USDA’s First Harvest 2023 Forecast

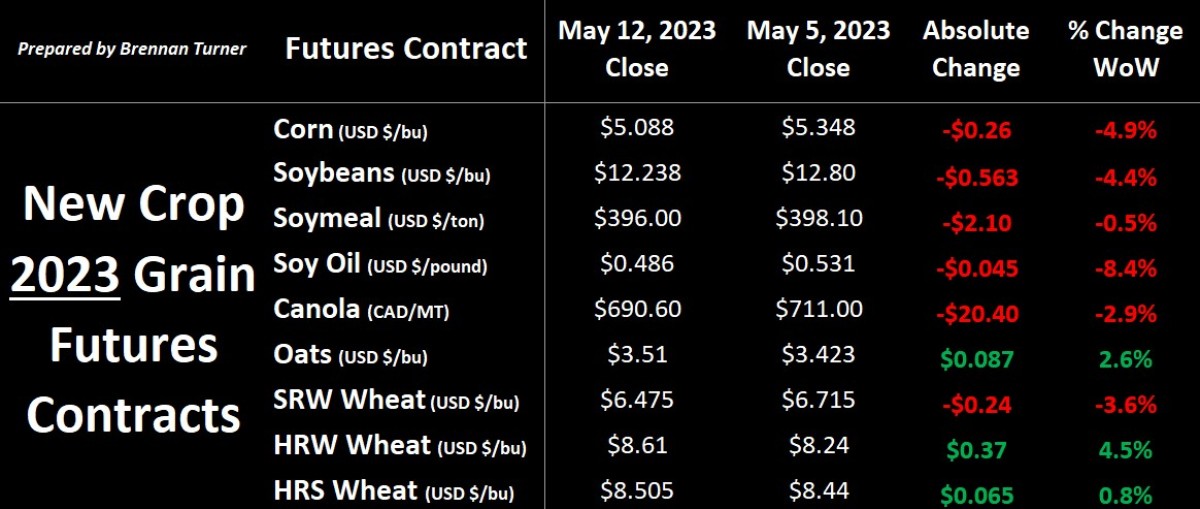

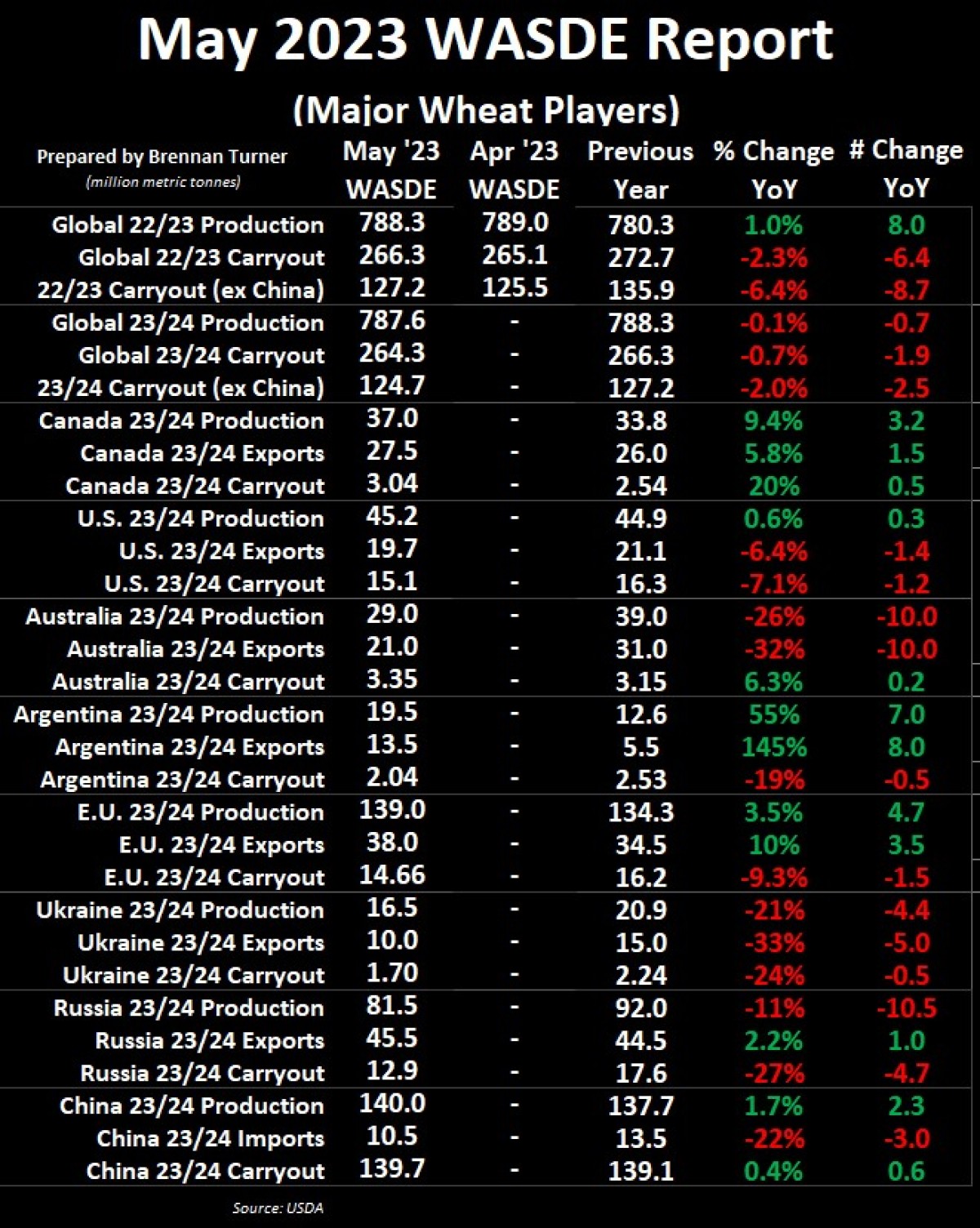

Grain markets were mixed as we moved into the second half of May as some WASDE report surprises, accelerating Plant 2023 activity, and Black Sea Grain Deal negotiations all weighed on the complex. In the May WASDE, the USDA provided their first supply and demand forecasts for the 2023/24 crop year, and biggest bearish surprise was in corn and soybeans with record yields and production for the U.S., as well as Brazilian soybeans. On the flip side, the USDA provided a bullish outlook for wheat, namely because of the downgrade of the U.S. winter wheat crop and smaller harvests in the likes of Australia, Russia, and Ukraine. Of course (and as we all know), yield and production potential is entirely a function of Mother Nature, and given the increase in Minneapolis HRS and Kansas City HRW wheat futures, the market seems to be paying more attention to this reality.

For corn and soybeans specifically, the USDA is suggesting that as we flip from smaller production to potentially record crops, prices must come down. At lower prices, this usually means bigger exports but the U.S. remains terribly uncompetitive with Brazil, especially when it comes to soybeans, so it’ll be interesting to see where we’re at in six months time and how international buyers are approaching U.S. grain prices then. As perhaps a glimpse into the future, immediately following the Wednesday release of the May WASDE, new crop December corn futures toyed with $5, a level not seen for new crop contracts in over 18 months!

On the flipside, KC HRW wheat futures nearly hit $9 USD / bushel as the USDA is finally starting to admit that April rains came too late or were insufficient, and so the crop just isn’t there this year. More specifically, in this WASDE report, the USDA said that the U.S. winter wheat crop will see above-average abandonment, with just a 67% harvest rate, the lowest since 1917, or 25.3M acres out of the 37.5M acres seeded last fall. While white wheat and SRW wheat yields are offsetting production losses in HRW, the USDA believes they’re going to have more domestic feed and residual demand, therefore pushing U.S. total wheat ending stocks to their lowest level in 16 years.

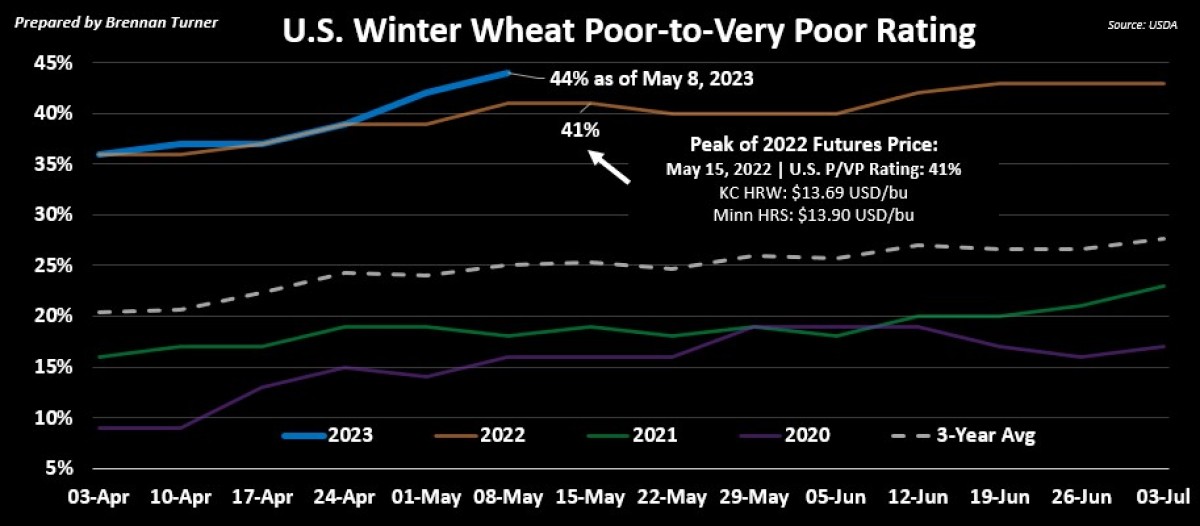

Frankly, there’s a reminder that wasn’t printed in the May WASDE that small crops tend to get smaller. With the USDA printing a HRW wheat harvest number that was 100M bushels lower than the average analyst’s pre-report guesstimate, the market is now scrambling a bit to reflect the reality of what most of us already know: the U.S. winter wheat crop isn’t improving. Last Monday’s crop progress report showed that the portion of the winter wheat fields rated poor-to-very poor increased by 2 points to 44%, 3 points higher than this time a year ago and well above the 3-year average of 25% P/VP. Leaning in, crop ratings in all major winter wheat-producing states in the Southern Plains echoed what the USDA is suggesting:

• Kansas: 68% Poor-to-Very Poor (64% last week, 37% a year ago, and 3-year average of 26%)

• In Kansas, there are currently no fields with a surplus of subsoil moisture, and instead, 81% of the state short or very short subsoil moisture.

• Oklahoma: 64% P/VP (61%, 47%, 23%)

• Texas: 56% P/VP (57%, 77%, 42%)

• Colorado: 47% P/VP (37%, 58%, 42%)

Looking abroad, the USDA used average weather for all their forecasts, and so they expect a major rebound in Argentina’s wheat crop to a harvest of 19.5 MMT. However, the Rosario Grain Exchange noted last week that while some rain did fall in April, it’s unlikely that it will support a major expansion in wheat acres for the 2023/24 crop year, which is expected to start getting planted in the next few weeks. The Buenos Aires Grain Exchange echoed this sentiment, suggesting that heavy rains likely won’t fall in the major agricultural regions before September so should we already be asterisking the USDA’s estimate? (Hint: I will). Elsewhere though, Canada and the EU are the only major wheat producers expected to see a production increase in 2023/24. On the flip side, Australia’s three-year trend of monster crops should slow as yields return to the average, and Russia’s harvest should also revert to the mean as acres and yields are forecasted to decline.

Finally, as you’ve read in this column a few times this spring, wheat production in Ukraine is expected to fall yet again in 2023/24 thanks to the ongoing military conflict with Russia. Complicating matters though for Ukrainian farmers are persistent spring rains, limited access to limited crop inputs, and just the general loss of cultivated area. This is why the harvest is expected to be just 16.5 MMT, literally half of the 33 MMT taken off just two years ago, before the Russian invasion. Back then in the 2021/22 crop year, Ukrainian wheat exports were almost 19 MMT, but the USDA is expecting just 10 MMT in 2023/24, with the likelihood this will drop further if a renewal of the Black Sea Grain Deal is not made. Russia continues to stand by its demands ahead of the May 18th renewal date, and while they capitulated the last 2 times the renewal came up, meetings last week in Istanbul between all parties did not go anywhere.

With the Ukrainian grain export situation in limbo, I expect there to be a lot of volatility this week in wheat markets (and grain markets in general) on the various rumours and headlines that will be circulated. Thus, the next two weeks could provide some interesting opportunities to the upside, so while you’re busy in the field, my suggestion holds to look to put in some targets and let the market (and volatility) do the work for you. That said, as you put in any old or new crop targets with your buyers, it’d be also worthwhile to ask them if they will trigger your target, should it hit on the upcoming long weekend holiday Monday (May 22) as U.S. grain futures markets will still be open.

To growth,

Brennan Turner

Independent Grain Market Analyst