Trade Risk and Weather Weighs on Wheat

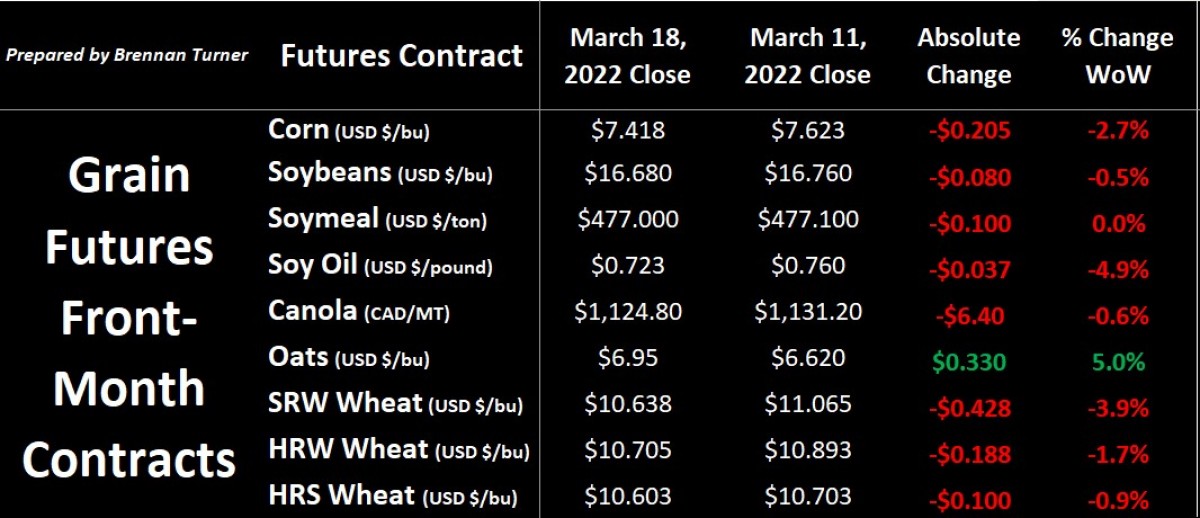

Grain futures didn’t see much luck of the Irish as trading through St. Patrick’s Day continued to see profit-taking amidst rains in the forecast for the Southern Plains and ongoing peace talks in Ukraine. Also this past week, we saw the U.S. Federal Reserve raise interest rates by 0.25% and their unexpected announcement that they’ll likely continue to raise rates by the same amount 6 times over the remainder of 2022 to try to slow down inflation rates not seen in over 40 years. Accordingly, some fund money likely viewed this as supportive of equities and so, with volume activity slowing down a bit in grain markets, got out of commodities and headed back into equities.

Rain is finally in the forecast for most central and southern growing regions in the U.S. this week. This is incredibly important as the U.S. winter wheat crop exits dormancy in one of its worst conditions ever. Thanks to the La Nina-induced drought that has worsened over the winter, 38% of the Kansas winter wheat crop, 41% of Oklahoma’s crop, and 75% of the crop in Texas is currently rated in Poor or Very Poor condition! While Kansas and Oklahoma are forecasted to receive 1–2 inches of rain this week, precipitation maps suggest Texas will be lucky to get 1 inch. Historically speaking, these 3 states produce about 13–14 MMT of wheat, with Kansas accounting for about 60–70% of the harvest. Without a major turnaround in the drought situation, the number could be somewhere between 7-9 MMT.

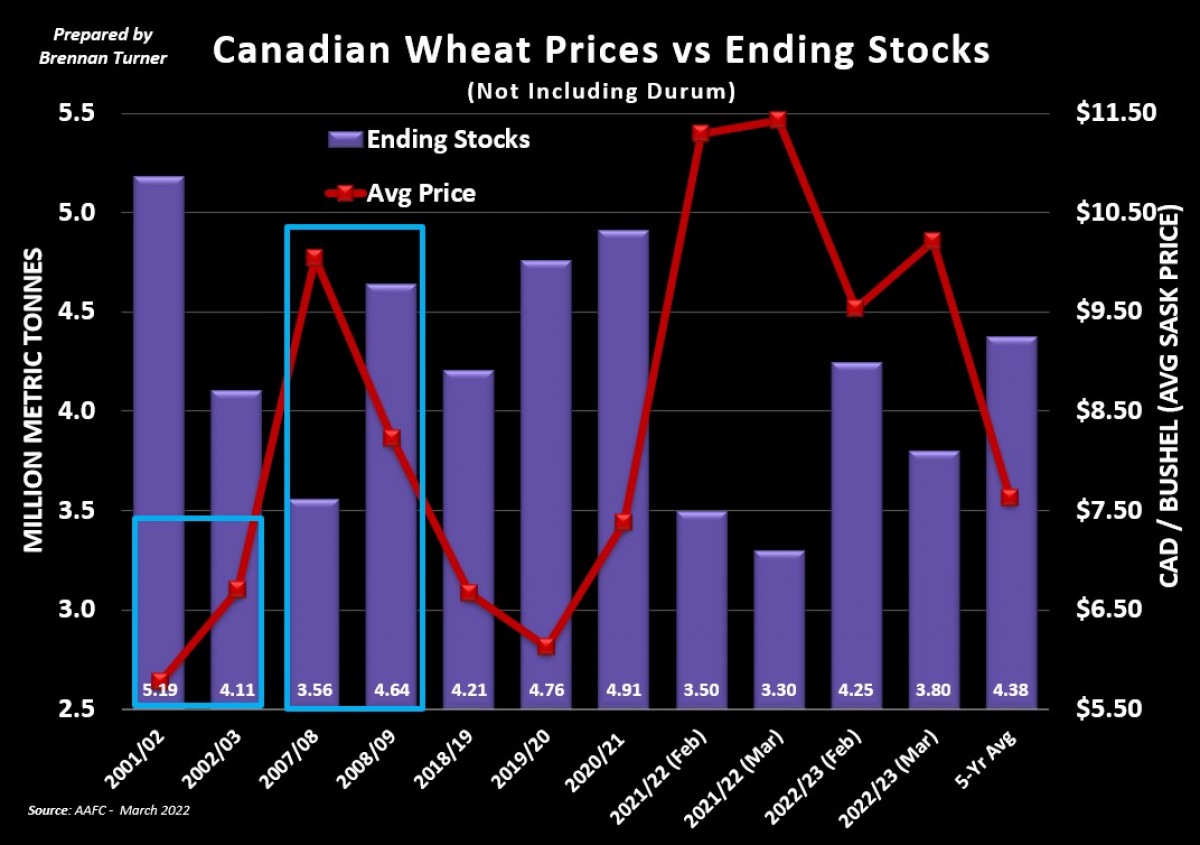

And it comes at a time when the list of available export supplies from the world’s major producers is looking fairly tight, thanks to the war in Ukraine and sanctions on Russia. Agriculture Canada's monthly update of their supply and demand tables echoed this sentiment and raised their non-durum wheat exports from Canada by 200,000 MT for the current crop year, and 250,000 for 2022/23 new crop. As a result, 2021/22 non-durum ending stocks in Canada are now pegged at 3.3 MMT, the lowest on record.

While the Canadian durum balance sheet was unchanged, AAFC did make special note of the ongoing drought situation in Northern Africa, which likely points to increased imports in 2022/23 by the likes of Morocco, Algeria, and Tunisia. Conversely, the crop in Europe is looking alright today. Ultimately, the world will likely be counting on a rebound in Canadian durum production. However, the recent labour disruption in CP Rail could complicate getting products to market (let alone fertilizer to farmers!).

Obviously contrasting this is the state of things in the Black Sea, notably Ukraine, where there continues to be questions about the ability to plant a crop this spring, let alone take care of their fall-seeded fields exiting dormancy. Ukrainian farmers have been cleared from military service, but the likelihood they can do everything they want to in the field remains uncertain, given limitations on fuel, crop inputs, and other labour. That said, the winter crop does look to be in decent shape.

If there’s one lesson I think we can take away from the impact on grain futures when war occurs in a major exporter, is that the bullish run on prices peaked after about 2 weeks. Put another way, it took 8 – 10 trading sessions for the market to determine what the impact on grain production and exports from the region would be. While I would never wish for war, unfortunately, geopolitical risk has been increasing for the last few years and, therefore, it’s a lesson we should probably remember. That said, assuming there’s no major escalation beyond the current state of war, most traders are going to be focusing on the March 31 Prospective Planting report from the USDA, and Plant 2022 prospects, a function of the weather over the next 8 weeks.

On a final related note, there’s increasing speculation that China will support Russia’s military in some way. We already know that Russian companies are doing business through China’s CIPS international payment processing system, which is SWIFT’s main competitor (for a refresher on the impact of Russia’s partial removal from SWIFT, look to the March 2nd version of this column). While China has indicated they’re not planning any support for Russia from a military sense, there are many times where we’ve seen the leaders in Beijing say one thing, and then do another.

While it’s healthy that the White House had a 2-hour call last week with their counterparts in the People’s Republic, if China were to back Russia in some way, it’s likely that some level of sanctions would be tabled for China, possibly similar to that of Russia. On the flip side, the trading relationship that China has with every country in the world cannot be understated, and so sanctions may be less punitive than Russia has experienced. Nonetheless, it would likely put some bearish risk on the U.S. grain export program to China, pressuring corn and soybeans most, but likely some spillover to wheat. Overall, weather and international trade risk are on everyone’s mind, but with the seeding campaign around the corner, it wouldn’t be unusual to have planting premiums to also support grain values.

To growth,

Brennan Turner

Founder | Combyne