Wheat Climbs with Bullish Report, Temperatures

Grain markets pushed higher through the middle of July as the USDA gave its confirmation of what we already knew: this year’s North American wheat crop is going to come in well below average. The U.S. spring wheat and durum crops are looking quite small, thanks to the severe drought conditions in the Northern Plains (and Western Canada). More broadly, average American wheat yields were felled by nearly 5 bushels from the June WASDE report to 45.8 bushels per acre. That said, winter wheat production was actually increased, giving further proof of the level of damage to the American spring wheat and durum crops.

While the USDA raised U.S. corn production by 4.5 MMT to now sit at 385.2 MMT (or 15.17 billion bushels), the U.S. soybean harvest number stayed at 119.9 MMT (or 4.41 billion bushels). Nonetheless, the bullish action in the wheat market helped pull soybeans and corn higher, as shown in the weekly performance chart above. However, the bullishness in the July WASDE has only been amplified by the hot, hot weather in the forecast, namely for the U.S. Northern Plains and Western Canada. Keep in mind that corn and soybean prices aren’t just following wheat as the Northern Plains states actually account for 18.2M acres of corn and 20.4M acres of soybeans, or about 20% and 23% of the total national acreage for each crop, respectively.

This higher corn and soybean acres in these states is also a driving force behind the lower spring wheat and durum harvest numbers as, with less acres, and poor growing conditions, the smaller supplies are amplified (U.S. durum acres are down 12% year-over-year to 1.48M, while HRS wheat acres are down 6.5% to 10.8M). More specifically, the USDA is now estimating U.S. durum production at just 37M bushels, down 46% year-over-year, while the American HRS wheat harvest is forecasted at 305M bushels, down 42% year-over-year.

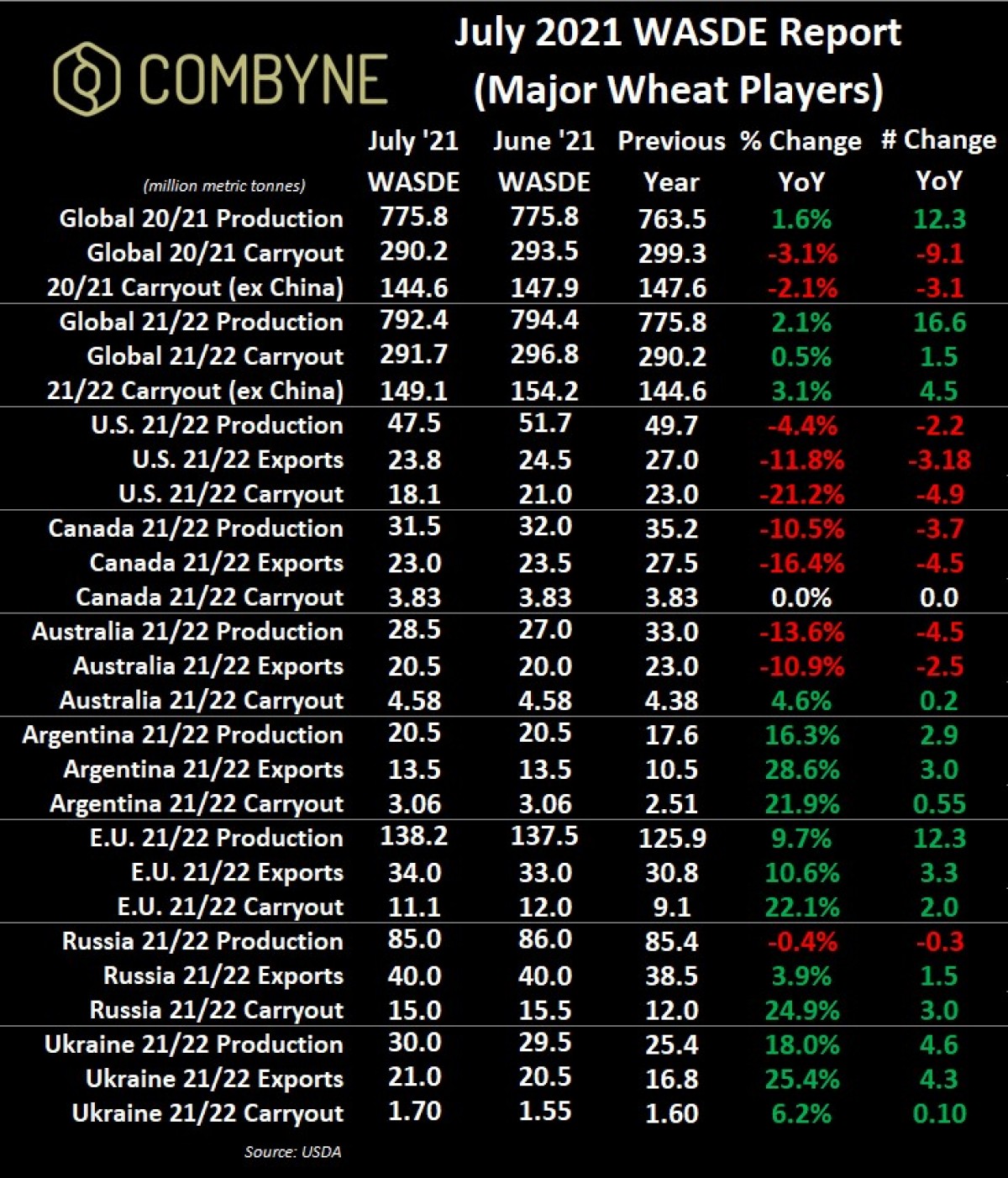

More broadly, with less wheat going through the American farmer’s combine this year, U.S. 2021/22 wheat exports are expected to fall to 875M bushels (or 23.8 MMT), which would be the lowest since 2015/16. Therein, U.S. 2021/22 wheat stocks are expected to drop 105M bushels year-over-year to 665M bushels (or 18.1 MMT), the lowest since 2013/14!

As the U.S. spring wheat and durum production numbers were significantly lower, despite Western Canada getting virtually the same growing conditions as the Northern Plains, the USDA only lowered their estimate of the Canadian wheat harvest by 500,000 MT to now sit at 31.5 MMT. With HRS wheat new crop futures now firmly trading above $9 USD/bushel in Minneapolis, the market is telling us that these wheat production numbers are likely to continue to drop, especially if the hot temperatures stick around.

Looking abroad, Australia looks to be the winner of the North American drought as their 2020/21 record harvest of 33 MMT continues to be shipped out at a solid pace with old crop exports getting raised by another 1 MMT to now sit at 23 MMT. Further, thanks to good rains, Australia’s new crop, 2021/22 wheat harvest is now pegged by the USDA at 28.5 MMT, up 1.5 MM from the previous estimate. Similarly, the 2021/22 European harvest was improved by 700,000 MT, while exports were raised by 1 MMT; Ukrainian wheat production and exports were also both increased by 500,000 MT to 30 MMT and 21 MMT, respectively. On the flipside, Kazakhstan and Russian wheat harvests were each othered by 1 MMT, but their exports stayed the same.

Overall, the USDA’s July WASDE was one of the more bullish ones we’ve seen in a while, especially for wheat. Despite the obvious upside potential in today’s market, keep in mind that the global 2021/22 harvest and carryout are still at record levels and will likely rein in some of the bullishness over the long term. Thus, while wheat prices are likely to continue to rise as long as this searing heat hangs its hat in the Northern Plains and Western Canada, there’s a global market to still consider. Put another way, we’ve benefited from weather issues in other markets (i.e. Australia), and so maybe 2021/22 is our “tough” year to get through.

To growth,

Brennan Turner