Wheat Winds Down Into the Holidays

Leading into the last week of trading before the Christmas holidays, North American wheat markets saw a slight rally, before selling off a bit at the week’s end. As traders and speculators get focused on wrapping and unwrapping presents, they’re heading to the sidelines, and that selling has continued to start this week. While Omicron COVID-19 concerns continue to grab a lot of attention, the data continues to show that it’s more like the common cold, with VERY few hospitalizations. That said, wheat has been selling off for the past 4 weeks heading into the usual slowdown in trading activity for this time of year.

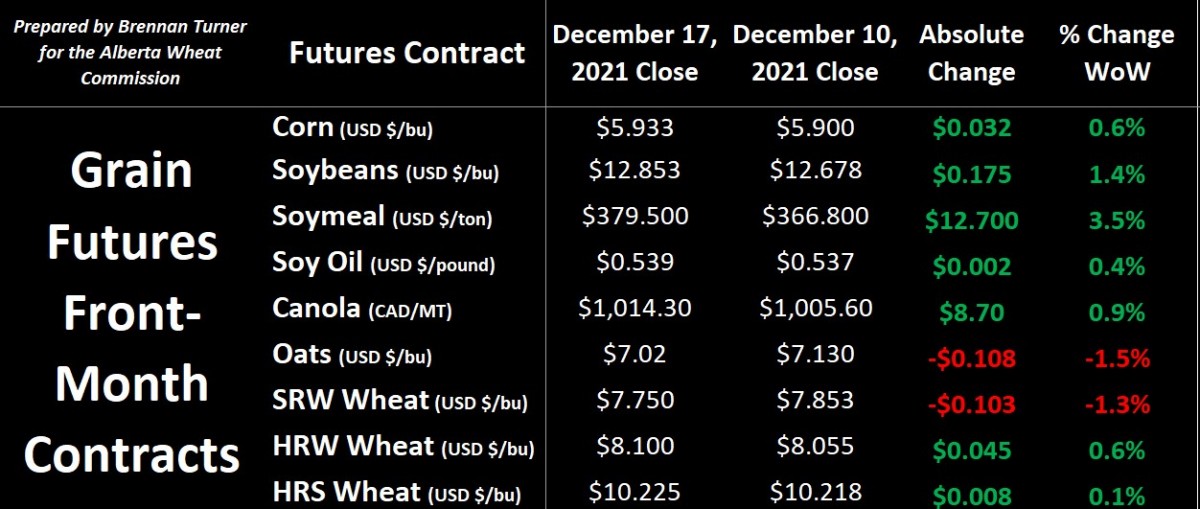

Dry weather in the U.S. Southern Plains continues to be a concern, as dust-storms and wildfires are catching a lot of headlines, especially in Kansas where at least 21% of HRW wheat acres planted this fall are now suffering from drought. That said, hedge funds continue to hold a sizable net-long position in HRW futures, but significantly increased their net-short SRW wheat futures to nearly 10,000 contracts. Meanwhile, money managers trading in Minneapolis HRS wheat futures slightly reduced their net-short position, but it’s still sitting at just under 5,000 contracts.

This past week, we got three separate bullish updates out of Russia regarding their wheat export. First, the Kremlin has lowered its export quota by 1 MMT to now sit at 8 MMT for the period of Feb 15 – June 1, which basically opens the door for someone else to take that low-protein wheat business. Second, the Russian central bank increased their interest rate by 1 full percentage point to 8.5%, which isn’t exactly friendly for Russian wheat exports either.

Finally, Russian officials also said that, in order to continue to minimize inflation of domestic food prices, they will plan to increase their existing export taxes if wheat prices go above $375 USD/MT (or $484 CAD/MT or $10.20 USD and $13.15 CAD/bushel). As of last week, Russian wheat prices at Black Sea ports for 12.5% protein were sitting at about $335 USD/MT, with an export tax of $94 (or about 28% of the purchase price!).

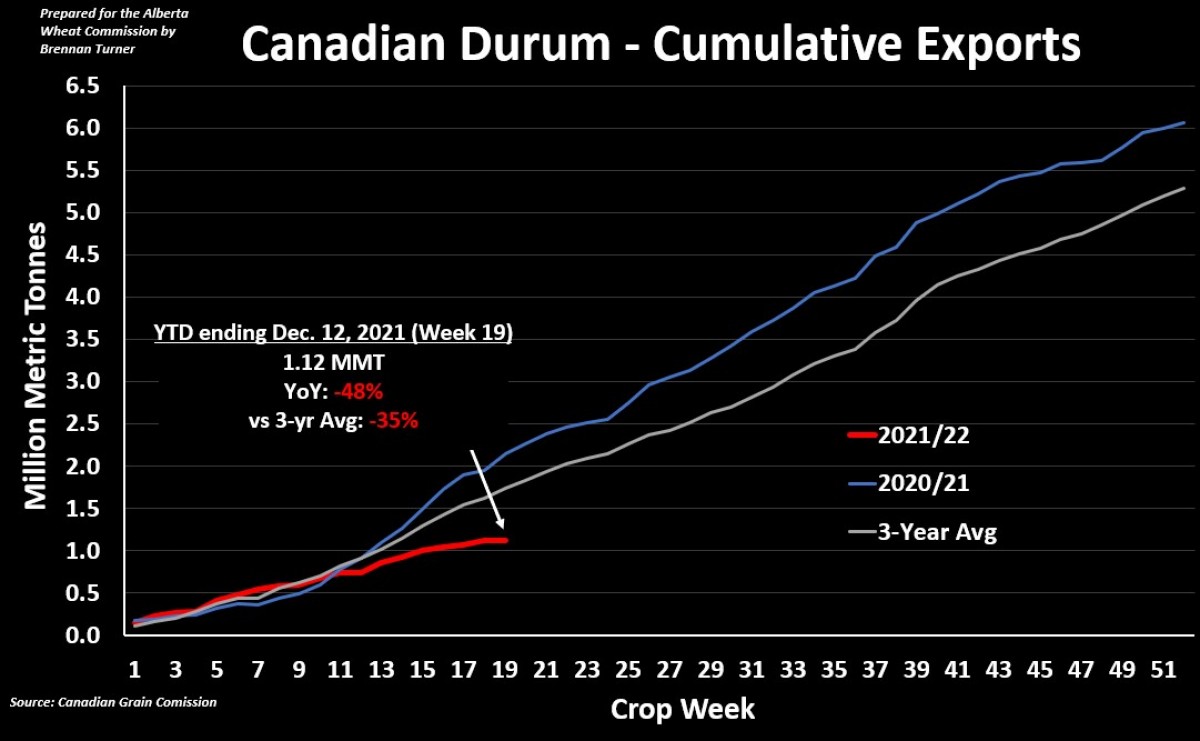

Coming back to this side of the Atlantic, Canadian durum exports had their worst shipping week of the year in Week 19, with just 3,400 MT going out of the country. This would be the lowest weekly volume of Canadian durum exports since Week 30 in 2018/19 when just 400 MT left the Great White North. Crop year-to-date, 2021/22 Canadian durum exports have totaled just over 1.12 MMT, which is about half of what had sailed this time a year ago, and about a third behind the three-year average.

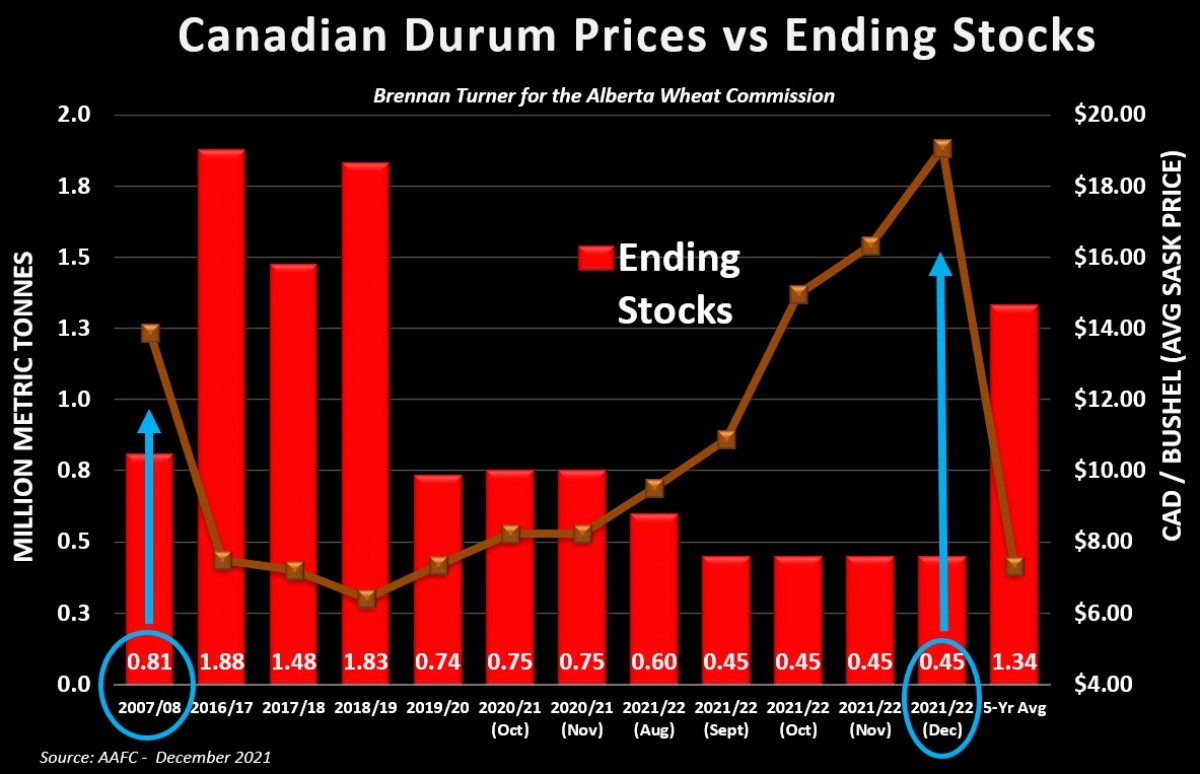

Looking forward, Agriculture Canada updated its supply and demand tables, using the revised production data released by Statistics Canada earlier this month and by far, the most notable update was in the durum category. Using StatsCan’s updated record-low production total of 2.65 MMT, AAFC reduced their export forecast by 25% from the November estimate to just 2.3 MMT. While ending stocks were stayed at just 450,000 MT (the tightest since 1984/85), average durum prices were raised by nearly 20%, or $2.70 CAD/bushel to now sit above $19 (or $700 CAD/MT). At these prices, international demand is likely to be more price-sensitive so I think 2.3 MMT in exports could still be on the high side!

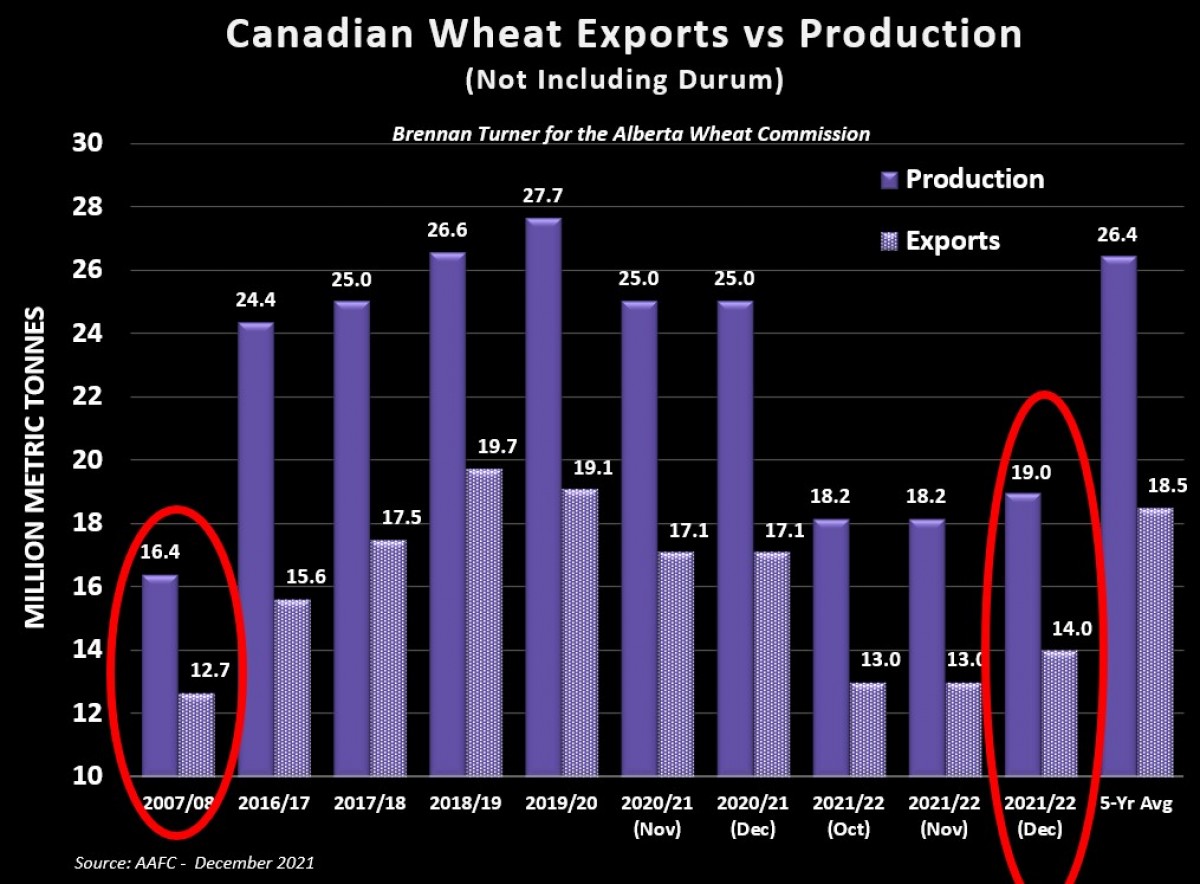

For non-durum wheat, as I suggested a few weeks ago in a Wheat Market Insider column, AAFC took the extra 828,000 MT of wheat found by StatsCan and put it all into more exports, and then some! 2021/22 non-durum wheat shipments were raised by 1 MMT to now sit at 14 MMT. However, combined with an extra 100,000 MT in imports, and feed use dropping by 72,000 MT, ending stocks were stayed at 3 MMT (which, historically speaking, is still quite tight). Overall, the political headwinds of COVID have softened wheat prices, but the fundamentals remain strong, and until we see more Plant 2022 acreage estimates, I’ll be watching events in the Black Sea (namely any armed conflict) over the next few weeks. Worth also adding here is that we tend to see some seasonal highs in the wheat market in January, and I’ll help visualize this in the coming weeks as we flip the calendars into 2022.

Merry Christmas!

Brennan Turner

Founder, Combyne Ag