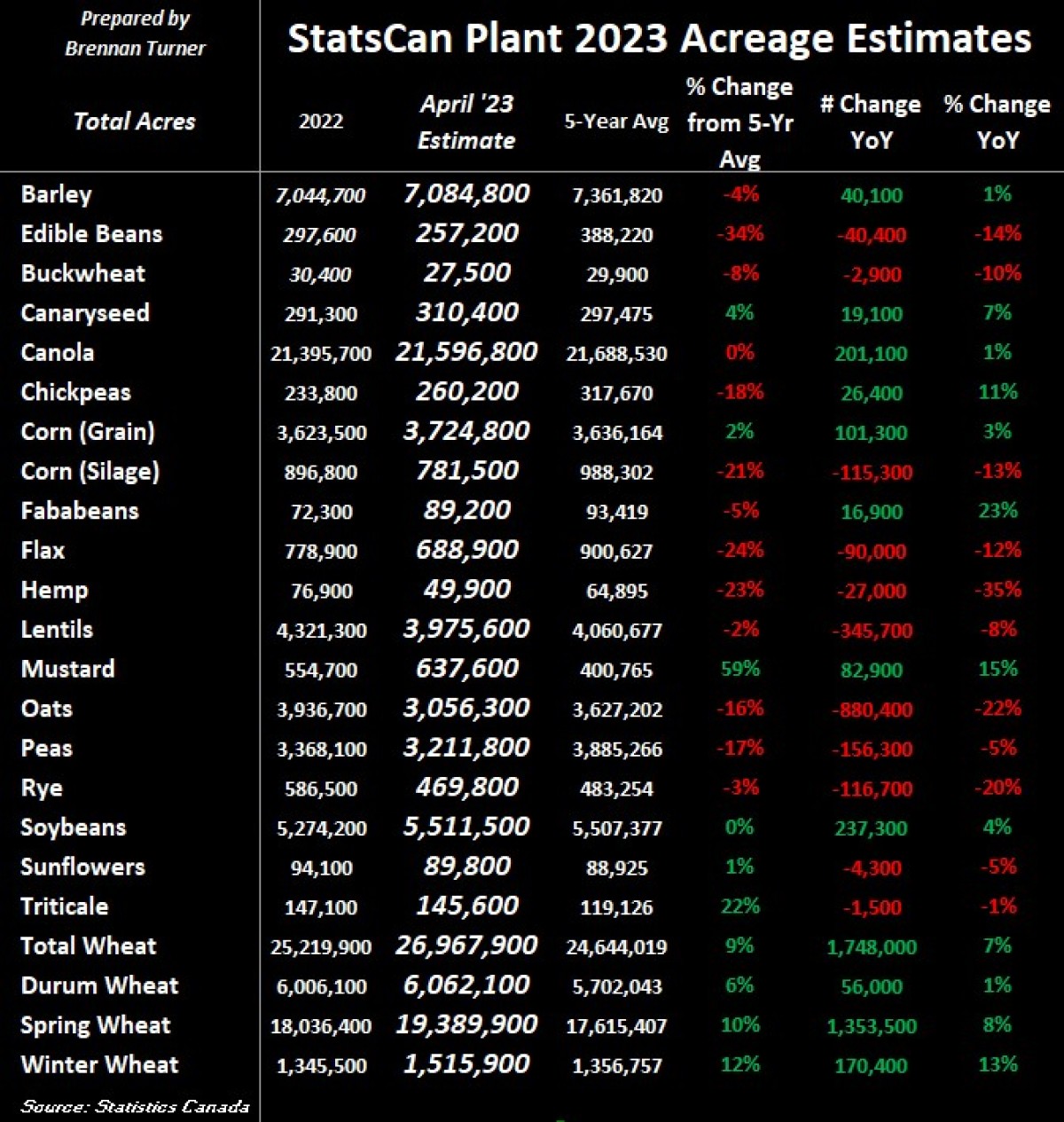

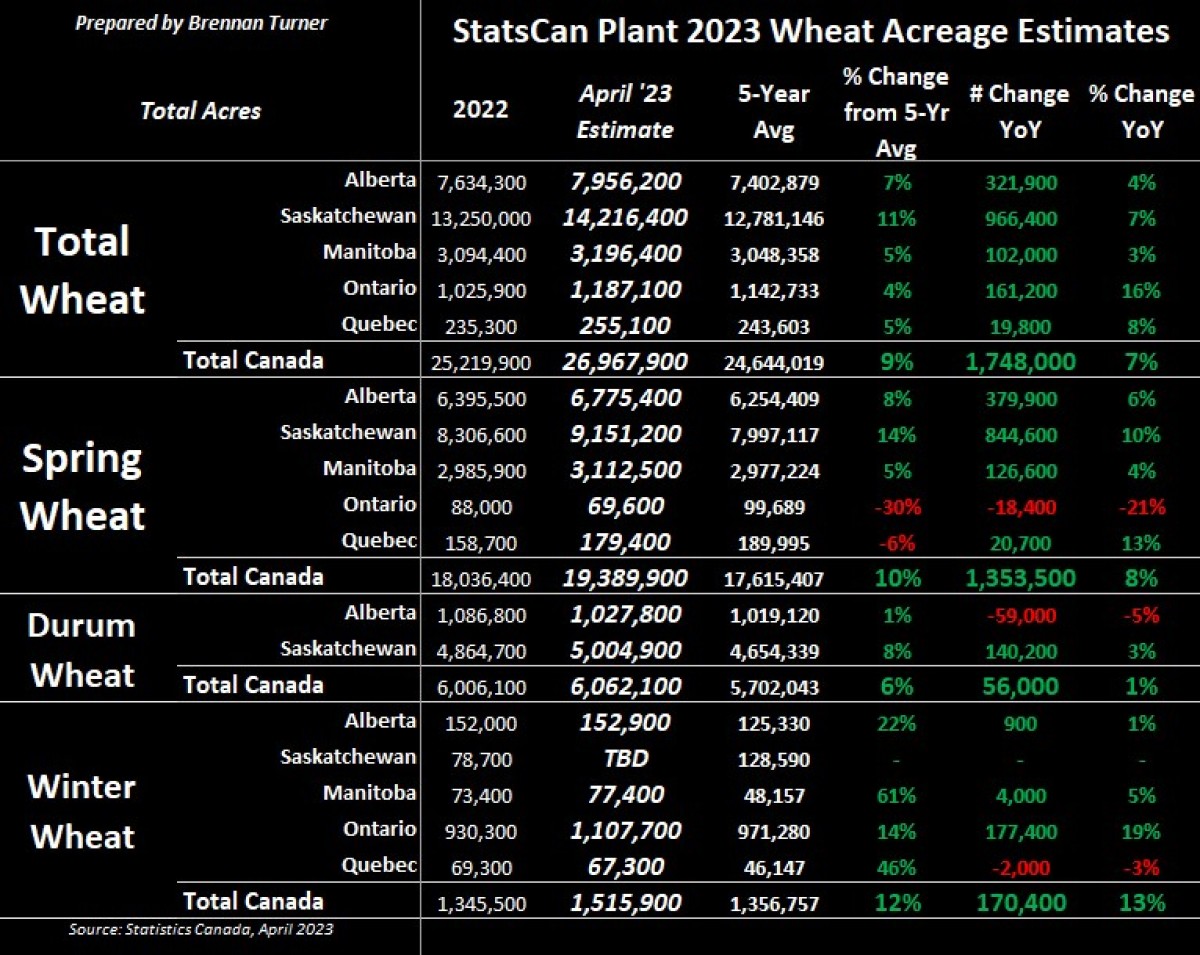

Coming home, perhaps in response to the Black Sea’s logistics quagmire, Statistics Canada is speculating that Canadian farmers will plant the most amount of wheat since 2001. You can see in the tables below that StatsCan is forecasting way more wheat and a few more canola and barley fields, basically at the expense of every other crop. Everyone and their mother is already throwing caution to the wind on this report though because likely a lot has changed on the basis of:

1. The survey was conducted over 4 months ago in December and January,

2. This was before 2023 crop insurance coverage levels were set, and

3. ~20% fewer farmers participated (9,500 this year versus 11,500 in years past).

Personally, I believe that the barley, oats, and lentils numbers are too low, the spring wheat number is too high, but durum is probably about right. As I’ve suggested a few times in 2023, we tend to respond to high prices with higher acres, which pushes the price pendulum to swing another way. Nowhere is this more relevant than in Ontario, where winter wheat acres pushed back up over the 1M after last year’s dip, and in Saskatchewan, where spring wheat’s nearly 850,000 expansion is a 10% jump year-over-year. Assuming Mother Nature plays nice this growing season, I wouldn’t be surprised if Agriculture Canada raised its 2023/24 total wheat carryout up above 6 MMT in their late May supply and demand update.

Ultimately, relatively higher grain prices, rising interest rates, and inflation are all keeping buyers in a relatively hand-to-mouth buying pattern, with most having needs covered for the next few months. As such, last week’s pullback in grain values echoes the wait-and-see sentiment for the Plant 2023 campaign, with profit-taking and resetting positions for any May rallies the average speculator’s approach. Therein, more analysts are looking at these demand factors and suggesting grain markets are either at its spring low, or close to it as there are many momentum indicators suggesting much of the complex is now technically oversold. While I’m cognizant that recent rallies have been met with resistance, there’s usually some herding around this time of year, where once a few animals (read: hedge fund mangers) start heading one direction, many others start to follow.

To growth,

Brennan Turner

Independent Grain Market Analyst