When to Make Fall Wheat Sales

Grain markets finished the last week of September mixed as fresh grain stocks data from the USDA, and ongoing trade risk issues in the Black Sea weighed on the complex. Soybeans took a nosedive on Friday, thanks to the quarterly inventory report from the USDA, which showed 32M bushels more beans available in America as of September 1st than what the market was expecting. Also a 7% increase year-over-year, this adds to a soybean market already being impacted by the potential of a record crop in Brazil expected later this year (which will be dependent on the possibility of 3rd straight year of La Nina weather). U.S. corn stocks of 1.38 billion bushels was up 11% year-over-year, but was 135M bushels below what the market was expecting, thereby helping the coarse grain squeeze out a green performance for the week.

For the month of September, Chicago SRW wheat was the biggest winner of the grains complex, up nearly 11% or 90¢ USD/bushel, while soy oil performed the worst, down almost 9%. For the calendar quarter, everything except for Chicago and Kansas City wheat futures ended 3Q2022 in the red, below the still relatively high values seen at the end of June. Also supporting U.S. wheat futures to end September was a fresh estimate of the American wheat harvest by the USDA of 1.65 billion bushels, which was below both trade expectations and the 1.783 billion bushels printed in the September WASDE! This only adds uncertainty to the wheat complex, given the trade risk out of Ukraine, and resets the market’s focus on a relatively tight wheat balance sheet. That said, the USDA’s print of 1.776 billion bushels of wheat still available in the U.S. as September 1st was not a market-mover, as it was in line with the average pre-report guesstimate.

With the calendar flipping to October, harvest is nearly complete for Alberta and Saskatchewan, but things are still far from completion in Manitoba. As of last week in Alberta, the harvest was nearing 90% complete, in line with last year’s pace and well ahead the seasonal average, which is asterisked by some early frosts. In Saskatchewan, 81% of the crop had been taken off as of last week, with oilseeds, spring wheat, and oats basically the only thing left to come off. Conversely, most of Manitoba got its first frost last week, and combined with some rains and overcast conditions not helping dry things out, harvest is sitting at less than 50% complete.

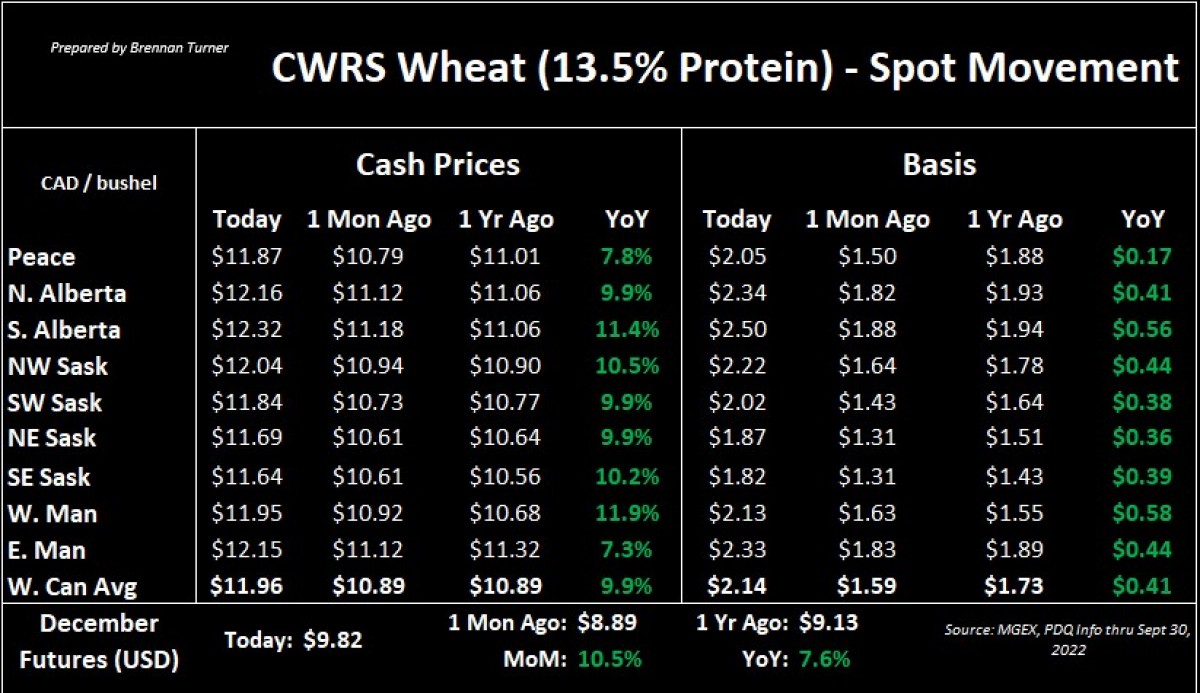

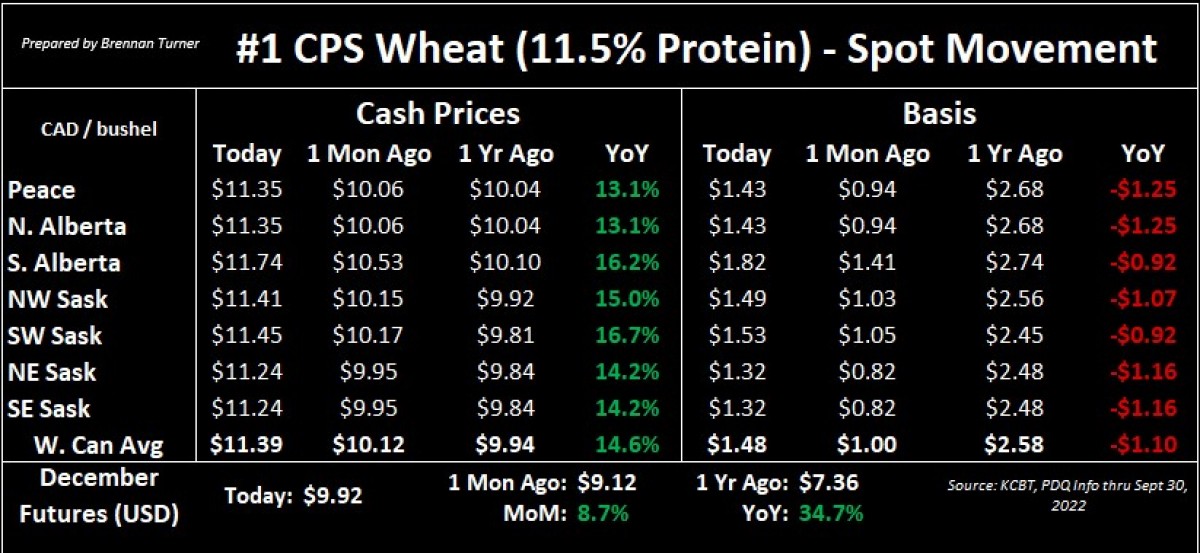

For Manitoba spring wheat, most quality downgrades will be seen in eastern regions (spring wheat harvest at 65%), the Interlake (30%), and southwestern Manitoba (70%), meaning more eastern Saskatchewan grain could be pulled in via better basis, and therein, better cash prices. Thinking further out, with only about 30% of the province’s canola harvested, winter wheat seeding plans are likely to be curtailed, suggesting that only 50% - 75% of what normally gets planted would actually get drilled in.

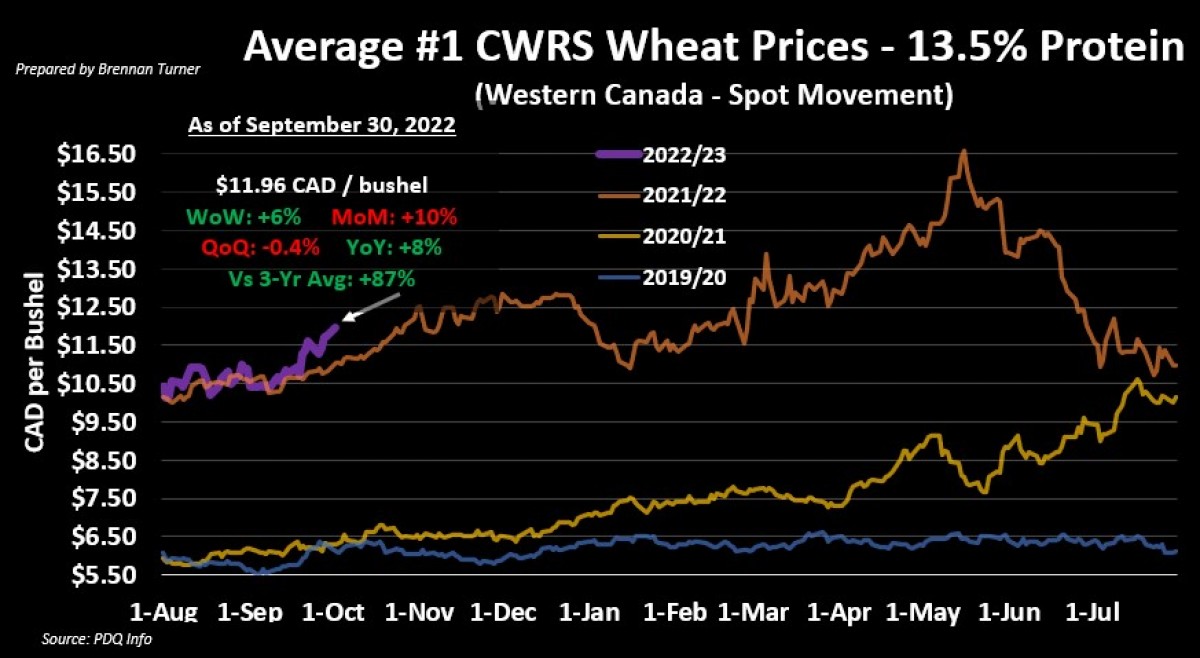

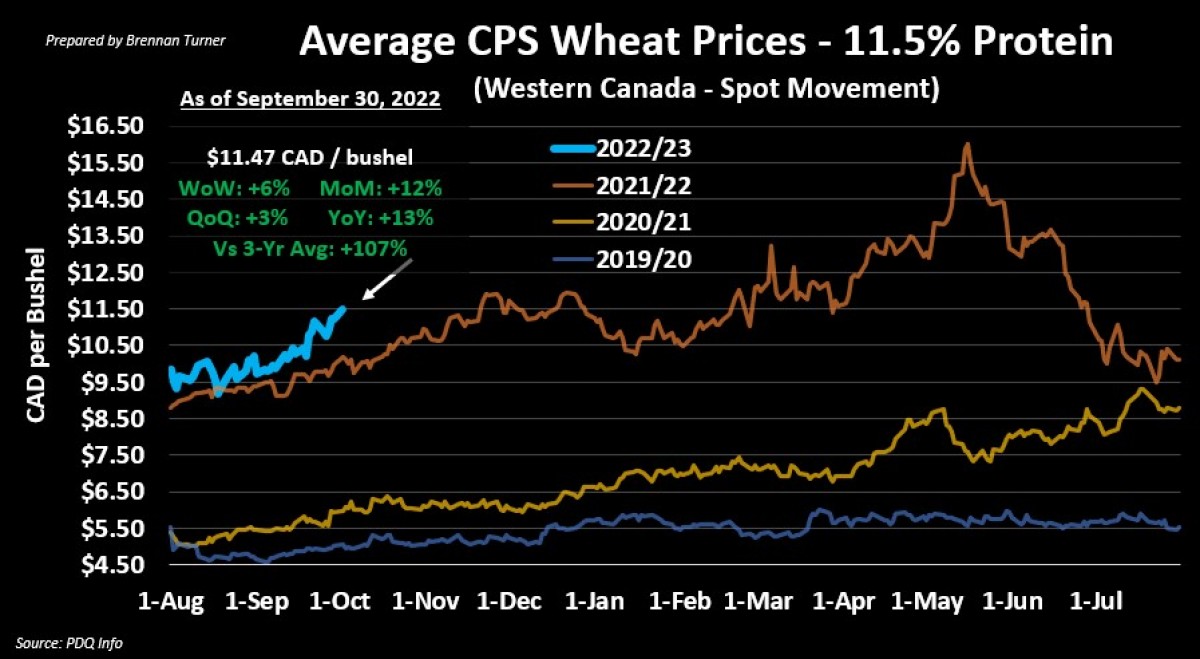

There’s also some buzz that Statistics Canada’s yield estimates from a few weeks ago might be too generous, especially when accounting for a few pockets in Saskatchewan and Alberta to experienced similar levels of moisture to last year’s drought. Needless to say, spring wheat prices are still performing better than where they were a year ago, despite the return to near-average yields this year against last year’s drought!

That said, there are a lot of variables impacting wheat prices right now including factors like Europe’s drought, Ukraine’s exports, potential recession risk impacting demand globally which could theoretically offset smaller inventories worldwide for the 4th straight year. My marketing plan is still the same though, looking to make a next sale sometime in the next 2 months, as this coincides with seasonal tops for this time of year (and as shown in the charts below). On the flipside, while HRS wheat seeing significantly better basis over the last month, basis tends to trade sideways into December before improving again. Therein, I might consider locking in some basis today, off either the December 2022 or March 2023 contract (depending on when you want to haul and when you need cashflow) and then pricing out the futures in the next few months.

To growth,

Brennan Turner

Founder | Combyne Ag