Wheat Pushing Through Harvest Lows

This past week’s grain markets ended mostly higher, because of some bullishness in the USDA’s September WASDE and stronger buying by funds of wheat futures. Despite the higher production and export potential out of the Black Sea in said WASDE report, military operations in the region continue to put an asterisk on the ability for grain to get exported, not to mention the ongoing question mark of if Ukrainian farmers will be able to plant their winter wheat crop or not, something I’ve discussed in this column in the past. All things being equal, Chicago wheat futures now have a technical setup for a near $10 USD/bushel target, which is an evident and significant increase from current levels.

One reason that this technical target could be supported is the bullish variable that the U.S. hard winter wheat crop could be facing its third straight year of drought. Three different weather forecasting models agree that a dry October, November, and December will be seen in the U.S. Southern Plains because of La Nina sticking around (for regular readers of this column, you’ll remember that I noted this in last week’s column, and how it might help Australian crops). With planting currently underway in relatively hot, windy conditions, there’s obvious concern that there won’t be enough soil moisture to get the crop properly established before heading into dormancy over the winter months. That said, one decent rain would probably do the trick – can that happen in the next month or so?

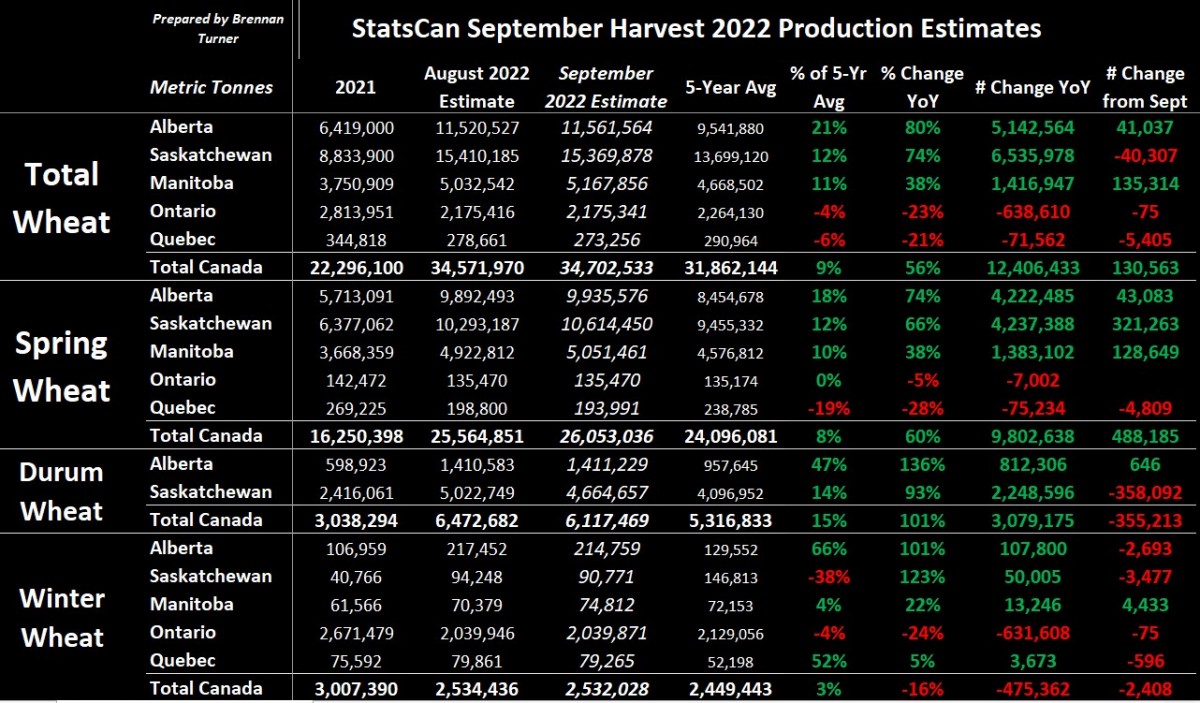

Speaking of supply, on Wednesday, September 14, Statistics Canada provided its second estimate of crop production in three weeks, with a few subtle, but noteworthy updates. Canola production was lowered by 400,000 MT, on account of national yields dropping by 0.8 bu/ac from the StatsCan estimate three weeks ago, to 39.7 bu/ac. This was primarily because Alberta’s average canola yield was lowered by 2.6 bu/ac from the August estimate to 41.7, and Manitoba dropped by 0.5 to 42.5. Lentil production was felled by nearly 129,000 MT, soybeans output was increased by 124,000 MT, while oats saw a big jump, up by more than 183,000 MT, with Manitoba’s and Saskatchewan's average yields increasing by 9.6 and 6 bushels per acre, respectively!

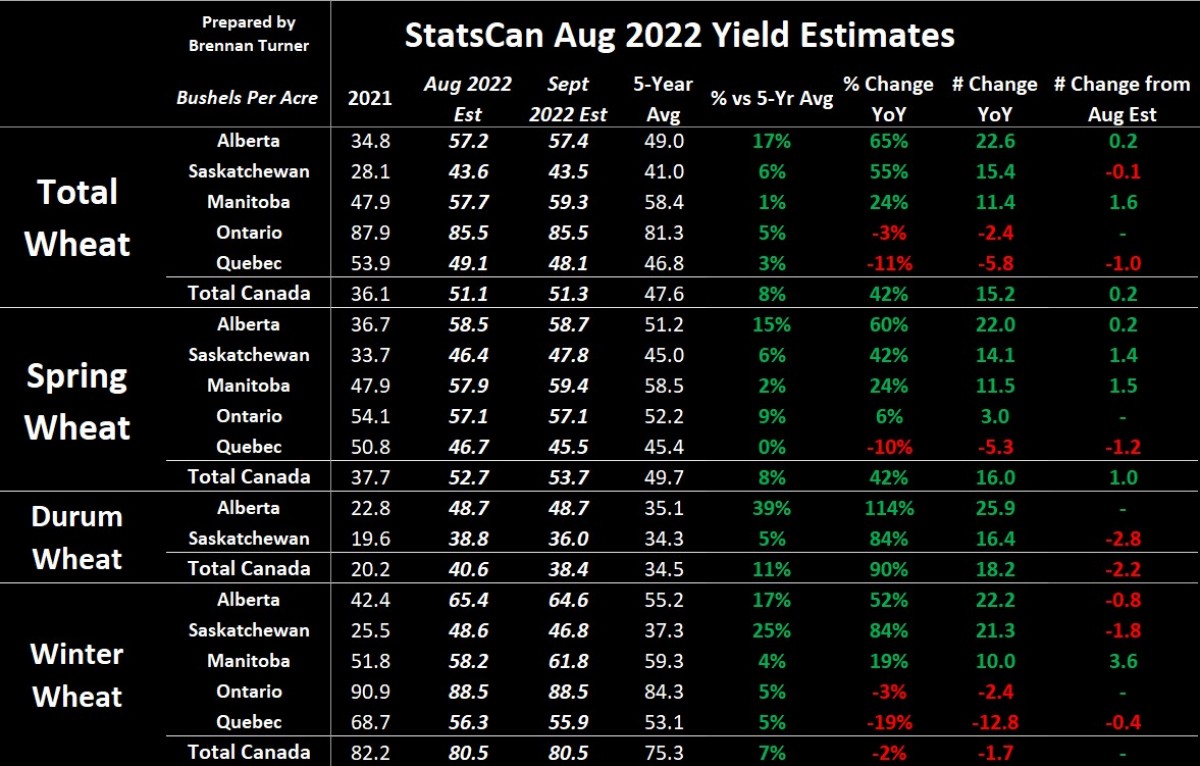

For wheat, the winter wheat crop was mostly unchanged from the August estimate, but durum had a significant downgrade, with average yields in Saskatchewan falling by 2.8 bushels per acre to now sit at 36 bu/ac. This meant that the durum harvest in the Land of Living Skies was lowered by nearly 360,000 MT (and the overall net downgraded to total durum production was 355,000 to 6.12 MMT). It was the opposite for spring wheat, as most provincial spring wheat yields were raised slightly, adding an increase in production of over 488,000 MT to a harvest total that now sits above 26 MMT! Across all wheat classes, this means total Canadian wheat production was up about 130,000 MT from StatsCan’s August estimate, to now sit at 34.7 MMT. For the record, this is still slightly below the USDA’s updated estimate from last week for the total Canadian wheat harvest of 35 MMT.

With all this in mind, one data point that I’m cognizant of is that in the last five years, Statistics Canada has raised their estimate of Canadian wheat crops. In fact, they have raised them a lot: almost 100,000 MT for winter wheat, over 340,000 MT for durum, and an impactful 1.14 MMT for spring wheat. Will StatsCan increase their wheat estimates by this much come to their December publication? I should note that 2017 was a significant outlier for these changes, as estimates were raised by more than double these averages just mentioned (meaning that they potentially skew the averages to the high side). This contradicts some notion held by the market that this year’s Harvest 2022 won’t reach its potential, and substitution effects – i.e. wheat for corn or vice versa – usually suggests higher values.

The Canadian wheat harvest has accelerated significantly, with progress now in line or even ahead of the average in all three Prairie provinces. Going forward, changing production estimates will push the market, up, down, and sideways, with volatility helping drive these moves. This is because of a few reasons: First, with recessionary economic issues on the table, institutional capital will be looking for a place to go, and commodities are one of those sectors money managers could look to. Second, with heightened risk in the grain markets, risk means opportunity, and traders look for and chase opportunity. At the farmer, grain marketing level, this translates to the importance of knowing your grain’s quality, your inventory and contracted versus uncontracted bushels, and when your bills are due. This is because, as opportunities present themselves, you already have the information to make a sound sales decision.

To growth,

Brennan Turner

Founder | Combyne Ag