How are Wheat Prices Performing to Start 2022/23?

Grain markets finished the last week of July on a strong note, with a bullish week helping oilseeds and corn finish the month with a green performance. Minneapolis spring wheat futures were weighed down this week by the prospect of record yields in North Dakota, but KC and Chicago winter wheat contracts followed the rest of the complex. While wheat futures were able to recover some of their losses in late-month trading this past week, the complex still saw new crop contracts fall in July by an average of about 80¢ USD/bushel.

As the weekly performance table above shows, the oilseed complex saw the biggest gains this past week, thanks to rumours that Argentine farmers are holding back sales (a hedge against their 64% annualized inflation) and ongoing dryness concerns for most of America’s soybeans. On the latter, Drew Lerner from World Weather Inc. stated last week that “the soybean crop is at risk, in my opinion”, as the potential for a hot, dry August comes at the critical pod-filling stage of the crop’s development. In a similar vein, last week’s U.S. corn good-to-excellent fell by 3 points week-over-week to 61% G/E.

Also supportive of grain markets was a $370 Billion “climate change” bill that was agreed on in the Senate, which, if passed, would include a $1-per-gallon tax credit for biodiesel and renewable diesel and a new $1.25/gallon credit for sustainable aviation fuel. While the expanded market demand may be helpful, the catch-22 is that more food crops would go into fuel, and at a time when food prices aren’t exactly cheap!

Speaking of fuel, Ukraine continues to face an acute shortage of fuel, creating significant challenges for farmers who are trying their best to get this year’s crop off. Unsurprisingly, Ukrainian President Zelensky said this week that it’s likely that the country will only produce half of what it normally does. I believe that the market has already priced this in, and going forward, the market will likely have knee-jerk reactions to headlines out of Ukraine. More pointedly, while it’s touch-and-go with Ukraine’s exports – no ships have sailed since the “Grain Corridor” deal was announced 2 weeks ago – I think there could be even more issues a year from now. While getting this year’s crop off is its own battle, securing loans, crop inputs, and labour for this fall and next spring are significant obstacles for many Ukrainian farmers.

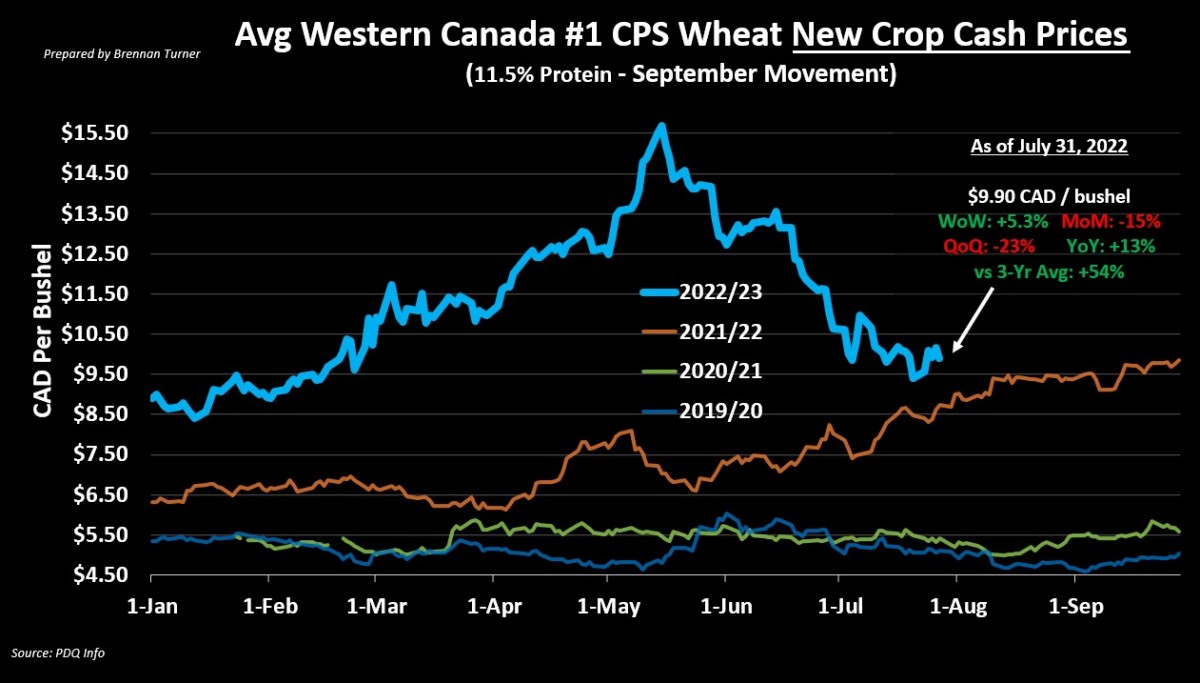

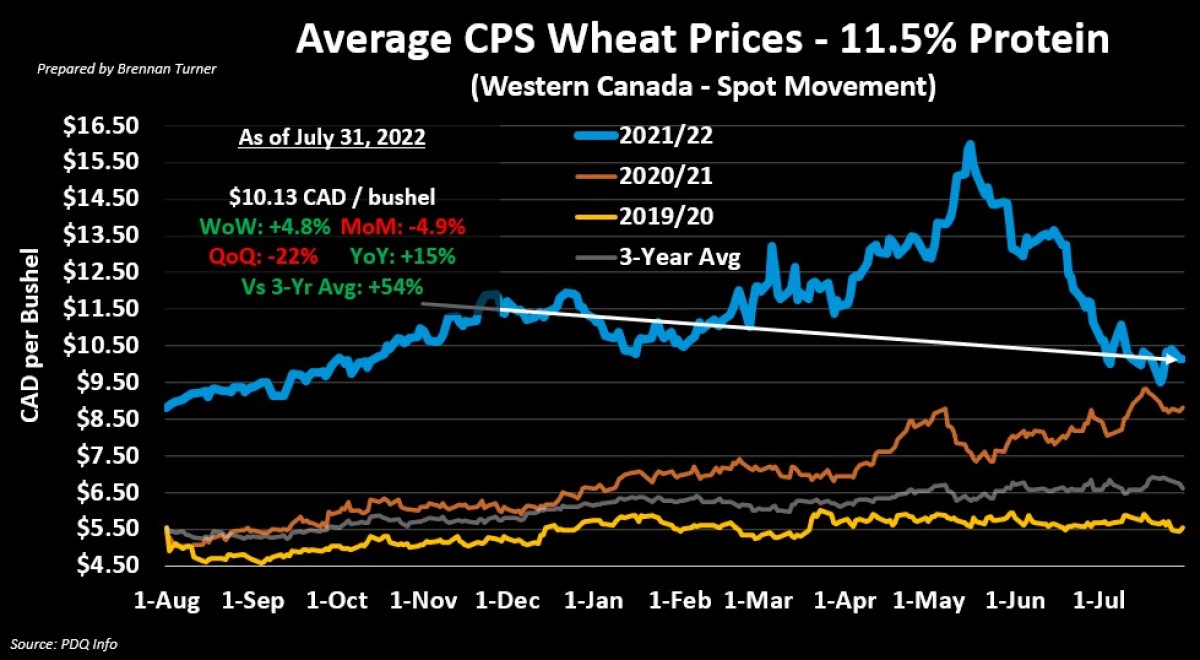

This is why I think CPS and other low-protein wheat prices will remain elevated over the next year or so. While cash values for CPS wheat in Western Canada have dropped by 22% over the last 3 months, as we flip the crop year calendar to 2022/23, they’re still up 15% year-over-year and 54% above their 3-year average. In terms of new crop pricing (the 2nd chart below), values for the off-the-combine movement have diverged on new-crop prices, dropping below $10 CAD per bushel for the first time since Russia invaded Ukraine back in late February. Historically speaking, mid-to-late October and late January have proven to be good times to make sales of CPS / low-protein wheat in Western Canada. However, with questions about Ukrainian grain’s exportability, these pricing windows may be different in 2022/23.

Last week, the U.S. Wheat Quality Council toured for 3 days through 267 North Dakotan fields, coming up with an average yield estimate of a state record 49.1 bushels per acre (also about 2 bushels short of the USDA’s forecast of 51 bu/ac). The tour noted that the crop’s development is a few weeks behind normal, given that up to 40% of the crop was planted in June, thanks to the incredibly wet spring seen in the region. Comparably, the average yield estimate for North Dakota’s durum came in at 39 bu/ac, again, slightly below the USDA’s forecast of 40 bu/ac.

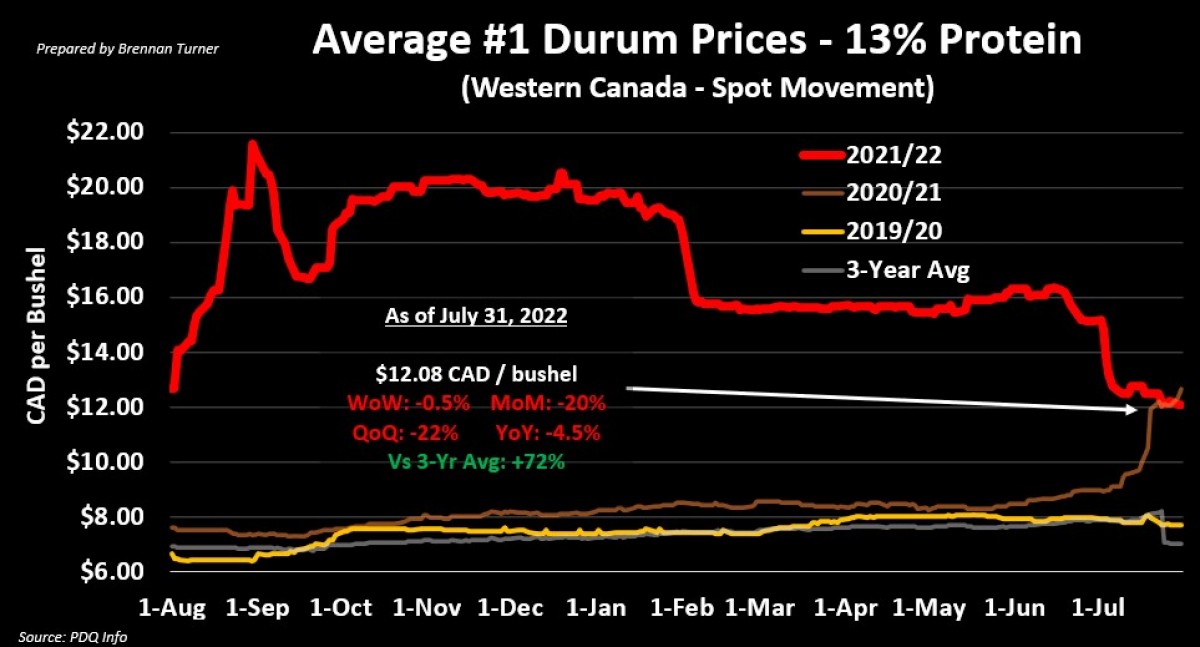

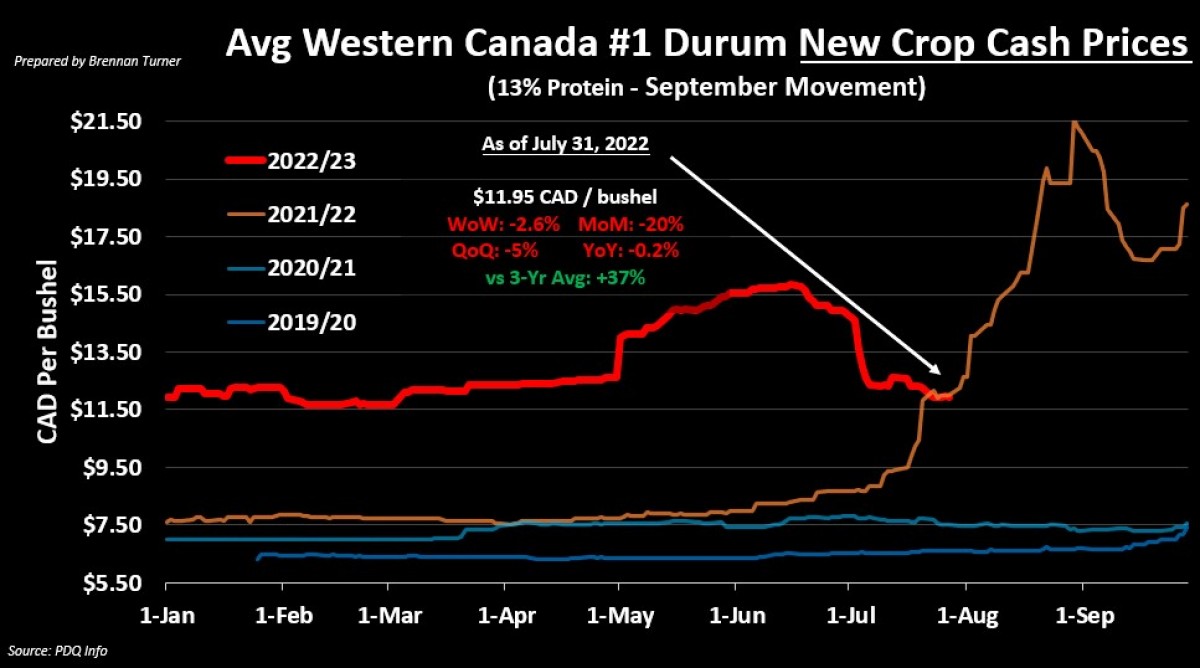

That said, we’ve seen durum prices fall by 20% in the past month, with both old and new crop prices diverging from one another to around the $12 CAD/bushel mark. Without some bullish surprises from the yield monitor in the next few weeks, durum prices will probably be at this level, possibly even lower, for the next 2 months as supply comes to market. Thereafter, as historical spot movement trends suggest (2nd chart below) I’m looking at late October / early November for my next durum sale, then maybe again sometime in early 2023, depending on how international demand is performing.

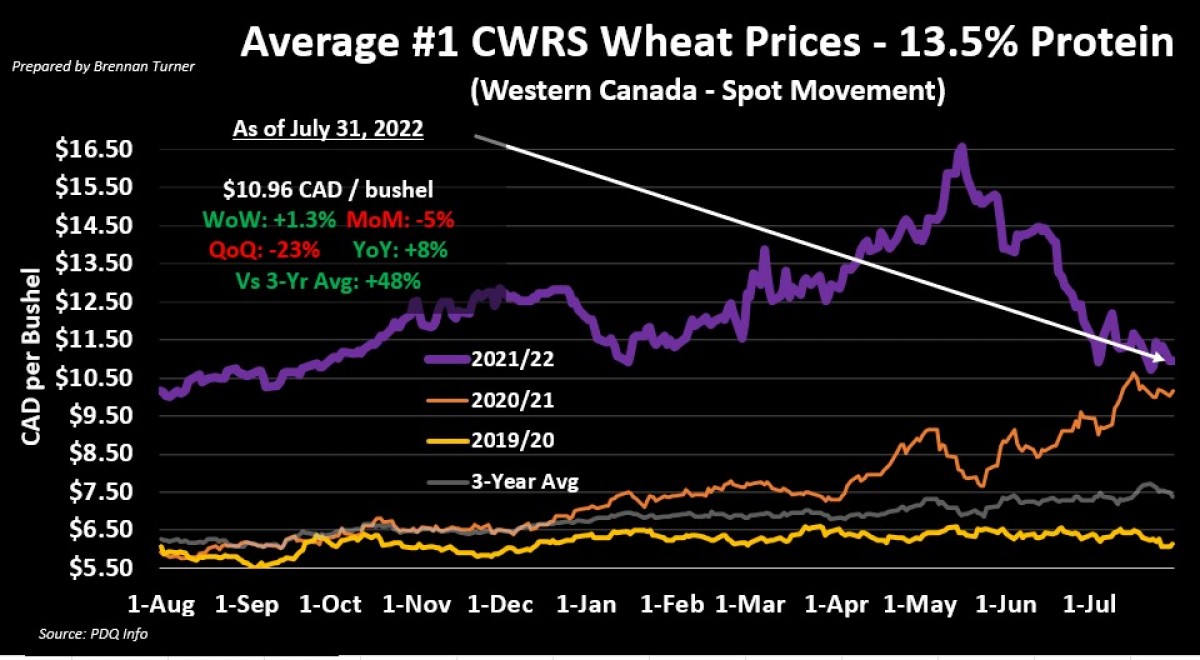

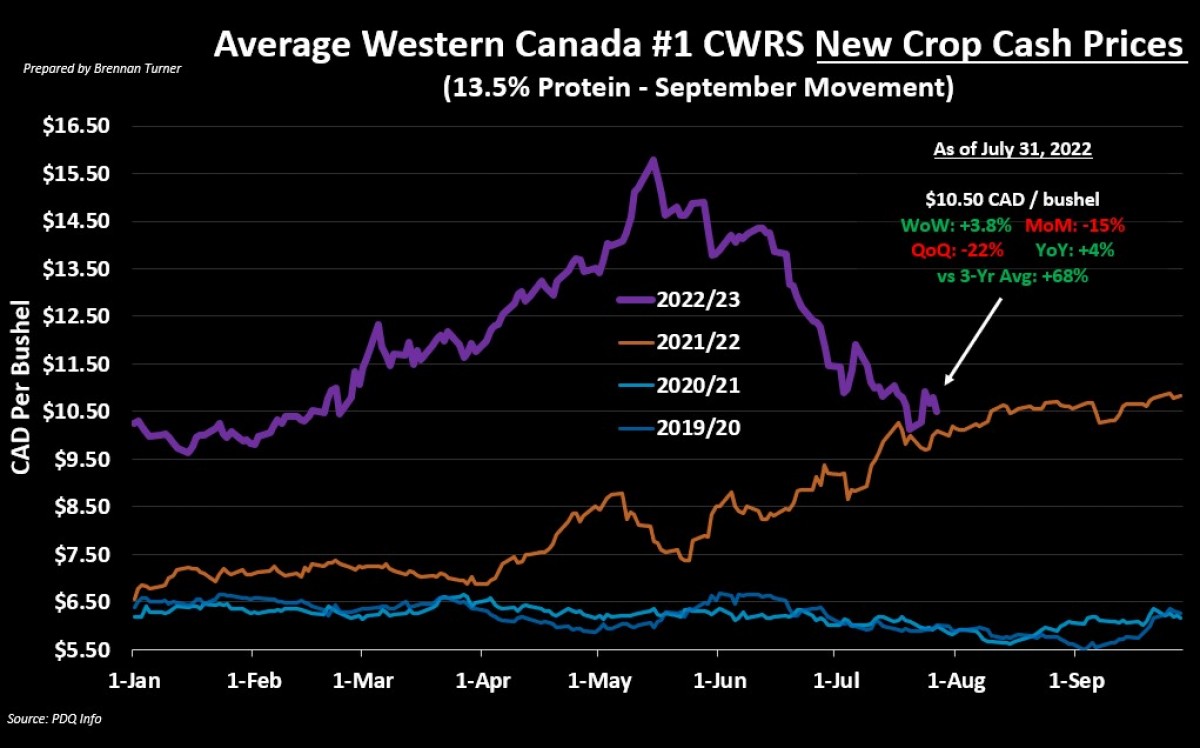

Similar to CPS and durum wheat prices, Canadian HRS wheat values have corrected lower since their highs in May, but both spot and new crop prices are still in double-digits. As is the historical norm, I expect HRS values to continue their downtrend until early-to-mid September, before trickling higher into the winter months. Much like my other crops where I’m focused on delivering on already-signed new-crop contracts, I won’t probably want to price out any more HRS wheat until late October / early November. This could change, again likely because of Ukraine, and so I’ll also be watching for some basis opportunities where I can lock something in, and then price out the futures any time there’s a spike on a headline (a strategy of “sell the rumour, profit on the fact”).

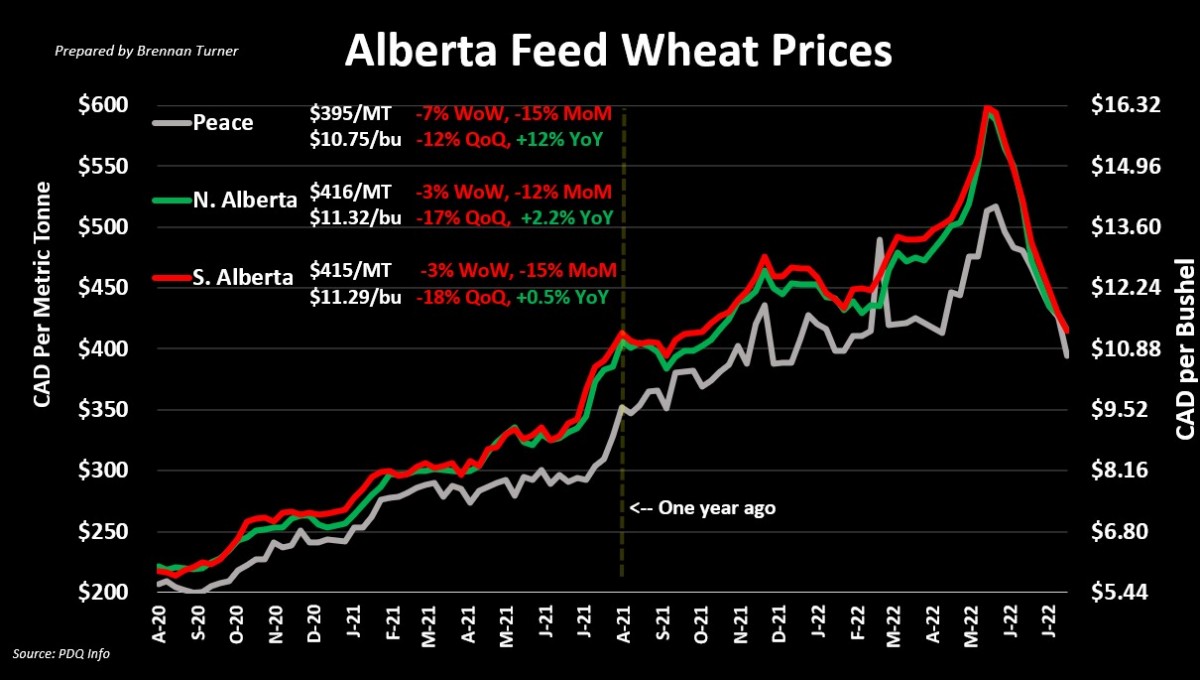

Last but not least, the biggest correction we’ve seen heading into the 2022/23 crop year is that in the feed markets. From their record highs a few months ago, feed barley values in Alberta have fallen by 17% while feed wheat prices are down nearly 30%. This correction was expected though, as is usually the case with feed crops once the potential of new crop supplies starts nearing (Obviously, we didn’t see much of a pullback last year because of the drastically below-average crop produced in the Prairies). That said, feed wheat and barley values are still 5% higher than a year ago. If I’m in a situation where I have some feed cereals to sell, I’ll probably look at late November / early December, and then again in February.

To growth,

Brennan Turner

Founder | Combyne Ag