More Focused on Plant 2022

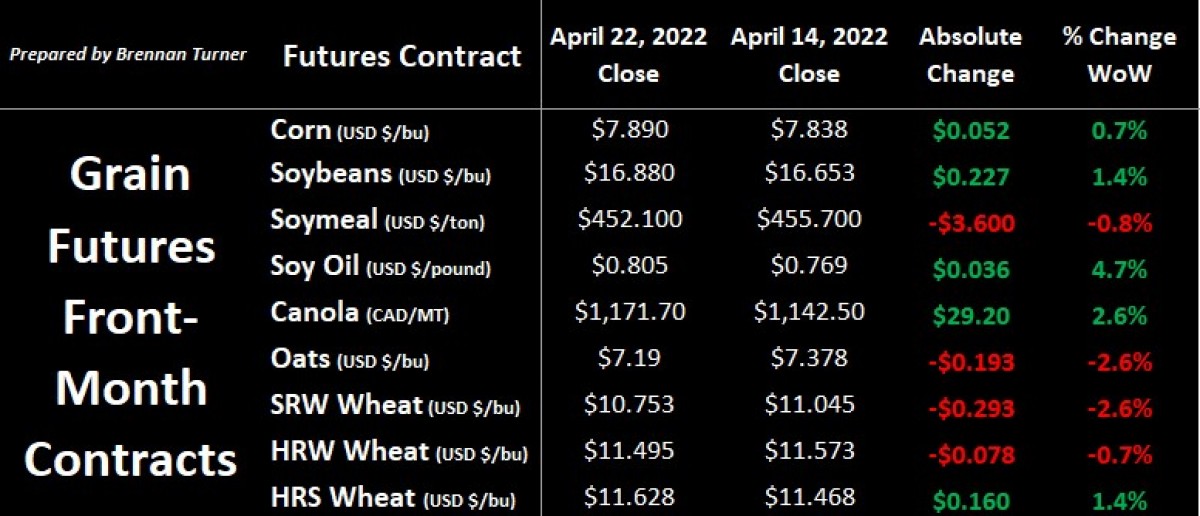

Grain markets tossed and turned after the Easter holiday weekend with a mixed result, as the market is starting to put more focus on the Plant 2022 campaign and potential supply scenarios. Larger expected wheat crops in Europe and Russia, as well as improving conditions for the Chinese winter wheat crop, offset another drop in ratings for the U.S. winter wheat crop. Corn and soybean prices continue to be impacted by a slower start to the U.S. seeding campaign, improving weather in South America, as well as (what appears to be) slowing Chinese demand. Ultimately, we’re starting to see some old and new crop prices diverging from one another, notably for HRS wheat and canola, both of which are sitting on very small inventories set to carry over into the 2022/23 crop year.

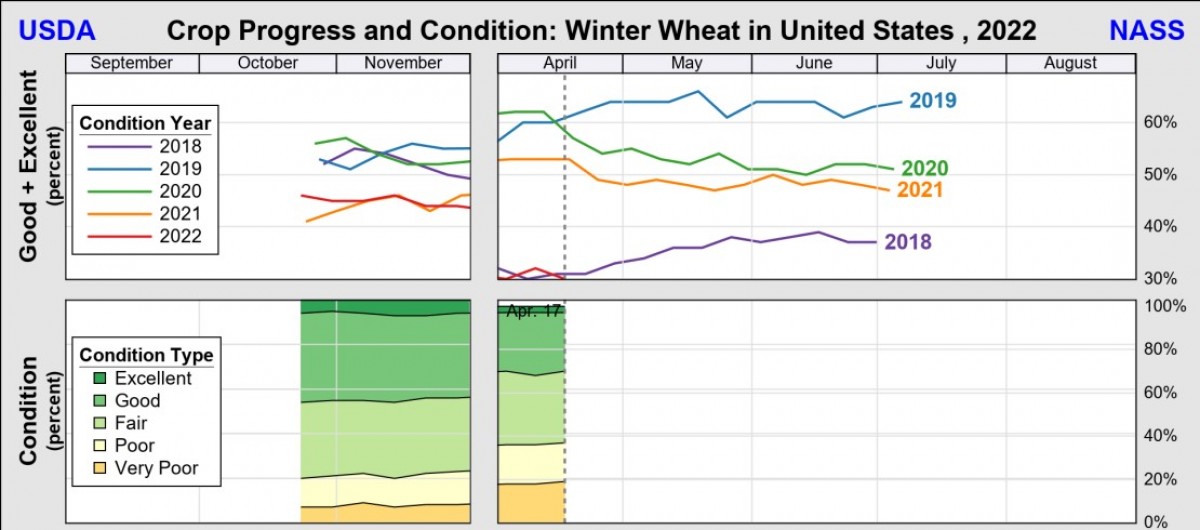

After last fall’s rains and some heat stress in early April, the Chinese winter wheat crop seems to be stabilizing, albeit the rapeseed crop in the same area is under pressure to recover from said average-average temperatures. On the flip side, 37% of the entire U.S. winter wheat crop, is rated as poor-to-very poor (P/VP), up 1 point on the week and 20 points higher than what we saw at this time a year ago. The U.S Southern Plains continue to get most of the attention, with 81% of Texas’ winter wheat crop now rated P/VP (+2 week-over-week) and 37% of Oklahoma’s crop in a P/VP state (+4 WoW). Kansas’ crop seems to be doing okay but the eastern half of the state accounts for the large majority of The Wheat State’s 33% good-to-excellent (G/E) crop (-1 WoW). On the flip side, western Kansas continues to be heavily impacted by drought and accounts for most of the state’s 31% P/VP fields.

Winter wheat futures were also pressured last week by fresh estimates of near-record wheat crops and export programs out of Europe and Russia for the 2022/23 crop year. For the former, DRV, the German farmers association, is estimating 22.7 MMT of wheat production this year, up more than 6% from last year, while FranceAgriMer says 92% of the French soft winter wheat crop is currently in good-to-excellent (G/E) condition. Unsurprisingly, the European Commission is currently forecasting a record wheat export program of 40 MMT in 2022/23.

According to Argus Media in last week’s Alberta Wheat Commission spring market update webinar, Russian producers should harvest 85 MMT of wheat, but that number could easily climb to 90 MMT if the current ideal weather conditions hold. Accordingly, Russian wheat exports in 2022/23 are forecasted to be around that 40 MMT mark, but it’s a question of how many more countries will adapt and agree to trade in rubles, like Turkey, Egypt, and Iran are opting into, rather than USD.

If there are limited hiccups in Russia’s export program – which, as a reminder, could include more shipments to China after Beijing re-opened its borders to Russian wheat and barley – then EU and Russian wheat exports could theoretically make up for a lot of the smaller winter wheat crop expected from Ukraine and the United States. Argentina and Australia, and India are all currently taking on some of the old crop wheat export business that Ukraine and Russia have lost out on. In fact, after this past year’s second consecutive record wheat harvest (36.3 MMT), and that monthly Aussie wheat exports are logistically constrained to about 3 MMT per month, the shipping season from the Land Down Under is likely to last longer than usual and creep into the North American fall campaign. Meanwhile, India is expected to export up to 10 MMT of wheat in 2022/23, but it’ll mostly be feed wheat.

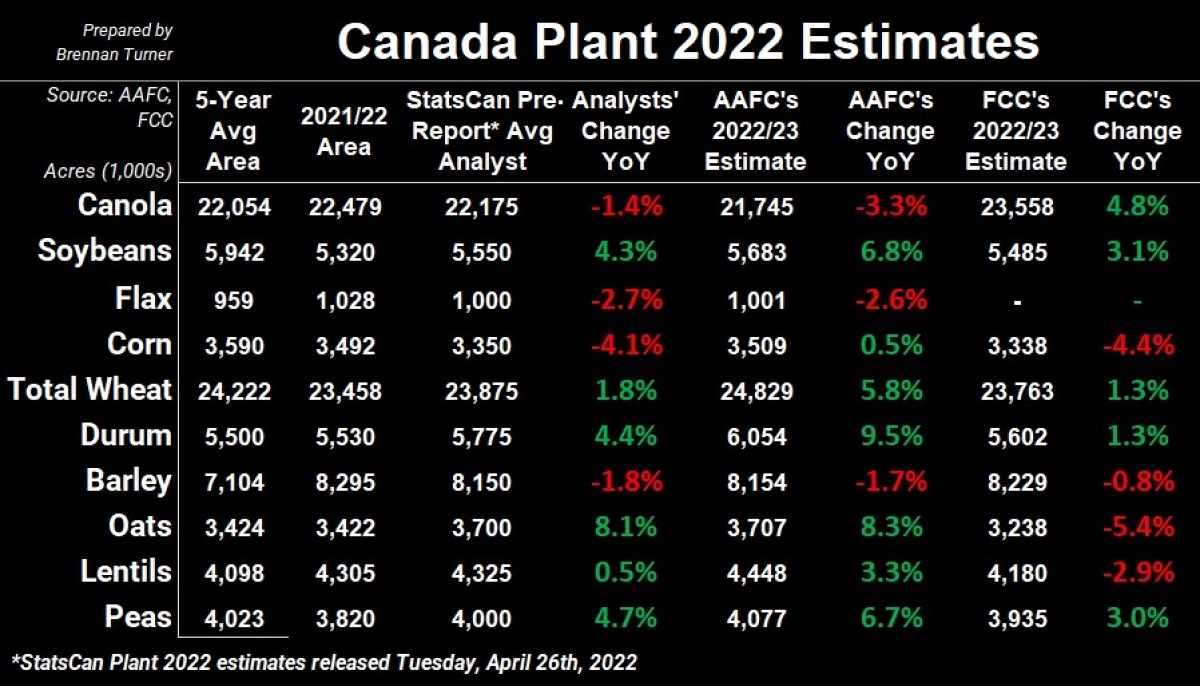

Coming back home, at 6:30 am MST on Tuesday, April 26th, Statistics Canada will publish its first estimate for the Plant 2022 campaign. Going into the report, which is based on producer surveys in March, the average pre-report guesstimate suggests more wheat, oats, and pulses, and less barley, corn, and canola. Compared to Plant 2021, the market is expecting to see durum acres expand by a few 100,000, which is much less than what Agriculture Canada has been forecasting so far (as the table below shows). On the flip side, non-durum wheat acres are estimated by the market to only climb marginally, from 17.93M acres last year to 17.95M this year, which is much less than the 18.8M acres that AAFC has been using in its 2022/23 estimates. As you can see below, Farm Credit Canada’s estimates, published in February before the war in Ukraine started, suggests just a marginal increase in both durum and non-durum wheat acres.

While Agriculture Canada did update its supply and demand tables last week, things will immediately change once the StatsCan numbers come out. Therein, in next week’s Wheat Market Insider column, with the fresh forecasts for Plant 2022 in hand, we’ll dig into the potential Canadian wheat prices and supply scenarios.

To growth,

Brennan Turner

Founder | Combyne