It’s Game On for Another 60 Days

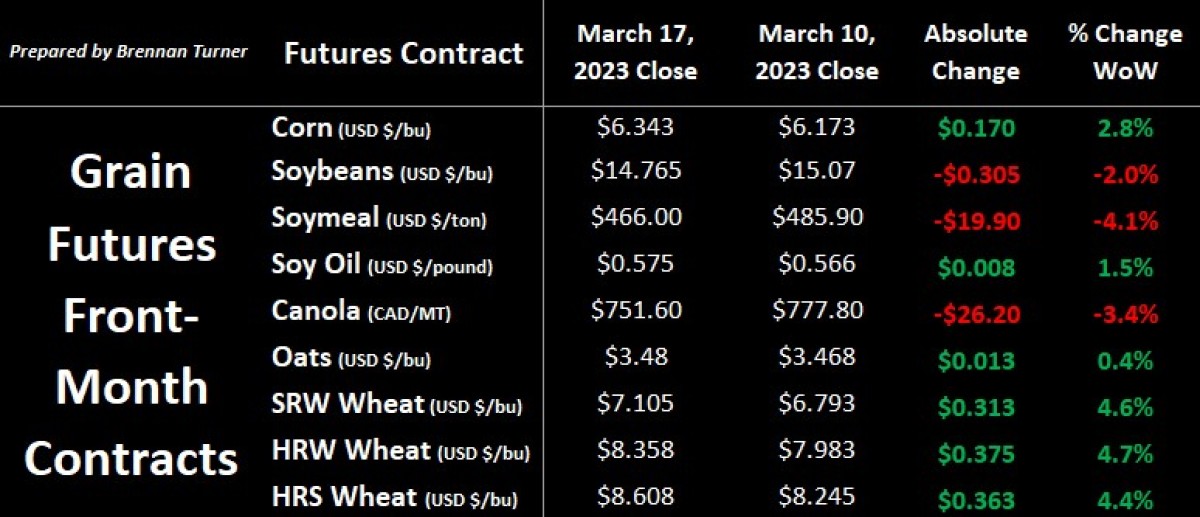

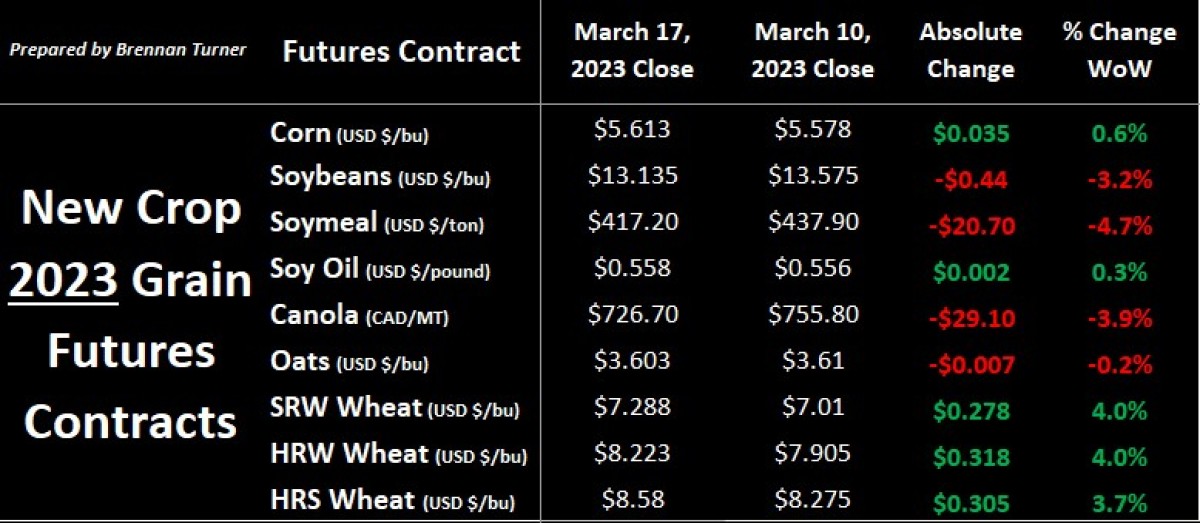

Grain markets had a mostly green week, with corn and wheat posting weekly gains for the first time since early February, thanks to China buying more U.S. corn and funds covering short positions while Black Sea Grain Deal negotiations played out. China bought over 2.1 MMT of U.S. corn last week, boosting the confidence of bulls and farmers, but I don’t think this is a trend. After all, mostly thanks to a strong U.S. Dollar, American corn export sales are tracking 39% lower than where they were a year ago, while and wheat purchases by international buyers are 6% behind last year and soybean export sales are down 8%. Canola had another rough week, following soybeans lower, and making for some interesting Plant 2023 conversations (and decisions), especially since cash wheat prices in Western Canada remain very attractive.

The biggest news of the wheat market’s week was whether or not the Black Sea Grain Corridor Deal, allowing Ukrainian grain safe passage into world markets, would be extended. The language of the renewal agreement signed back in November suggested that, save opposition, the default would be an extension for another 120 days. However, Russia pushed back and only agreed to 60 days, saying that another renewal in mid-May would be needed. This is important to note because, this is also right in the middle of when the market tends to provide weather-related planting premiums.

More specifically, Russia wants Western sanctions removed in the next 2 months, principally allowing easier flow of Russian exports and their banks to be re-accepted into the SWIFT banking system (here’s a refresher on SWIFT from the Wheat Market Insider column a year ago when Russia initially invaded Ukraine). Ironically though, this past Friday, the International Criminal Court (ICC) issued an arrest warrant against Russian President Vladimir Putin, accusing him of war crimes. Thus, the rest of the world continues to put pressure on Russia, and therefore, the broader market sentiment seems to be that either Russia continues to agree to the Grain Deal, or sanctions will get worse.

This comes as Russian wheat exports are increasing, but also the likelihood that they’ll have a smaller crop in 2023/24. Ukraine would also be in this boat for many reasons mentioned in past Wheat Market Insider columns, but India is also expected to see a smaller crop due to hotter weather. Meanwhile, the market is pricing in at least an average crop by other producers, hence the net short position in Chicago SRW wheat futures being the second largest in historical terms by volume.

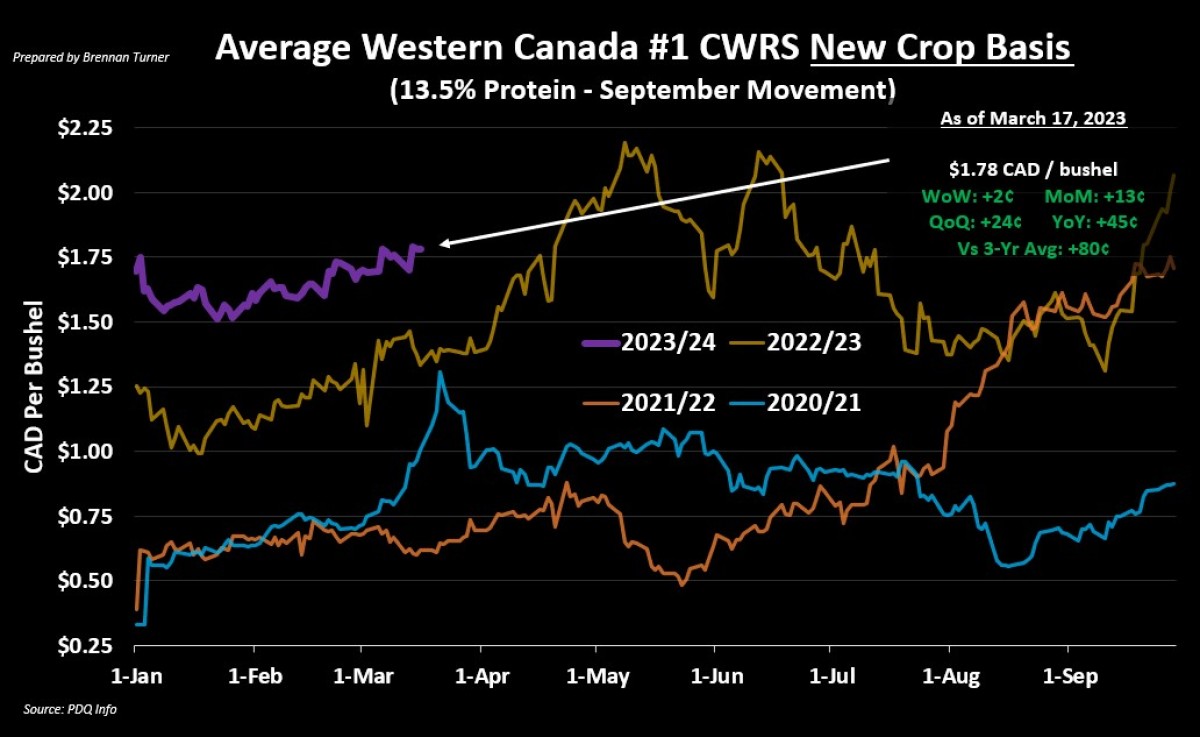

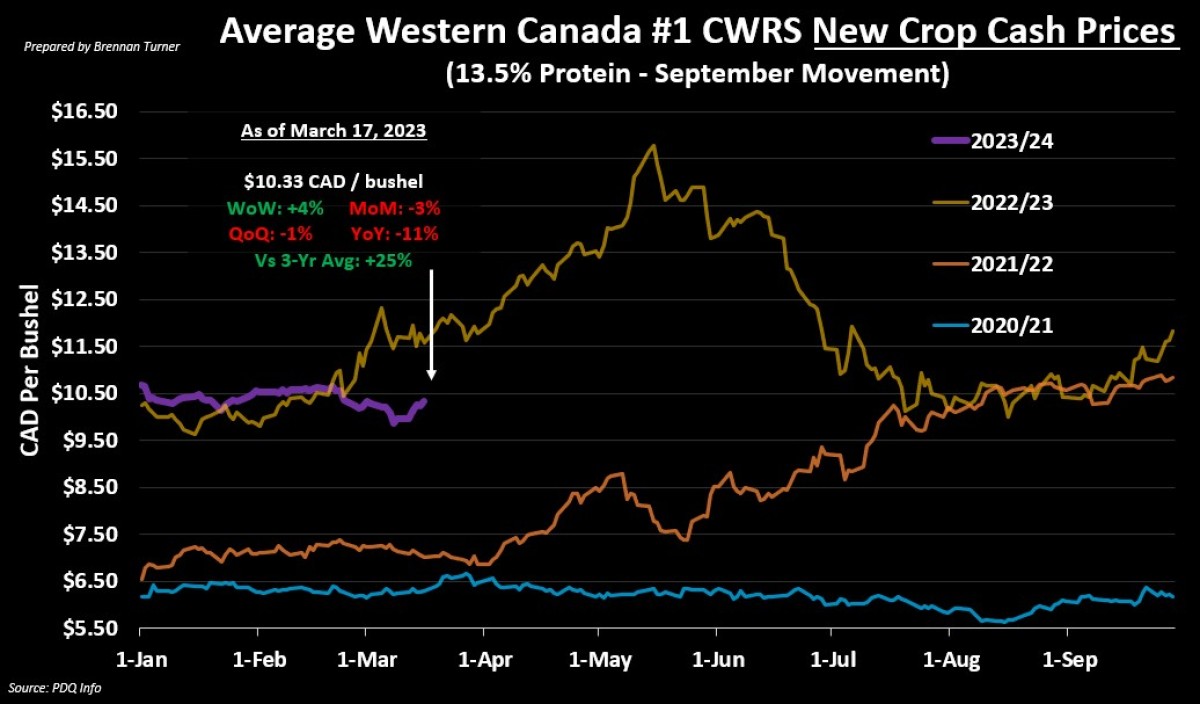

Surprisingly, despite mostly bearish headlines these days in wheat markets, new crop wheat prices in the Canadian Prairies have been fairly resilient, largely because basis levels have improved as futures values have fallen a bit. Looking at the first chart below, of new crop HRS wheat basis levels, what it tells us is that barring a drought or increase in military conflict in wheat-producing countries, basis for new crop delivery in September might be nearing its highs. More concretely, locking in basis now on 5 or 10 bushels of new crop HRS wheat could be a profitable move, especially since we know futures to tend to climb with planting premiums into late May to early June. Any move in the futures market in the next 60 days though, could be accelerated by the unwinding by hedge funds of this very large short position, and/or Russia trying to talk tough going into the next Grain Deal renewal deadline in mid-May.

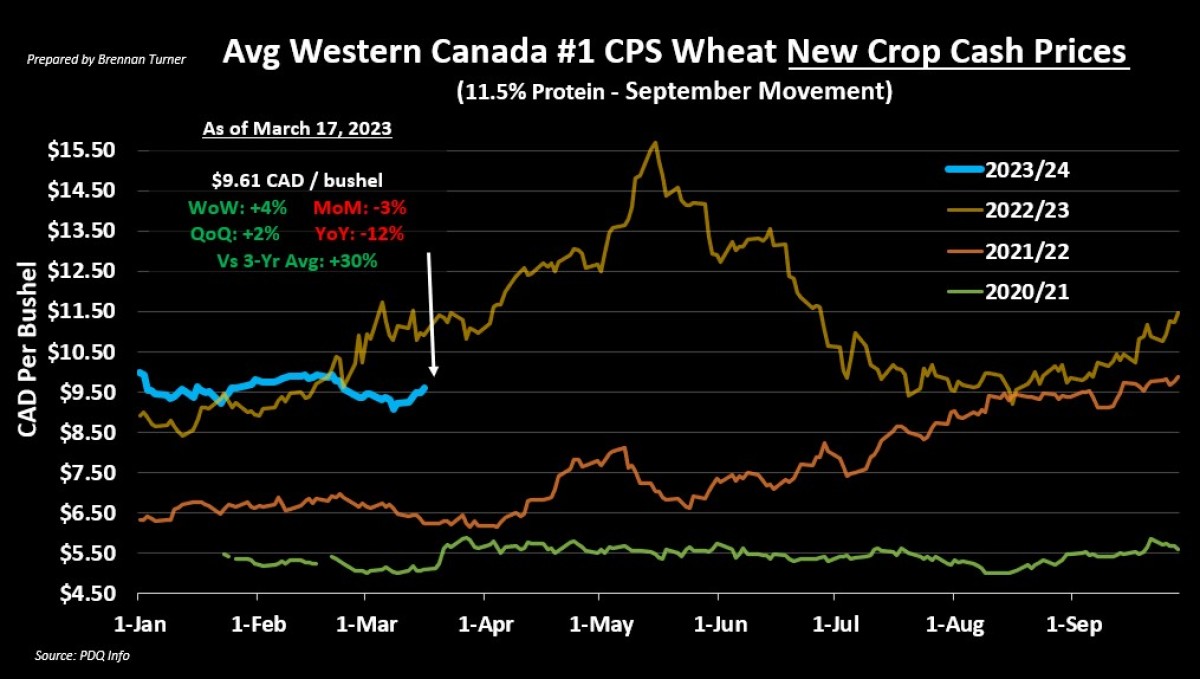

It’s a very similar dynamic in CPS wheat, as while cash prices are basically exactly where they were at the start of the 2023 calendar year, basis levels continue to creep higher. Given low-protein milling wheat in Western Canada like CPS tracks the Kansas City HRW wheat market, the biggest driver for futures values (and therefore cash), could be what the USDA says about the condition of the U.S. winter wheat crop in their first official crop progress report of the 2023/24 crop year, published on April 3. One could argue, however, that the relatively poor quality has already been priced in for now, but April rains in the U.S. Southern Plains (or lack thereof) could easily set the direction of wheat market for the next few months. Like HRS wheat, it’s also impacted by how fund managers play their short positions, and/or what happens to wheat markets come mid-May at the next Grain Deal renewal date.

Ultimately, despite the global inventories of wheat dropping over the last few years, what I can conclude is that there’s no shortage of supply, but perhaps just a shortage of easy trading and shipping. Arguably, the pop we saw in the charts at this time a year ago was largely because the market thought the supply from two of the world’s largest wheat players would be taken off the table (but that hasn’t obviously happened). From a macroeconomic lens, even with a pop in wheat futures over the next few months, with more cracks in the global banking system showing up thanks to higher interest rates and inflation not cooling, longer-term demand for commodities may start to get rationed going into next fall and winter. Put another way – and again, without a drought or military conflicts increasing – wheat prices in the next 60 days could possibly be the best we see for the 2023/24 crop year.

To growth,

Brennan Turner

Independent Grain Markets Analyst