Wheat Prices Face Harvest, Crop Tour Reset

Grain futures pulled back in the third week of August as cereals harvest activity is ramping up and the ProFarmer crop tour through Midwestern states put a bearish spin on what’s been a bullish summer. The annual crop tour – which runs over 4 days through parts of Ohio, Indiana, Illinois, Iowa, Nebraska, South Dakota, and Minnesota – suggested average yields much higher than what the USDA predicted the previous week in their August WASDE report. One must understand though that in that report, the USDA finalized its forecasts as of August 1st, whereas the crop tour has a few more weeks of crop development and arguably, accuracy, but there are plenty of naysayers who think ProFarmer is too high.

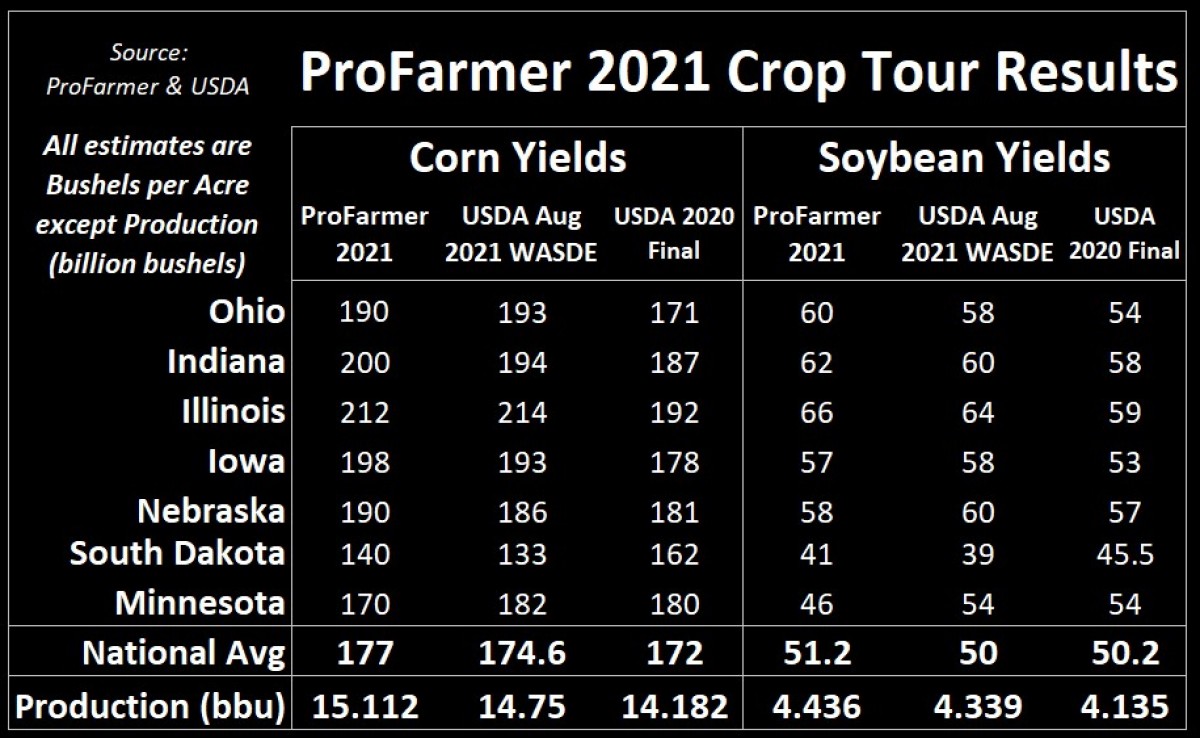

Digging in, ProFarmer is forecasting average U.S. corn yields 2.4 bushels per acre (bu/ac) higher than the USDA’s August estimate, while their soybean yield forecast is 1 bu/ac higher (see table below for more details). This means that ProFarmer is forecasting a U.S. corn production number that’s about 360M bushels more than the USDA, and a soybean harvest that’s roughly 100M bushels bigger. Keep in mind, however, that ProFarmer also increased its harvested corn acres number by 910,000 acres compared to the USDA’s June acreage report. Regardless, in a tight inventory situation like we’re currently in, that’s a pretty big bearish deal and explains why futures markets pulled back as much as they did.

What does this have to do with wheat? Well, since U.S. corn and soybeans are the most actively traded grain futures contracts in the world, where they go, other agricultural commodities tend to follow, or at least take direction from, including wheat. With concerns of corn and/or soybean shortages somewhat alleviated from the ProFarmer’s crop tour, the bulls inherently pull back on their positions in these 2 crops, as well as others. Put another way, and if there’s more corn and soybeans to go around, there’s less wheat and other cereals that might need to go into the feed column for livestock. Ultimately though, there’s a ton of other factors that continue to push uncertainty on global commodity demand, namely fears of COVID lingering, Chinese demand, and general geopolitical risk (read: Afghanistan).

Elsewhere in the world, Russian farmers aren’t selling their harvest as fast as they have in past years, as they try to navigate a complicated world of weekly changes to the export tax imposed by the Kremlin. Therein, SovEcon estimates that Russian grain exports will total just 5.3 MMT in the first two months of their 2021/22 crop year, which would be down 24% year-over. Ukraine and Romania seem to be taking advantage of the political intrusion in Russian wheat markets, but with Kazakhstan’s harvest down about 12% year-over-year, they’ll likely import more Russian wheat because shipments are exempt from the Russian wheat export tax.

In Europe, late season rains continue to feed quality concerns of the wheat harvest but only about one-quarter of the crop still needs to be taken off. Rainfall-inducing quality worries are also being heard in Western Canada, but most farmers are just appreciative of the opportunity to get some moisture for next year’s growing season. That said, harvest progress across the Prairies is well ahead of its seasonal average, as many fields are reaching maturity earlier than usual because of the hot, dry conditions this summer. Notably, in Saskatchewan, through last week, already 22% of the durum and 13% of the spring wheat crop in the province has been combined, way ahead of the 5-year average of 2% and 1%, respectively!

On the price front, I continue to hear of very high targets getting triggered, especially in durum with Canadian buyers and U.S. millers paying above $20 CAD/bushel for top quality (check out Combyne.ag’s multi-buyer target pricing tool which works extremely well for non-futures crops like durum). It’s widely expected that Canadian durum will have to compete this year with the better crops in the EU and Mexico, whose harvests are expected to climb 7% year-over-year to 7.7 MMT and up 9% to 1.3 MMT, respectively. Overall, I continue to suggest priorities at this time of year be centered around a safe harvest, knowing the quality of what you’re taking off (check out this grain sample cheatsheet), and communicating with your trusted trading partners about where their pricing is at.

To growth,

Brennan Turner